Texas Housing Insight – March 2021 Summary

Total Texas housing sales fell 6.4 percent during the first quarter amid rising mortgage rates and weather-related disruptions that dampened business activity in February. Most of the quarterly decline was attributable to decreased resale transactions priced less than $400,000, offsetting elevated luxury home sales in the existing-home market and overall new-home sales. Texas’ homeownership rate improved, although the proportion of owner-occupied units in the major metros persisted below the national and state average. Overall housing demand remained healthy but was constrained by depleted inventories, pushing median home-price growth into double-digit territory. Supply-side indicators corrected downward from record activity in the fourth quarter of 2020 but remained generally positive compared with year-ago levels. The unprecedented low level of inventory available for sale is the greatest challenge to Texas’ housing market, assuming the pandemic remains contained.

Supply*

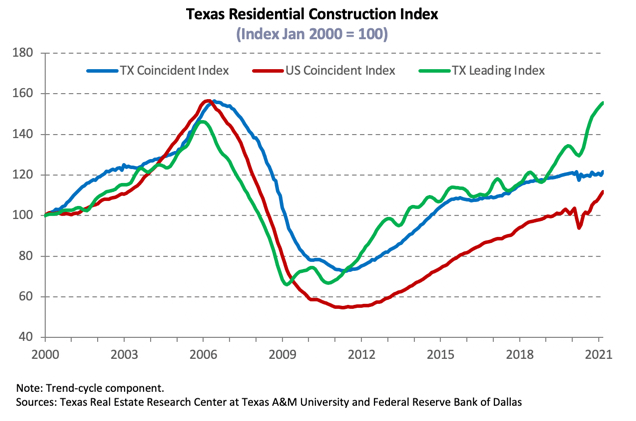

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction levels, increased to its highest level in a year due to improved industry employment, wages, and construction values. Construction activity is expected to remain strong in the coming months as indicated by the Residential Construction Leading Index, which rose to an all-time high in March amid elevated weighted building permits and housing starts, offsetting growth in the ten-year real Treasury bill. Similarly, the leading indexes in North and Central Texas trended upward, but Houston’s metric continued to decline, suggesting an impending slowdown in construction.

According to Zonda, the number of new vacant developed lots (VDLs) fell 12.2 percent during first quarter 2021, normalizing around its two-year average after record activity to end the year and the winter storm disruption in February. Austin accounted for most of the quarterly decline as VDLs intended for homes priced less than $300,000 plummeted. The metric in Dallas-Fort Worth (DFW) and San Antonio also decreased but remained above year-ago levels. Conversely, Houston VDLs still fell short of 1Q2020 numbers despite increasing for the second straight quarter following depressed activity last year, mainly at the bottom of the price spectrum.

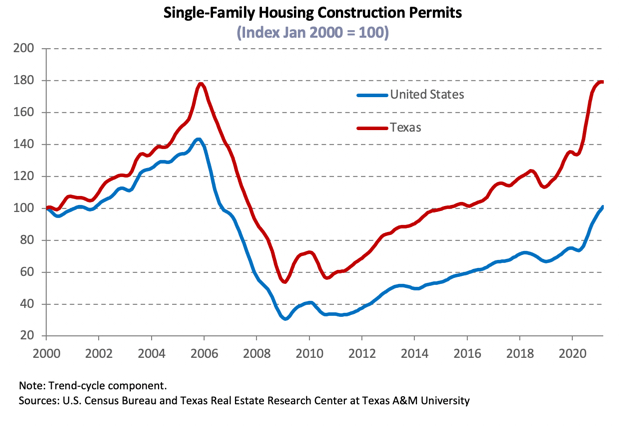

Quarterly fluctuations in single-family construction permits reflected movements in VDLs, although the metric increased 9.8 percent on a monthly basis. Houston and DFW topped the national list and accounted for most of the state’s improvement, issuing 5,142 and 4,875 nonseasonally adjusted permits, respectively. Similar to VDLs, San Antonio was the only major metro to maintain an upward trend as permits rose to 1,474. Austin’s metric posted a record-breaking 2,428 permits but ticked up modestly after adjusting for seasonality. On the other hand, a strong start to the year pushed Texas’ multifamily permits up 28.2 percent quarter over quarter (QOQ), offsetting monthly declines in February and March.

As lumber prices doubled compared with year-ago levels and Winter Storm Uri caused utility outages across the state, total Texas housing starts flattened on a quarterly basis. Zonda data revealed that single-family housing starts also inched down from its post-Great Recession high of 34,600 groundbreakings in 4Q2020 but remained elevated 25.1 percent year over year (YOY). Single-family starts in North Texas and San Antonio declined QOQ, but activity increased in Austin and Houston for homes priced more than $300,000.

Single-family private construction values decreased every month this year to date, dropping 4.7 percent QOQ in real terms. Only Houston construction values improved in March, although the metric still fell on a quarterly basis. Values in DFW and San Antonio sank for the second straight month, normalizing from record levels at the start of the year. Austin also registered a monthly contraction, but the metric posted the smallest quarterly decline out of the major metros, just 2.7 percent.

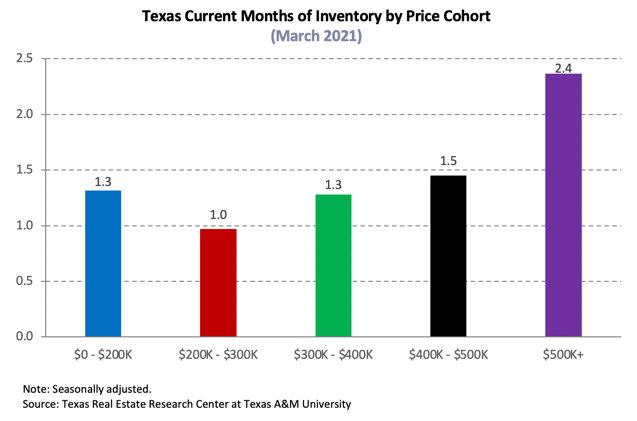

The number of homes added to the Multiple Listings Service rebounded in March after plunging during the winter storm. Sales also picked up and even outpaced the influx of new listings, pulling Texas’ months of inventory(MOI) down to an all-time low of 1.4 months. A total MOI around six months is considered a balanced housing market. Inventory for homes priced less than $300,000 was even more constrained, dropping to just one month. Even the MOI for luxury homes (homes priced more than $500,000), the price range at which inventory was at its most expansive, slid to 2.4 months.

The supply situation in the major metros was even more critical than the statewide metric. Austin’s MOI fell below 0.4 months, while the metric ticked down to one month in both Dallas and Fort Worth and 1.3 months in San Antonio. Although Houston’s overall MOI was greater than the state average at 1.6 months, inventory for homes priced less than $300,000 slipped below 0.9 months. Depleted inventory is a major headwind to the continued health of Texas’ housing market.

Demand

Sales picked up in March after the weather-related decline the previous month, but total housing sales fell 6.4 percent QOQ amid rising mortgage rates. Activity for homes priced less than $400,000 offset quarterly growth of 12.2 percent in the luxury-home sector. The overall decrease was concentrated in the resale market where DFW and Austin posted double-digit quarterly contractions. The latter, however, along with San Antonio and Houston, maintained substantial growth relative to 1Q2020 sales.

In contrast to decreased quarterly sales in the existing-home market, Zonda data revealed positive sales growth in all four of the major metros’ new-home sectors. New-home sales in Austin rose for the third consecutive quarter to a record 5,900 sales despite reduced transactions for homes priced less than $300,000. Similar decreases at the bottom price range in North Texas, at least partially due to climbing construction costs, resulted in just 1.1 percent overall YOY growth, matching the existing-home sales annual increase. Houston and San Antonio new-home sales, however, jumped 10.8 and 5.9 percent QOQ, respectively.

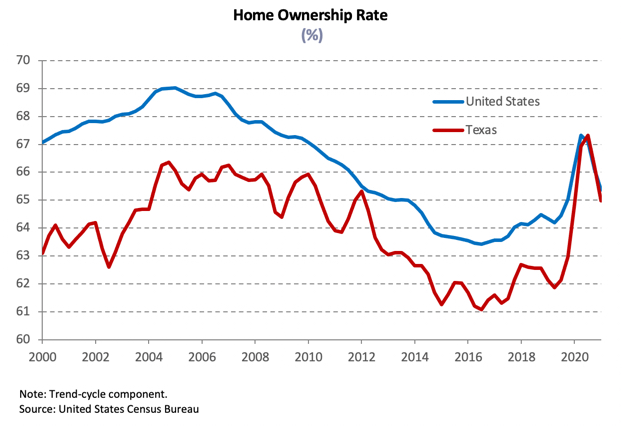

Amid recovering economic conditions and overall robust sales activity, Texas’ homeownership rate rose to 65.8 percent, about even with the U.S. rate, per the Census Bureau’s Current Population Survey/Housing Vacancy Survey. Nationally, homeownership decreased for white households but improved for Black households, households of other races, and householders of ages 35 to 44 years. Although homeownership in Texas’ major metros increased, rates persisted below the state and national average. Once the state leader with nearly three-quarters of total housing units owner-occupied in 3Q2020, Austin posted a homeownership rate of just 64.9 percent in 1Q2021. The metric ticked up to 64.8 percent in DFW, while climbing to 65.2 and 65.4 percent in San Antonio and Houston, respectively, after two quarterly declines. Homeownership rates, however, could decline in 2021 as COVID-19 foreclosure-protection policies expire.

Texas’ average days on market (DOM) continued to trend downward after a brief two-month increase around the economic shutdown last spring, falling below 42 days. Austin registered the most drastic decline from year-ago levels as robust demand cut the DOM in half to 25 days. The metric in North Texas sank to an unprecedented 32 and 28 days in Dallas and Fort Worth, respectively. Meanwhile, the average home in Houston and San Antonio sold at a rate closer to the state measure, staying on the market for 41 days.

Climbing oil prices, accelerating vaccination rates, and optimistic national economic data during the first quarter resulted in higher growth and inflation expectations for 2021. The ten-year U.S. Treasury bond yield increased to 1.6 percent** in March, recovering to pre-pandemic levels. The Federal Home Loan Mortgage Corporation’s 30-year fixed-rate rose for the third straight month from a record low at year-end to 3.1 percent (series starting in 1971). Further increases in mortgage rates this year may soften housing demand and slow home-price appreciation.

Within Texas, the median mortgage interest rate inched up to 2.68 and 2.83 percent for GSE and non-GSE loans, respectively, in February***. Meanwhile, home-purchase applications remained down 12.4 percent year to date (YTD) after just a slight increase in March from reduced activity the month prior during the winter storm. The YOY comparison, however, was still in double-digit growth territory. Refinance applications fell more than 20 percent on both a YTD and YOY basis, being more sensitive to mortgage rate fluctuations. Two factors are likely impacting refinance activity: lenders adding more requisites and the shrinking pool of households able to refinance. (For more information, see Finding a Representative Interest Rate for the Typical Texas Mortgagee.)

In February, the median loan-to-value ratio (LTV) and debt-to-income ratio (DTI) constituting the “typical” Texas conventional-loan mortgage decreased from 86.5 to 83.9 and 35.7 to 35.0, respectively. Moreover, the median credit score jumped from 748 to 755. This improved credit profile may reflect the fact that only the most qualified housing applicants are able to outbid their competition for their desired homes amid exceptionally tight inventories and robust demand. Conversely, the median LTV and DTI of the GSE borrower ticked up to 85.9 and 36.3, respectively, as Fannie Mae’s 1Q2021 Mortgage Lender Sentiment Survey reported purchase mortgage demand over the past three months fell for GSE-eligible and government loans. The metrics, however, flattened around their two-year averages.

Prices

A shift in the composition of sales toward higher-priced homes due to constrained inventories at the lower end of the market contributed to home-price appreciation. The Texas median home price accelerated 14.1 percent YOY to a record-breaking $283,200 in March. Homes priced more than $300,000 comprised more than four-fifths of total sales in Austin, resulting in the median price ($424,100) skyrocketing 28.8 percent. The metric also posted annual growth above the state average in Dallas ($341,300) and Houston ($288,200), elevating 15 percent in the former and 16 percent in the latter. The Fort Worth ($285,300) and San Antonio ($266,100) median price inched down from all-time highs the previous month but still increased 14.4 and 11.5 percent YOY, respectively.

The Texas Repeat Sales Home Price Index accounts for compositional price effects and provides a better measure of changes in single-family home values. Texas’ index corroborated substantial and unsustainable home-price appreciation, averaging annual growth of 10.4 percent in 1Q2021. The metric surged 22.6 percent in Austin, followed by North Texas with 11.5 and 10.8 percent home-price appreciation in Dallas and Fort Worth, respectively. In San Antonio, the index increased 9.9 percent. Houston’s metric rose by a relatively moderate 7.8 percent, less than the average price appreciation in 2014 but still exceeding income growth and affecting affordability.

Declining mortgage rates offset accelerating home-price appreciation in 2020. Increasing interest rates during 1Q2021, however, combined with double-digit home-price growth, chipped away at housing affordability. Austin registered the most drastic drop as the index sank from 1.69 in 1Q2020 to 1.57, indicating that a family earning the median income could afford a home 57 percent more than the median sale price. The Fort Worth and Houston indexes decreased for three straight quarters to 1.81 and 1.79, respectively, hovering around their year-ago readings. On the bright side, the metric inched up to 1.66 in Dallas and 1.78 in San Antonio. Continued improvement is important to Texas’ demographic advantages that have supported the state’s economic prosperity over the past decade.

Single-Family Forecast

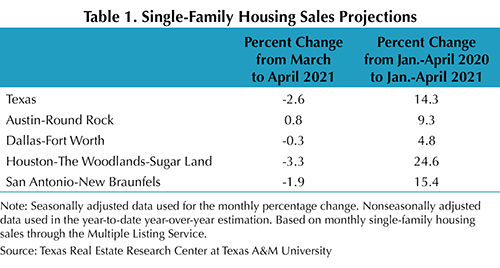

The Texas Real Estate Research Center projected single-family housing sales using monthly pending listings from the preceding period (Table 1). Only one month in advance was projected due to the uncertainty surrounding the pandemic and the availability of reliable and timely data. Texas sales are expected to decrease 2.6 percent in April from March. Of the major metros, Houston and San Antonio are predicted to bear the brunt of the decline with the metric falling 3.3 and 1.9 percent, respectively. Meanwhile, single-family sales in Austin and North Texas will likely flatten around March levels. Still, activity through the first four months of 2021 should surpass sales during the same period in 2020.

Household Pulse Survey

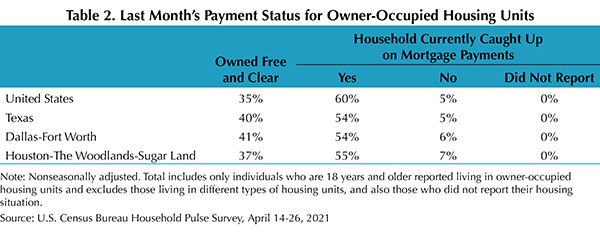

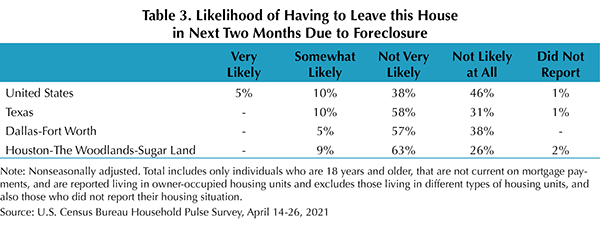

According to the U.S. Census Bureau’s Household Pulse Survey, only 5 percent of Texas homeowners were behind on their mortgage payments in March, the smallest proportion since July (Table 2). The metric within Texas’ largest metropolitan areas, however, hovered higher at 6 and 7 percent in DFW and Houston, respectively. The share of Texas respondents who were not current and expected foreclosure to be either very likely or somewhat likely in the next two months fell to 10 percent, lower than the national rate of 15 percent (Table 3).

The proportion of delinquent individuals who were at risk of foreclosure decreased in North Texas to 5 percent but ticked up to 9 percent in Houston, although the metric remained improved from its one-third reading from the Week 26 survey. The Federal Housing Finance Agency’s foreclosure and REO eviction moratoriums for properties owned by Fannie Mae and Freddie Mac (the Enterprises) are currently extended through June 30, 2021. The Centers for Disease Control and Prevention renewed its federal eviction moratorium through the second quarter. Continued stability in the housing market is essential to Texas’ economic recovery.

________________

* All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

** Bond and mortgage interest rates are nonseasonally adjusted. Loan-to-value ratios, debt-to-income ratios, and the credit score component are also nonseasonally adjusted.

*** The release of Texas mortgage rate data typically lag the Texas Housing Insight by one month.

Source – James P. Gaines, Luis B. Torres, Wesley Miller, Paige Silva, and Griffin Carter (May 13, 2021)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight

ullamcorper mattis, pulvinar dapibus leo.