Total Texas housing sales continued to fall in May, but the decline slowed to a 2.1 percent monthly decrease. Nonetheless, the inventory of homes for sale fell to a record low of 3.2 months, possibly due to owners pulling their homes off the market or failing to list them in the first place during the COVID-19 pandemic. Increased caution during the buying process resulted in softer demand, pushing the average days on market up to 61 days. The Repeat Sales Home Price Index, however, suggested stable price gains.

The coronavirus outbreak is the greatest threat to the Texas housing market since the 1986-90 recession via disruptions to buyer and seller confidence, the negative income shock, and wariness of visiting or showing homes for sale. Mortgage applications for home purchases and the Real Estate Center’s single-family housing sales projection, however, implied that home sales were beginning to recover before the second wave of new coronavirus cases.

Supply*

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction levels, inched up in May as the industry began rehiring some of the jobs shed during the economic shutdown. The Residential Construction Leading Index, however, continued to trend downward as falling housing starts offset increased permitting activity and decreased real interest rates, suggesting sluggish activity in the near future. The metropolitan leading indexes also extended downward trajectories.

Private bank loan data revealed construction activity accelerated 3.4 percent quarter over quarter (QOQ) during the first three months of 2020. After a sluggish second half of 2019, single-family investment increased 2.9 percent QOQ. Meanwhile, multifamily loan values rose for the fifth straight quarter, jumping 3.8 percent QOQ to a record-breaking $8.9 billion. Second-quarter financing, however, may stall as lending standards tightened at the onset of the pandemic.

As the statewide stay-at-home mandate expired and economic uncertainty temporarily calmed, single-family construction permits recovered 12.6 percent in May. Although levels remained nearly a fifth below that of peak issuance during February, Texas remained the national leader, contributing 17 percent of the national total. Houston topped the list with 3,035 nonseasonally adjusted permits, followed by Dallas-Fort Worth (DFW) with 2,799. Rockwall County accounted for much of the Dallas metropolitan division’s 14.1 percent improvement, the greatest increase in the Texas Urban Triangle, after adjusting for seasonality. San Antonio registered an upturn in activity, posting 787 nonseasonally adjusted permits. Issuance remained sluggish in Austin, however, with only 1,412 permits. In Texas’ multifamily sector, permits fell 18 percent, but the trend maintained a strong upward trajectory.

Total Texas housing starts fell 30.1 percent to a six-year low with particular weakness in the multifamily sector. Single-family private construction values increased 5.8 percent after adjusting for inflation with Houston posting the largest improvement, rising 20.2 percent, followed by San Antonio with a 10.0 percent climb. Values jumped 3.9 percent in Austin but extended a two-month fall in DFW, declining 3.7 percent.

Despite decreased sales, Texas’ months of inventory (MOI) fell to a historic 3.2 months as the state’s supply of active listings plummeted to its lowest level in three-and-a-half years. A total MOI around six months is considered a balanced housing market. Inventory for homes priced less than $300,000 slid to an all-time low of 2.4 months as the price range registered increased sales. On the other hand, the supply of active luxury home (homes priced more than $500,000) listings expanded for the first time this year while closed listings fell, pushing the MOI up to 7.6 months. This disparity exemplifies the shortage of affordable housing during a time when the rocky economic atmosphere may make lower-priced homes look more financially feasible to the potential homebuyer.

Inventory in the major metros decreased across the board in every price cohort except for homes priced more than $500,000. The supply of active listings fell the most in Central Texas, which, combined with falling sales, resulted in more substantial changes. Austin’s MOI slid to 1.9 months after two straight monthly increases, while the San Antonio metric recorded a historic low of just three months. In Dallas and Fort Worth, inventory inched down to 2.6 and 2.4 months, respectively. The Houston MOI was the only one above the statewide average at 3.4 months.

Demand

Public health precautions and social distancing measures during the previous couple of months continued to weigh on total housing sales, which decreased 2.1 percent in May. Sales for homes priced less than $300,000 increased marginally but remain one-fifth below peak levels this year. Still, Texas registered a smaller decline than the U.S. as a whole, as nationwide sales sank 6.6 percent.

North Texas sales fell 4.7 and 1.9 percent in Dallas and Fort Worth, respectively. Sales declined 7.7 percent in Austin and 3.0 percent in San Antonio. Houston was the exception with sales rising 1.9 percent. YTD levels are still behind last year’s pace during the first five months, much less record-breaking activity during February.

Reduced showing and visiting of homes during March and April translated to slightly softer housing demand, pushing Texas’ average days on market (DOM) up to 61 days and ending a year-long downward trend. The Houston and San Antonio DOMs hovered just above the statewide average, ticking up to 62 and 63 days, respectively. In Austin, the average home sold after 55 days, six days slower than the previous month. The metric in North Texas increased by five days to 57 and 50 days in Dallas and Fort Worth, respectively. Demand for existing homes softened more than for new homes in every location except Fort Worth, possibly reflecting more willingness to visit and purchase new construction.

The ongoing spread of the coronavirus kept interest rates at historically low levels, but an upturn in oil prices slowed the downward slide. The ten-year U.S. Treasury bond yield flattened at 0.7 percent, but the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate dropped to its lowest reading on record at 3.2 percent. Mortgage applications for home purchases rose by a third in May after three straight decreases yet remained 4.5 percent below year-end levels. Refinance activity stumbled on the month, although applications were up 60.8 percent YTD.

Prices

The Texas median home price contracted 2.3 percent in May, falling to a near-annual low of $240,500. In year-over-year (YOY) terms, the median sale price appreciated just 1.6 percent, the smallest annual change since 2012. A shift in sales composition may explain the monthly decline, but the distribution was similar relative to the same period last year. Another explanation for the subdued price appreciation is that the state’s sale-to-list price ratio fell for the second consecutive month, with the recent decrease the steepest in nine years. The shift in leverage toward buyers coincided with softer demand.

At the metropolitan level, median home prices declined on a monthly basis in all but Austin, where the metric flattened to $317,700 following a 4.6 percent decrease the prior month. Annual growth was sluggish except in San Antonio, where the median price rose 3.5 percent YOY to $235,400, but the increase remained below the long-term average pace. The metric in both Fort Worth and Houston was $240,800, while Dallas’ median price fell to $287,300.

The Texas Repeat Sales Home Price Index, a better measure of changes in single-family home values, provides insight into how Texas home prices evolve. Although the index did decelerate on a monthly and annual basis, a YOY increase of 3.4 percent suggests the pandemic’s effect on home values has been minimal. Houston’s and San Antonio’s indexes grew less than the statewide measure, rising 2.5 and 3.1 percent YOY, respectively. Austin’s metric jumped 4.9 percent but recorded its slowest rate in seven months. Only in North Texas did the index accelerate, climbing 2.9 percent in Dallas and 4.0 percent in Fort Worth.

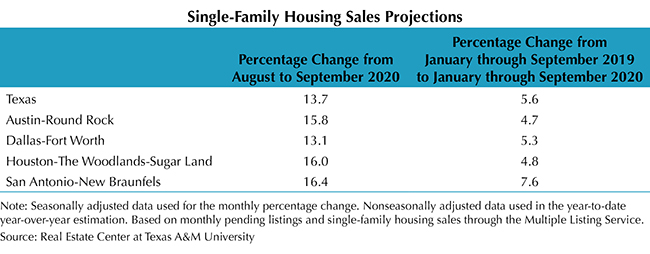

Single-Family Forecast

The Real Estate Center projected single-family housing sales using monthly pending listings from the preceding period (Table 1). Only one month in advance was projected due to the uncertainty surrounding the COVID-19 pandemic and the availability of reliable and timely data. Sales are expected to increase in June for the first time since February, when activity peaked. Texas’ single-family sales are estimated to rebound 33.7 percent, with Austin leading the major metros, climbing 39.1 percent. Dallas and Houston single-family sales are expected to jump 36 and 35 percent, respectively, while San Antonio’s sales increase 30 percent. Nevertheless, the data indicate a full recovery will not be reached in June. Even then, a third-quarter comeback may be threatened if the second wave of COVID-19 cases triggers another economic shutdown.