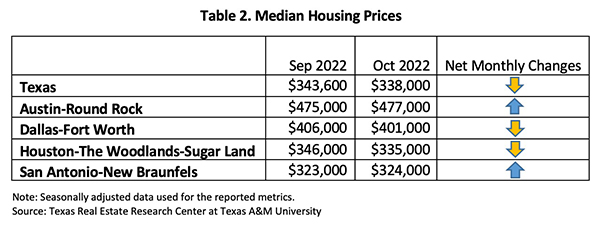

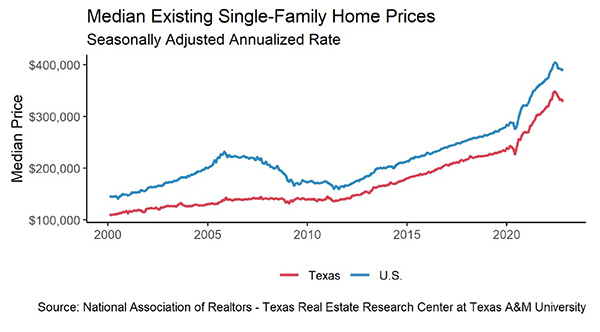

Since the Federal Reserve announced the first 75-basis-point increase in June of this year, the housing market has retreated with both demand and supply slowing down. Home sales were down 7.4 percent over the previous month, and housing starts for apartments doubled in a year as investors adapted their strategies from selling single-family homes to renting out apartments. As the Fed continues its aggressive inflation policies, mortgage rates will not drop until inflation is curbed. Home prices have been depreciating, and Austin—the metro that inflated the most during 2021—saw the largest depreciation amid the market’s abrupt slowdown.

Supply1

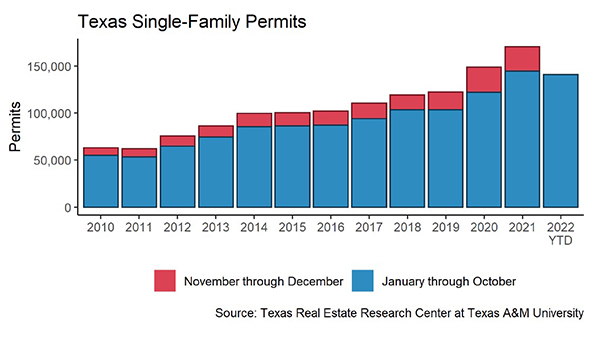

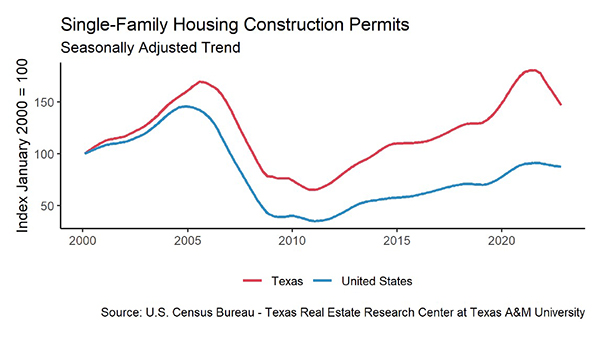

Texas’ single-family construction permits dropped below 10,000 units for the first time in two years. Despite slowing housing activities, Texas remained most active at authorizing construction projects, surpassing No. 2 Florida by one additional permit for every nine permits. Construction permits fell in all major metros except Houston. Dallas (2,545 permits) contracted by more than 700 permits in the past month, falling to a three-year low, while demand in Houston (3,226) stayed steady. As usual, Austin (1,380) was building homes twice as fast as San Antonio (629). Contrary to the weakened single-family sector, permits for Texas’ multifamily sector grew robustly. The number of issuances both for 2-4 family homes and apartments doubled from the year before.

The lumber producer price index (PPI) fell four times in the past six months, and the input cost had slid 17.6 percent since the year started. Since June’s interest rate rise, the South’s total housing starts plummeted quickly. However, this measure of new-home construction jumped to its highest level since bottoming out in June to 808,000 units in October, as housing starts inched up 6.7 percent month over month (MOM). Growth was driven largely by multi-unit construction permits while single-family units continued to stall.

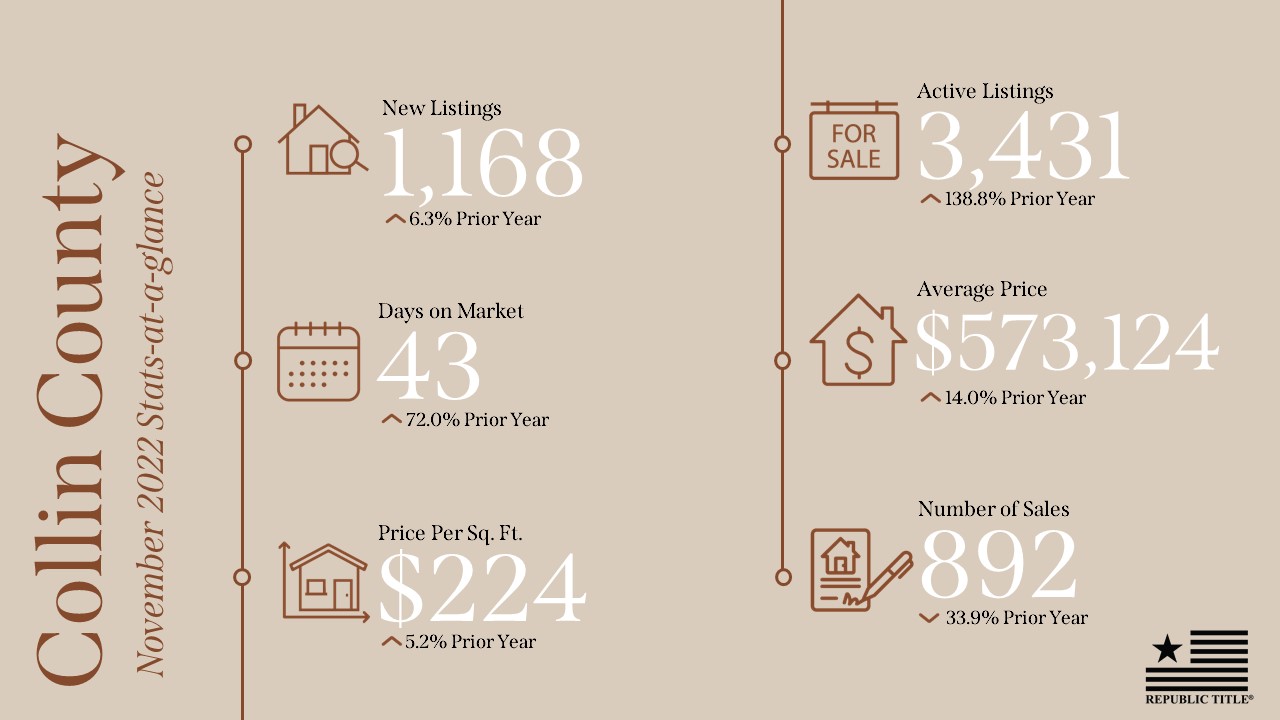

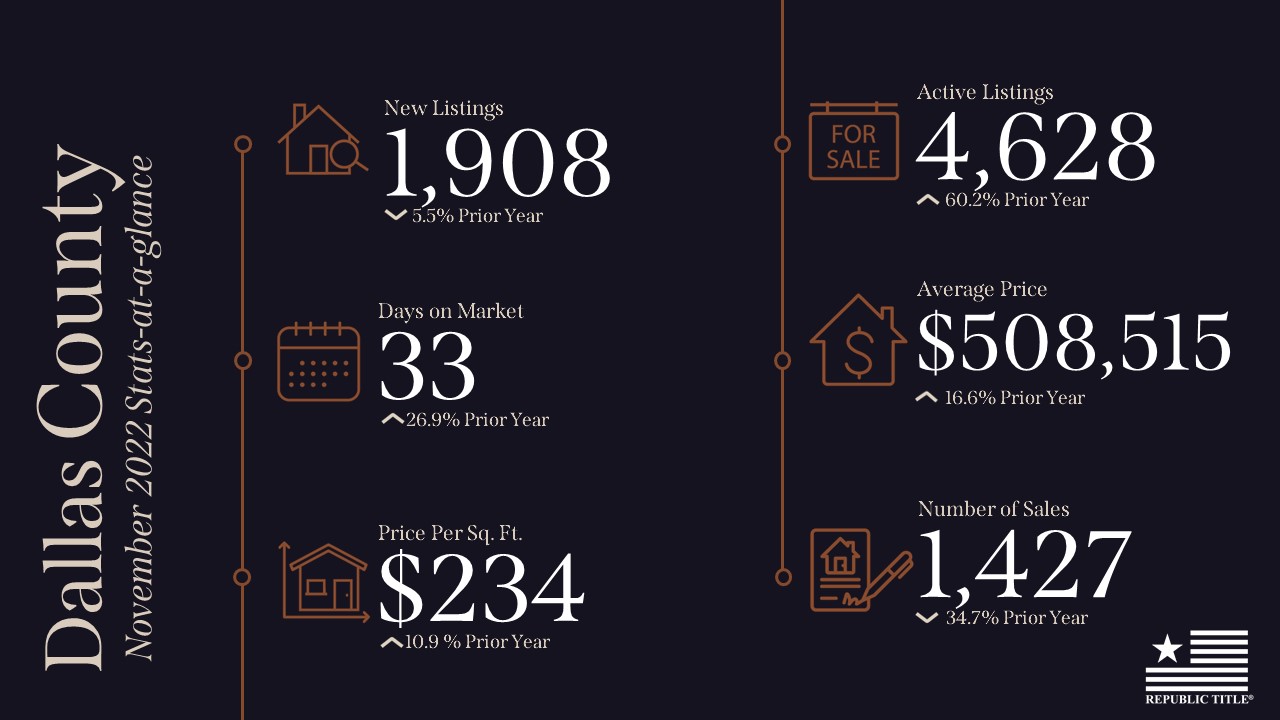

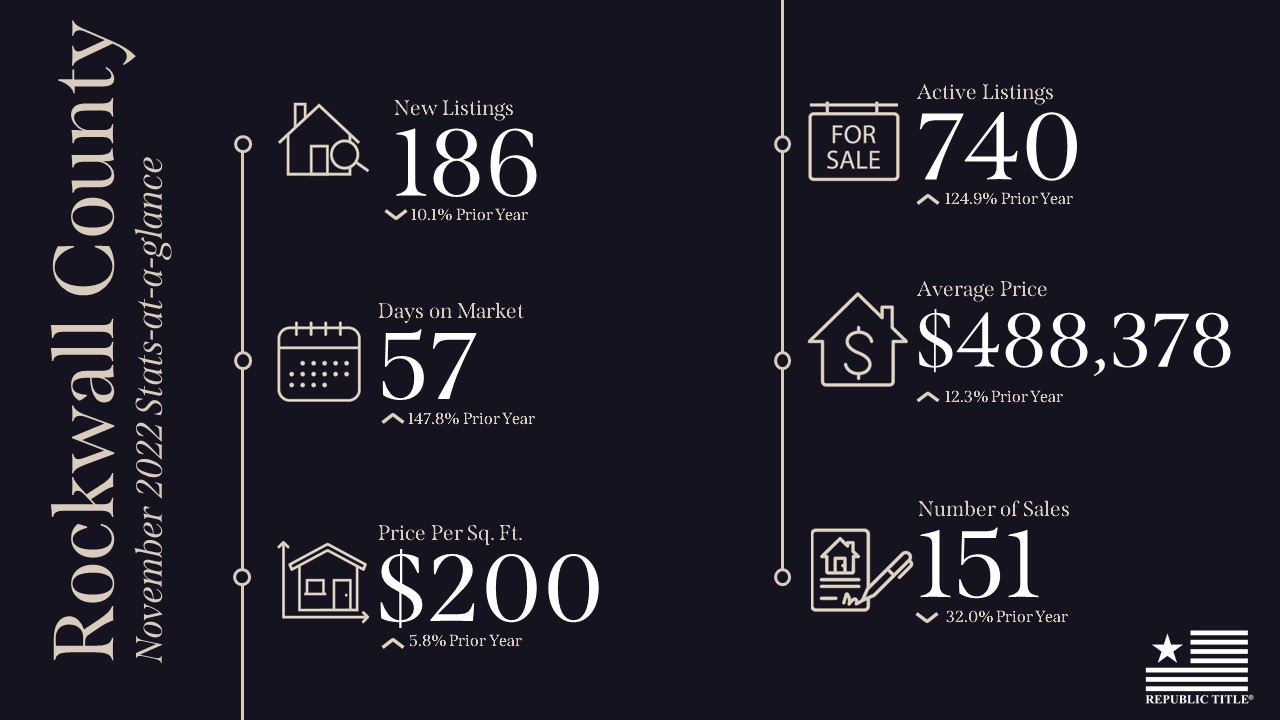

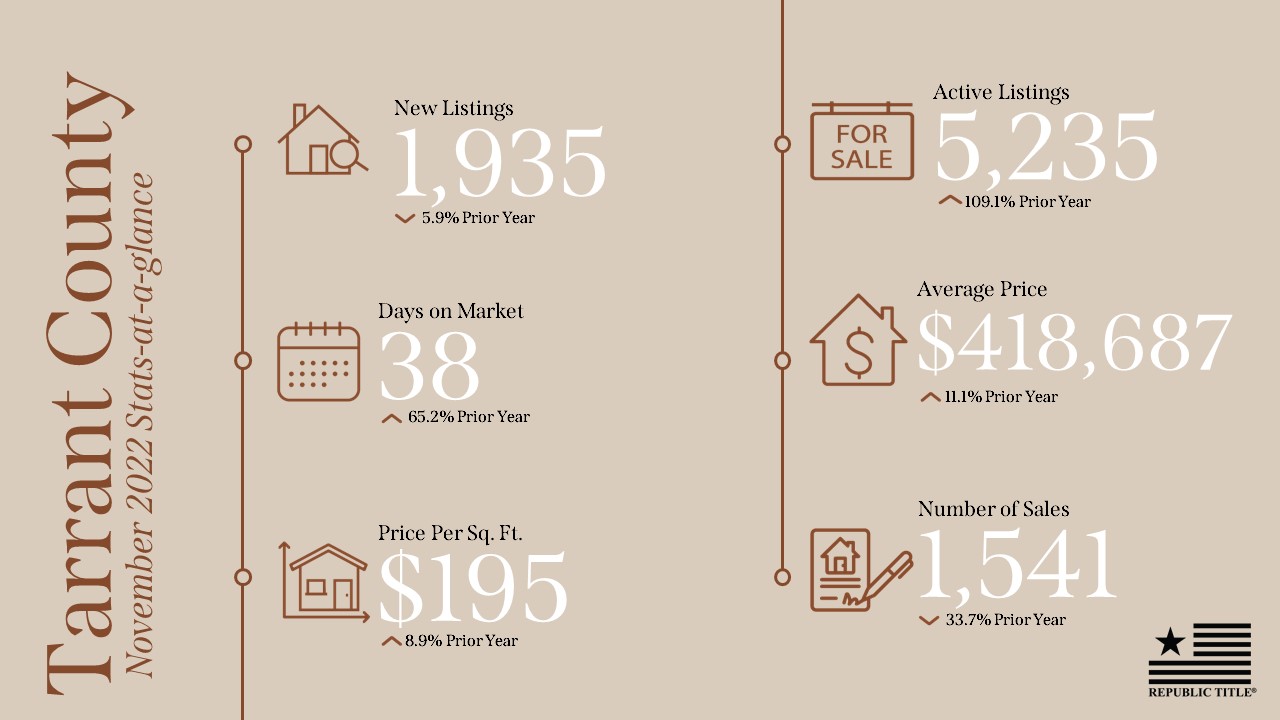

While new homebuilding projects are slowing, the state’s current supplies have been accumulating. Active listings grew 6.6 percent MOM to a seasonally adjusted rate of 89,800 units. Compared with March’s inventory of 41,800 units, the metric has doubled, and the state has nearly recovered to the pre-pandemic level. Accordingly, Texas’ months of inventory (MOI) ticked up to 2.7 MOI. San Antonio led the pack with three MOI, followed closely by Austin. Dallas remained the tightest with 2.3 MOI. This trend suggests a cooler housing market, considering the conspicuously low inventories in the past two years.

Demand

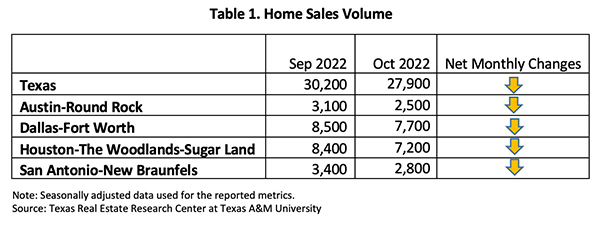

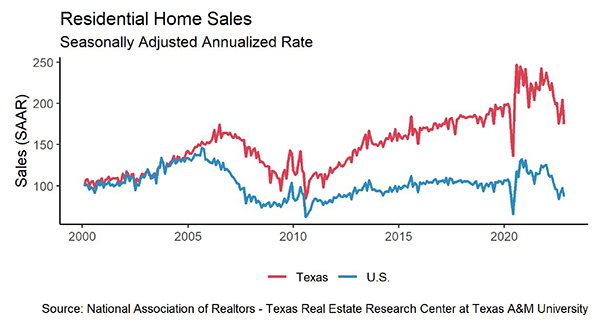

Total home sales diminished 7.4 percent MOM, settling at a seasonally adjusted rate of 27,900 closed listings (Table 1). Texas’ four Metropolitan Statistical Areas (MSA) all mirrored the statewide trend, as sales in each metro shrank by double digits YOY. The rapid decline in housing sales has revealed how important low mortgage rates are to the latest housing frenzy. According to Texas Realtors’ Data Relevance Project, October sales were down 21 percent from a year earlier. At the current rate, year-end 2022 sales will likely fall short of 2021.