Total Texas housing sales rebounded almost 30 percent after three straight monthly declines corresponding to the initial wave of domestic COVID-19 cases. Falling interest rates and pent-up demand from the economic shutdown supported sales in the existing-home market and for new homes priced less than $300,000, pushing the Lone Star State’s second-quarter homeownership rate up to record-breaking levels. Ongoing uncertainty surrounding the virus, however, dampened supply-side activity in the second quarter with reduced lot development in all the major metros except for San Antonio and downward-trending building permits and housing starts. Although the pullback in construction is likely to be temporary, the decrease will exacerbate already low inventory levels.

Home-price appreciation accelerated in June after slowing to start the quarter. Nevertheless, housing affordability improved during the low interest rate environment and overall moderate price growth. The Real Estate Center’s single-family housing sales projection suggests a complete recovery in single-family homes sales will be reflected in July numbers. COVID-19 remains the greatest obstacle to the Texas housing market, and the resurgence in contracted coronavirus cases and hospitalizations in July could reverse progress.

Supply*

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction levels, dipped slightly as construction values fell and hiring slowed. On the other hand, the Residential Construction Leading Index almost reached the post-recessionary high from December as interest rates continued to decrease and permits and housing starts picked up, suggesting positive momentum in the next few months. At the metropolitan level, Austin was the only major metro where the leading index decreased, pulled down by multifamily building permits.

According to Metrostudy, activity at the earliest stage of the construction cycle picked up slightly as the number of new vacant developed lots (VDLs) in the Texas Urban Triangle increased 3.5 percent quarter over quarter (QOQ). All of the second-quarter upturn, however, is due to VDLs in San Antonio more than doubling, with the $200,000-$300,000 price range accounting for most of the rebound. Houston and Austin’s 14.7 and 20.7 percent declines, respectively, kept total VDLs in negative YTD growth territory. The metric in Dallas-Fort Worth (DFW) ticked down 2.9 percent QOQ but the decrease slowed.

Despite sluggish activity to start the second quarter, single-family construction permits remained on track to exceed last year’s total after recovering 14.6 percent in June. Texas remained the national leader, contributing 16 percent of the national total. Nonseasonally adjusted permits increased to 1,105 and 4,028 in Fort Worth and Houston, respectively, almost reaching peak levels after accounting for seasonality. San Antonio permits rose to 889, while Austin and Dallas issued 1,540 and 2,358 permits, respectively. On the other hand, Texas’ multifamily fell 22.1 percent, declining for the third consecutive month.

Total Texas housing starts rebounded 27.9 percent on a monthly basis but extended a downward trend. MetroStudy data revealed less than 26,000 single-family homes broke ground in the Urban Triangle during the second quarter, a 4.3 percent decline. Houston accounted for most of the decrease, with starts sinking 16.3 percent QOQ. The San Antonio metric fell for the second straight quarter, but activity in the $500,000-and-higher price range accelerated. In Austin and Dallas, however, starts increased 1.4 and 4.7 percent QOQ, respectively, with improvement in North Texas widespread.

After a brief reprieve in May, single-family private construction values decreased for the third time in four months, declining 18.8 percent. Quarterly construction values dropped across all four major metros due to the effects of the pandemic, ranging from a 22.75 percent plummet in DFW to 30.1 percent in Houston.

A dwindling supply of active listings and a resurgence in home sales pulled Texas’ months of inventory (MOI) down to an all-time low of 2.8 months. A total MOI around six months is considered a balanced housing market. Inventory for homes priced less than $300,000 was even more constrained, sliding below 2.1 months. The MOI for luxury homes (homes priced more than $500,000) also decreased, falling to 7.2 months.

Austin and San Antonio posted record-low inventories of 1.6 and 2.6 months, respectively. The MOI in Dallas declined to 2.3 months, while the Fort Worth metric dropped to 2.1 months. Only Houston maintained a MOI above the state average at three months.

Demand

Pent-up demand and record-low mortgage rates pushed total housing sales up 29.4 percent in June. Improvement stemmed from a pickup in existing-home sales transactions as activity in the new-home market stalled after a year of solid growth. Sales accelerated more than 6 percent QOQ for new homes priced less than $300,000, but the $400,000-and-higher price range took a large step back. The divergence exemplifies the increasing demand for more affordable homes as many millennials become first-time homebuyers.

Fluctuations in second-quarter new-home sales varied across the major metros. Houston posted its sixth consecutive improvement, pushing transactions to 8,732. San Antonio new-home sales rebounded 16.1 percent QOQ to 3,640 after faltering to start the year. Although activity in DFW decreased during the second quarter, North Texas remained the top market with 9,100 transactions. Austin extended a downward trend, selling only 4,736 new homes after reaching an all-time high in 4Q2019.

Despite falling sales in April and May, Texas’ 2Q2020 homeownership rate rose its highest level on record (beginning 1996) at 67.5 percent, lessening the gap between the national rate to only half a percent, the smallest in eight years. National homeownership rates were higher across all races, including minorities. At the metropolitan level, Austin registered the greatest increase in homeownership, rising almost 6 percentage points to 65.3 percent. The metric in DFW and San Antonio ticked up to 64.7 and 66.2 percent, respectively. Houston boasted the state’s highest percentage of occupied housing units that were owner-occupied at 68.2 percent. Homeownership, however, could suffer as COVID-19 foreclosure-protection policies expire.

Approximately two months after the forced economic shutdown, Texas’ average days on market (DOM) inched up to 64 days, at least partially due to slower activity during April. The major metros recorded softer demand. Houston and San Antonio’s metrics exceeded the state average, rising to above 64 and 65 days, respectively. The average home in North Texas sold after 59 days in Dallas and 51 days in Fort Worth. Austin was the exception, as the DOM decreased to 53 days compared with 57 days this time last year.

Continued uncertainty stemming from the ongoing spread of the coronavirus pandemic kept interest rates at historically low levels, although increased oil prices slowed the downward slide. The ten-year U.S. Treasury bond yield ticked above 0.7 percent, but the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate sank below 3.2 percent for the first time in series history (starting in 1971). Mortgage applications for home purchases rose 9.8 percent, jumping into positive YTD growth territory. Refinance activity decreased for the third straight month but remained at levels one-and-a-half times greater than at year-end.

Elevated volumes of mortgage applications corresponded to falling Texas mortgage rates. (For more information, see Finding a Representative Interest Rate for the Typical Texas Mortgagee.) In May, the median back-end debt-to-income ratio (DTI), loan-to-value ratio (LTV), credit score, and interest rate constituting the “typical” conventional-loan Texas mortgage were 36.10, 85.57, 747, and 3.35 percent, respectively. The typical Texas borrower who obtained a loan from a government-sponsored enterprise had a DTI of 36.14 and LTV of 87.49 while receiving an interest rate of 3.45 percent.

Prices

The Texas median home price jumped 3.9 percent to $249,100 in June after subdued growth to start the second quarter. Annual price appreciation accelerated 4.2 percent. Movements in metropolitan median prices moved similarly to statewide fluctuations, with Austin’s metric leading the state at $324,700. The median price shot up to $298,800 in Dallas and exceeded $250,000 in Fort Worth and Houston. San Antonio’s median home price increased to $240,800.

The Texas Repeat Sales Home Price Index, a better measure of changes in single-family home values, provides insight into how Texas home prices evolve. The index corroborated healthy price appreciation, rising 4.5 percent YOY. The metric in North Texas also advanced, jumping 3.1 in Dallas and 4.3 percent in Fort Worth. The Austin and Houston indexes slowed but maintained healthy growth of 5.6 and 2.6 percent, respectively. Meanwhile, price appreciation in San Antonio stabilized at 3.5 percent.

Slower home-price growth and historically low interest rates increased housing affordability in Texas’ major metros during the second quarter. Houston and Fort Worth were the most affordable locales, with both indexes climbing to 1.8, indicating that a family earning the median income could afford a home 80 percent more than the median sale price. The metric in Austin and Dallas registered double-digit YOY gains, exceeding 1.7 and 1.6, respectively, with the former posting a five-year high. Meanwhile, San Antonio’s index rose steadily to 1.7. Continued improvement is important to Texas’ demographic advantages that have supported the state’s economic prosperity over the past decade.

Single-Family Forecast

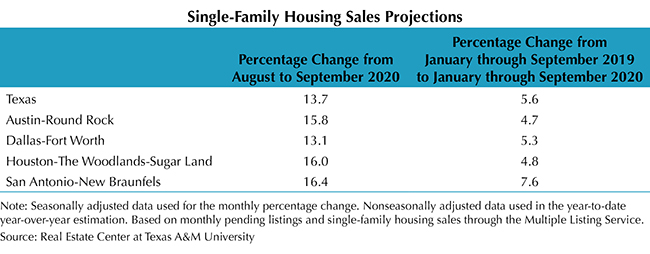

The Real Estate Center projected single-family housing sales using monthly pending listings from the preceding period (see Table 1). The Center projected only one month in advance due to uncertainty surrounding the COVID-19 pandemic and the availability of reliable and timely data. Sales are expected to rebound completely from the pandemic-induced shutdown in July. Texas single-family sales are estimated to increase 22 percent, while Houston should outshine the other metros with 25.2 percent growth. In Austin and Dallas, single-family sales are projected to bounce back 24.6 and 22.6 percent, respectively. San Antonio’s improvement is forecasted to be slightly lower than state’s at 17.8 percent but still sizeable nonetheless. Texas’ housing market recovery has so far outpaced its labor market’s less steady comeback.

________________

* All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

Source – James P. Gaines, Luis B. Torres, Wesley Miller, Paige Silva, and Griffin Carter (August 12, 2020)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight