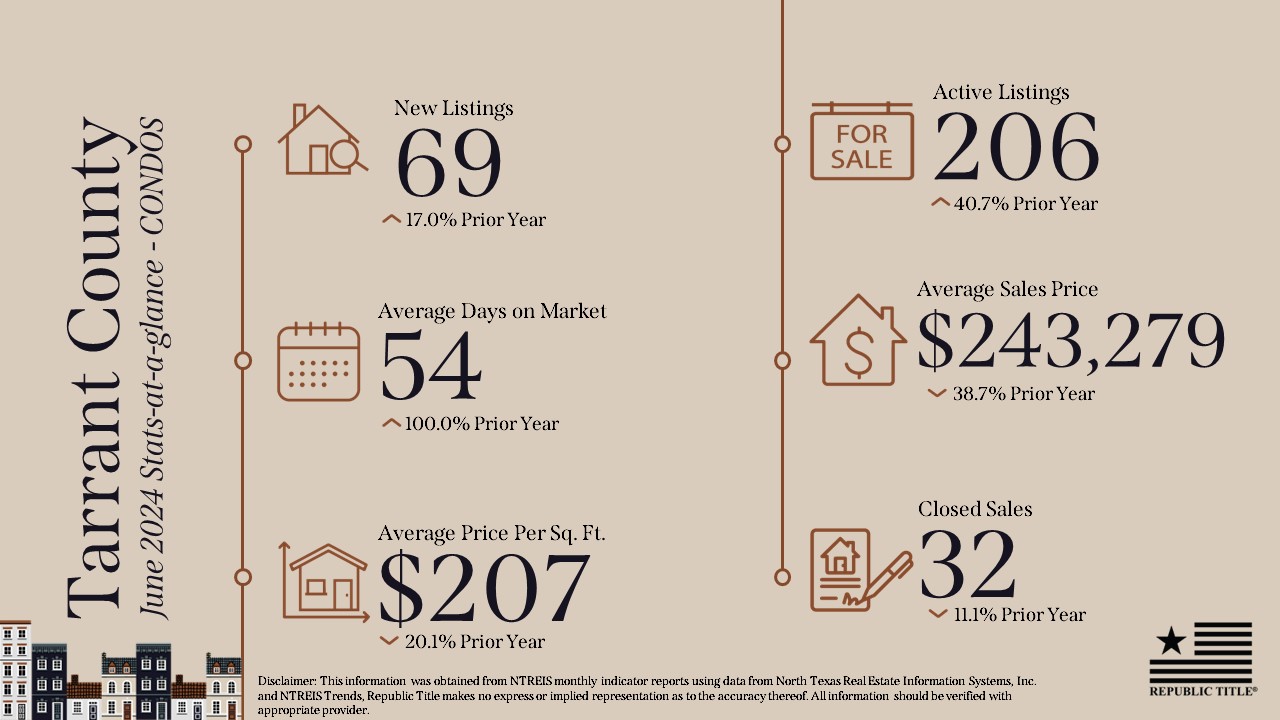

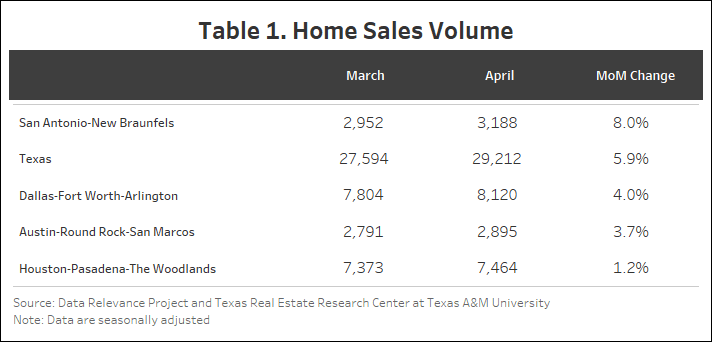

In June 2024, the real estate landscape across various counties in the Dallas-Fort Worth area continued to show varied patterns.

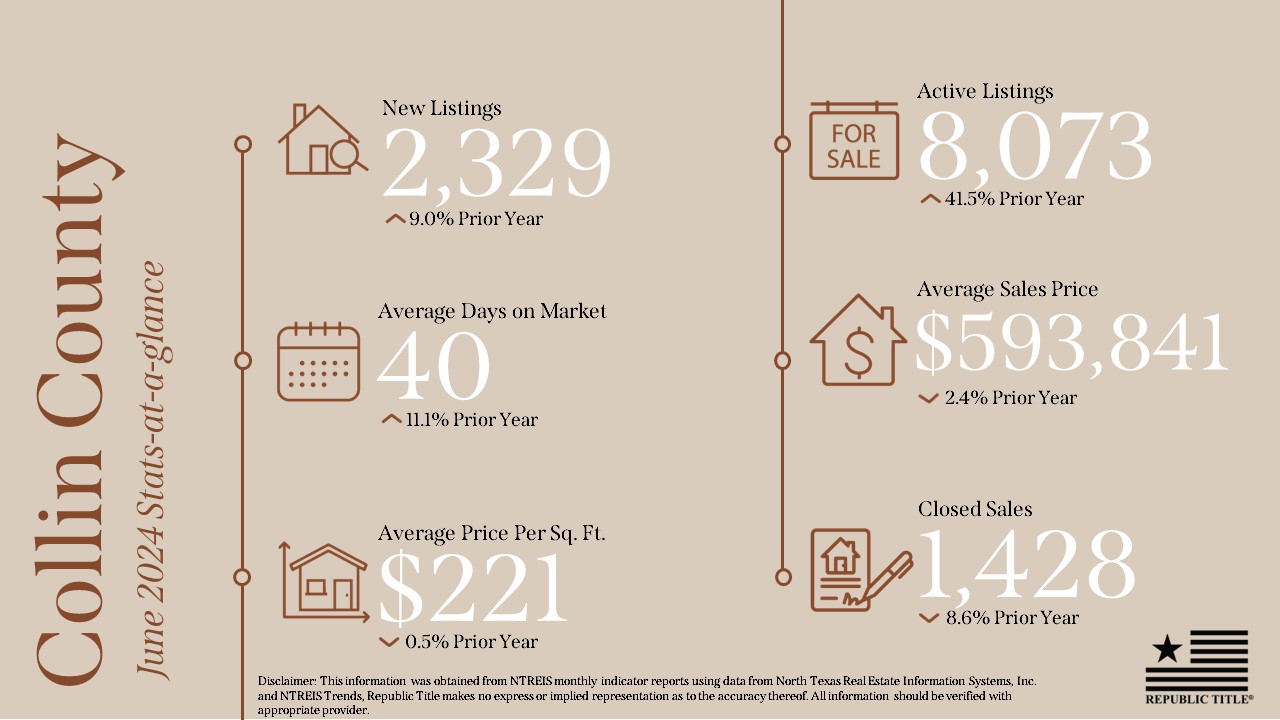

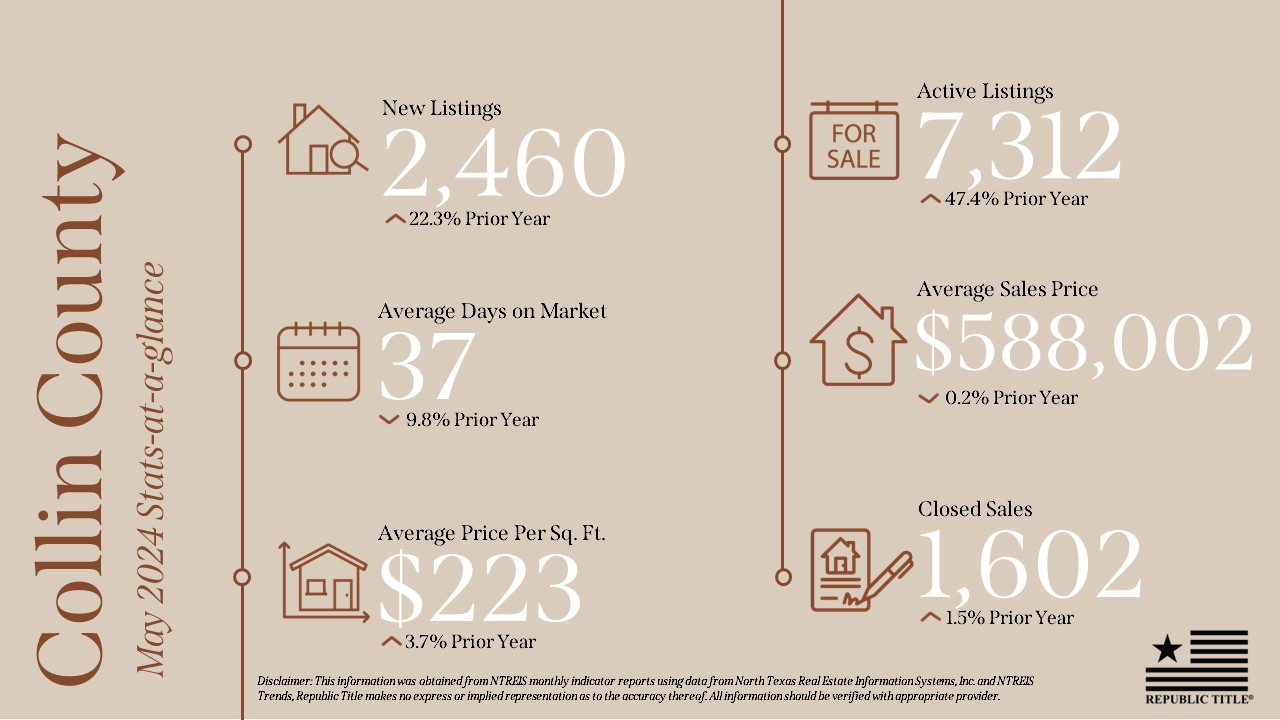

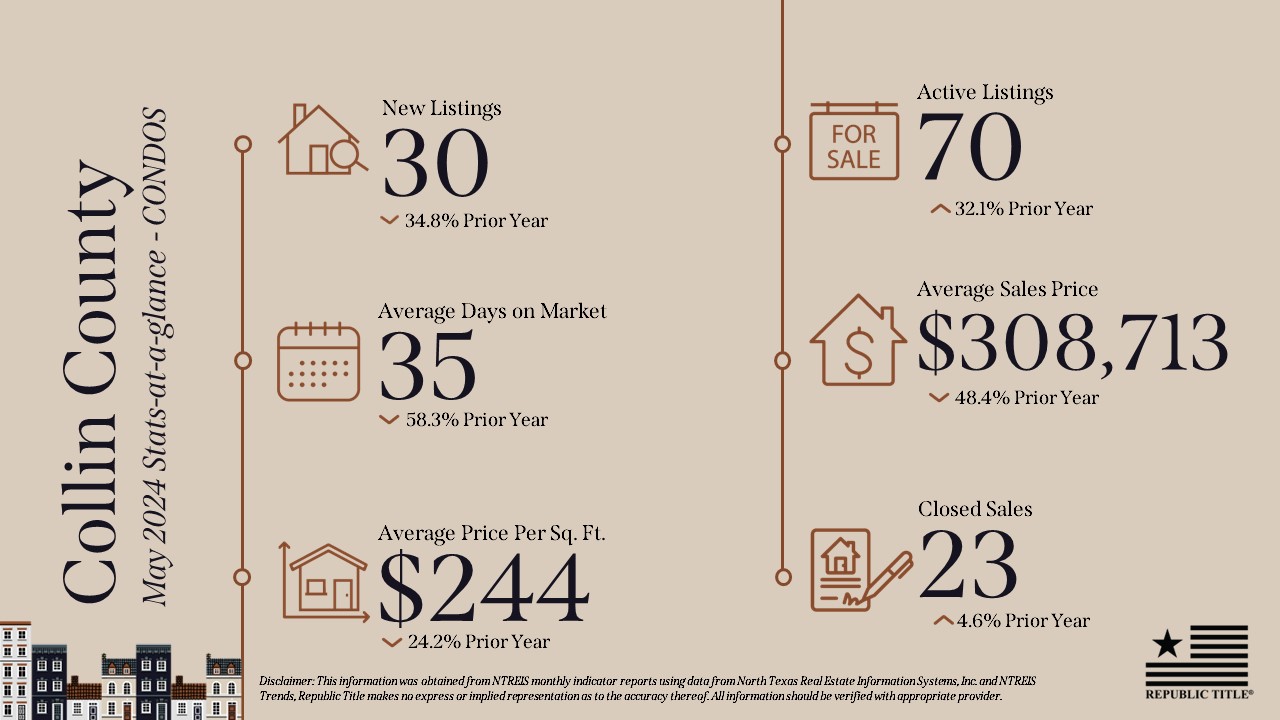

In Collin County, there was a notable 9% increase in new listings, alongside a substantial 41.5% rise in active listings compared to the previous year. The average days on the market saw an 11% increase, while the average sales price slightly decreased to $593,841, and the average price per square foot dropped by 0.5%. Closed sales experienced an 8% decline from the prior year.

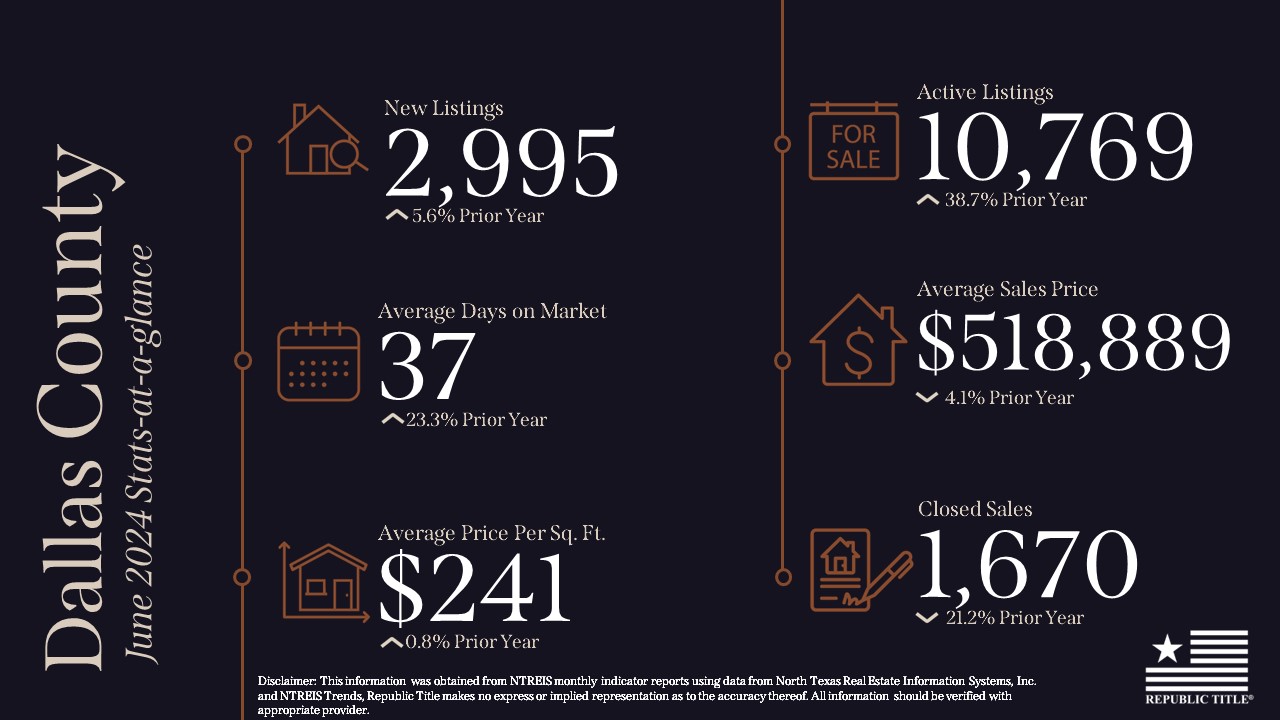

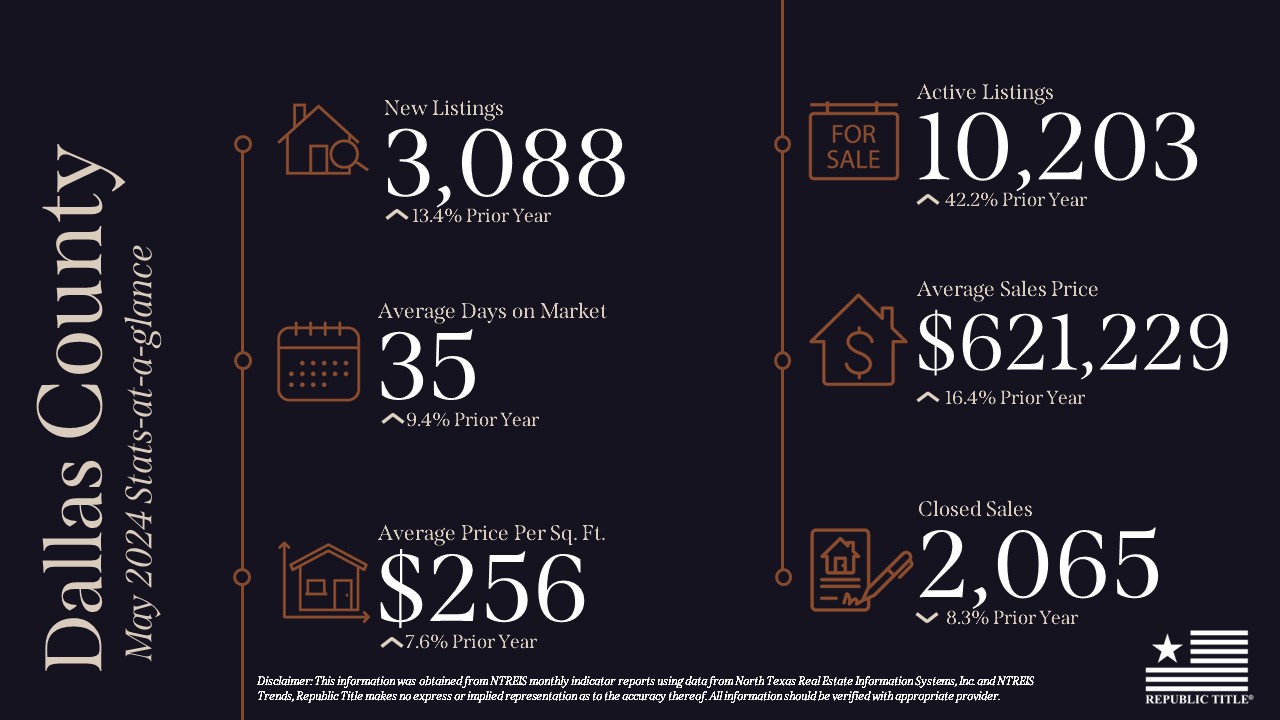

Dallas County observed a 5.6% growth in new listings, accompanied by a significant 38.7% increase in active listings year-over-year. The average days on market surged by 23.3%, while the average sales price decreased by 4.1% to $518,889. The average price per square foot, however, saw a slight uptick of 0.8%. Closed sales declined notably by 21.2% compared to the previous year.

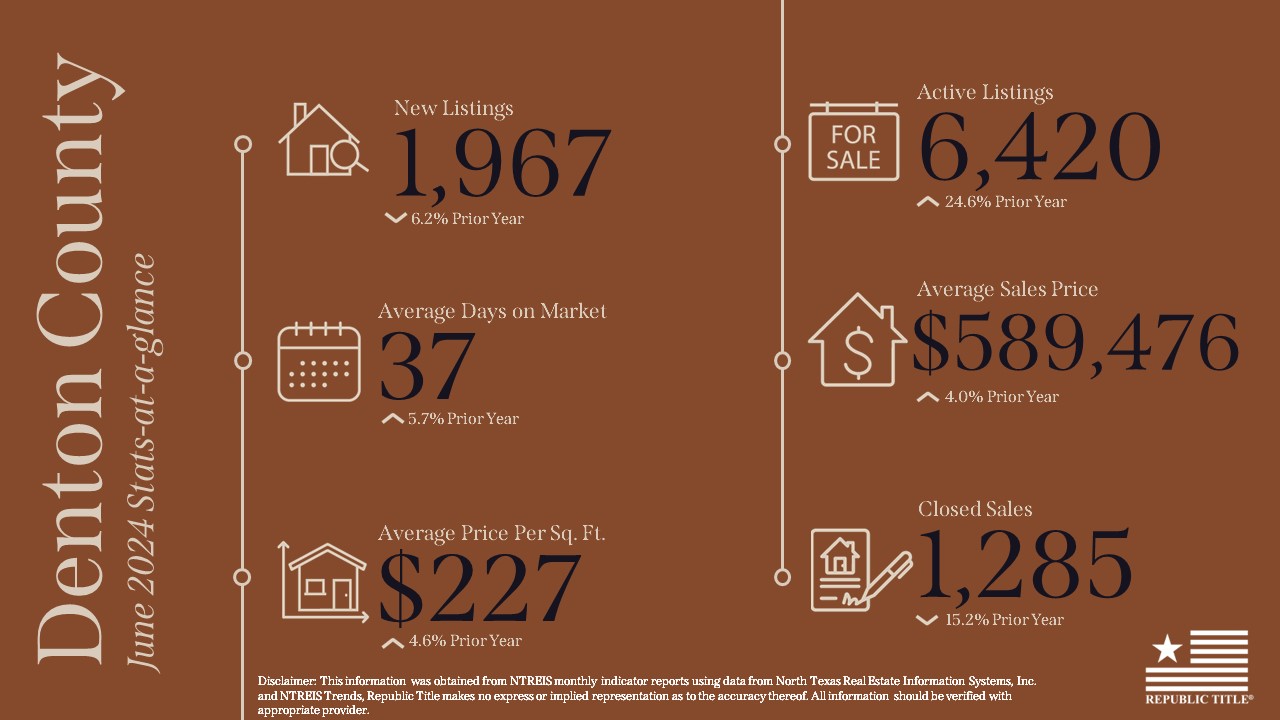

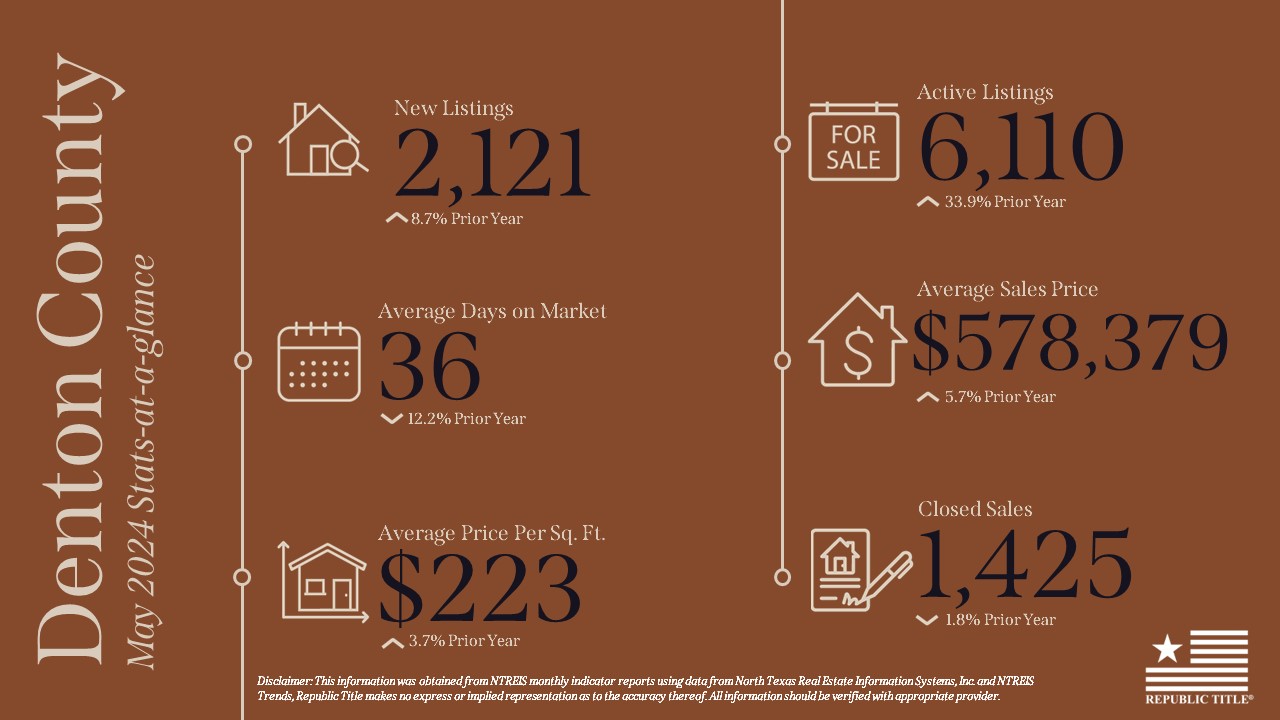

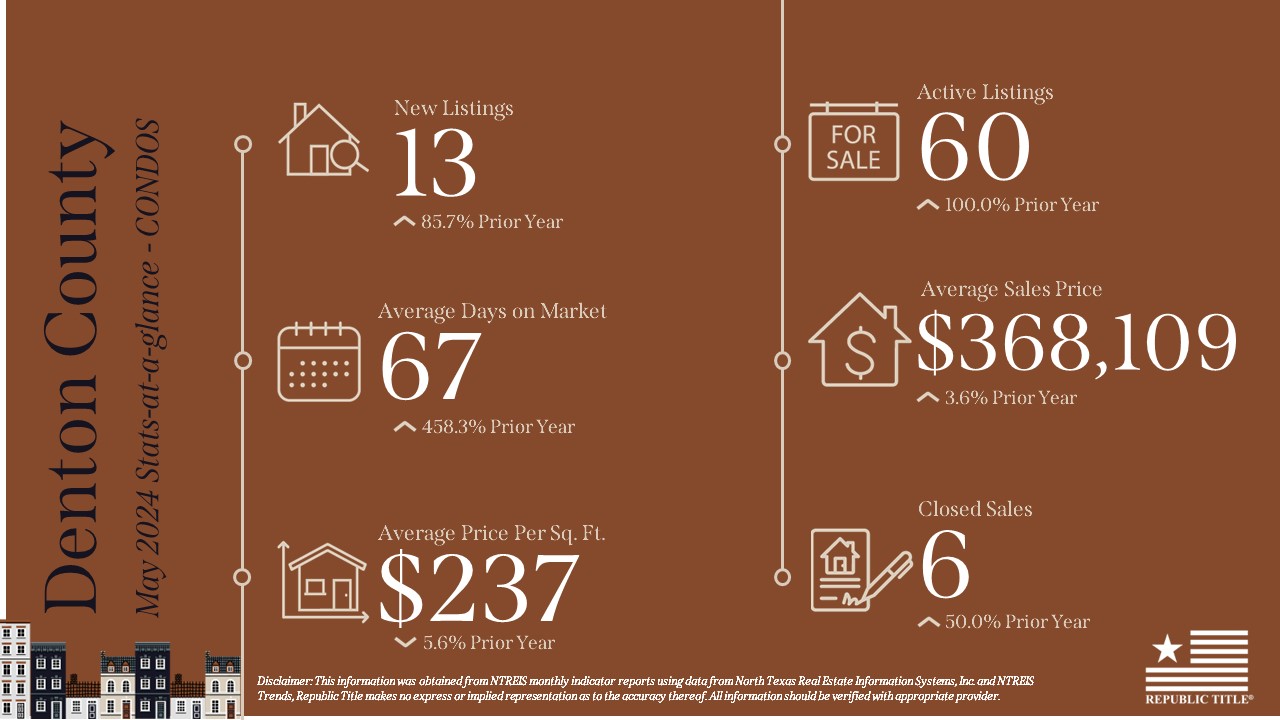

In Denton County, new listings decreased by 6.2%, but active listings rose by nearly 25% from June 2023. The average days on market increased by 5.7%, while the average sales price showed a 4% uptick. The average price per square foot also increased by 4%, despite closed sales declining by 15% compared to the same period last year.

Overall, the real estate market in North Texas appears to be navigating through a phase of adjustment and recalibration in mid-2024. Monitoring these trends will be crucial to understanding how the market evolves in response to economic conditions and buyer sentiment in the coming months.

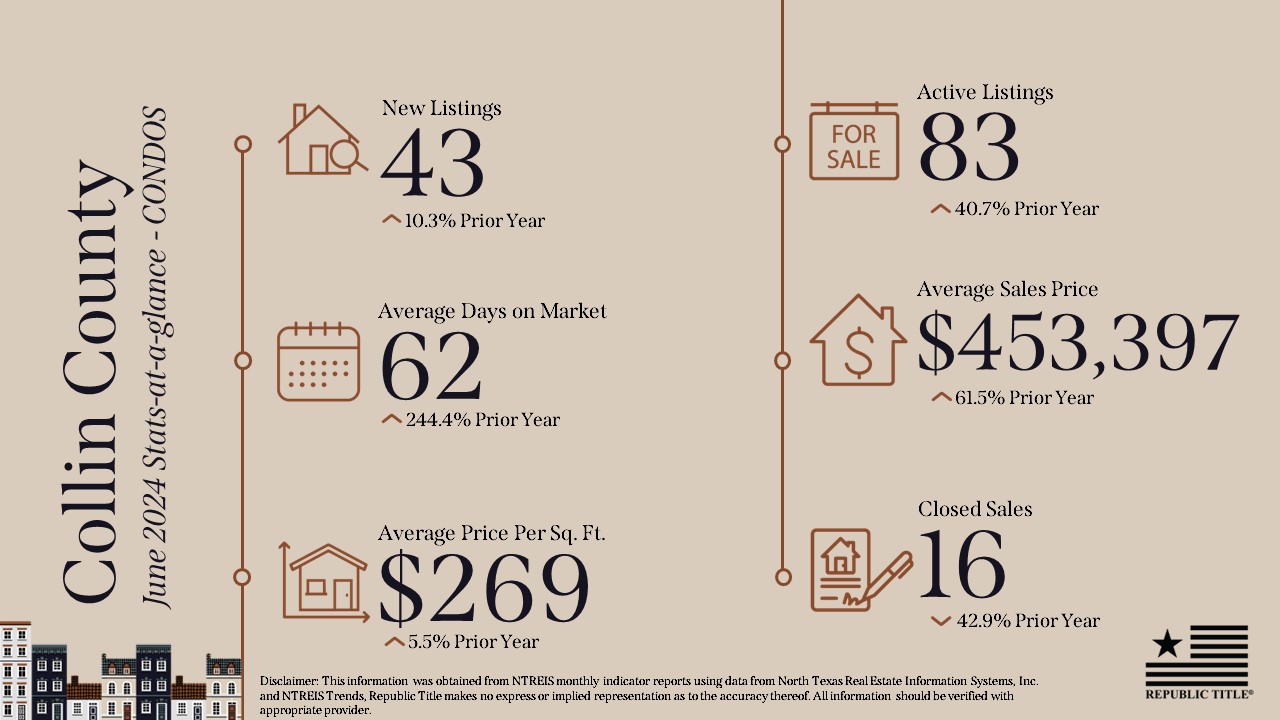

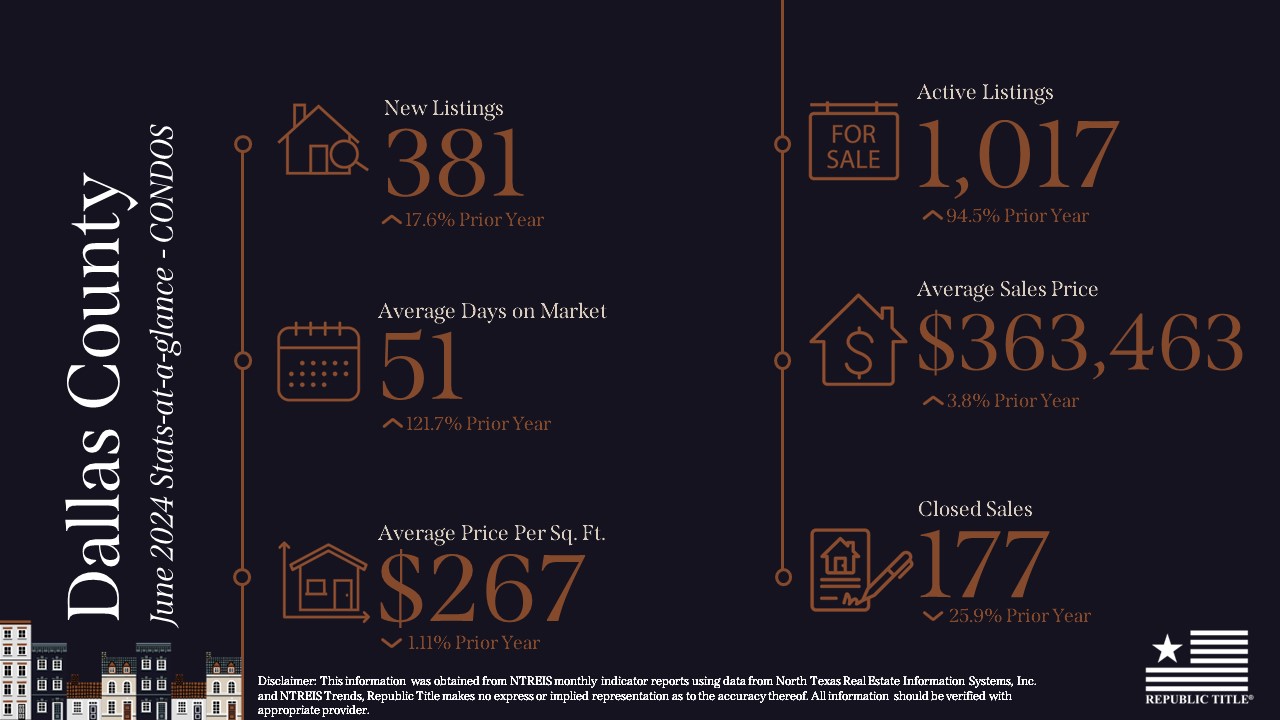

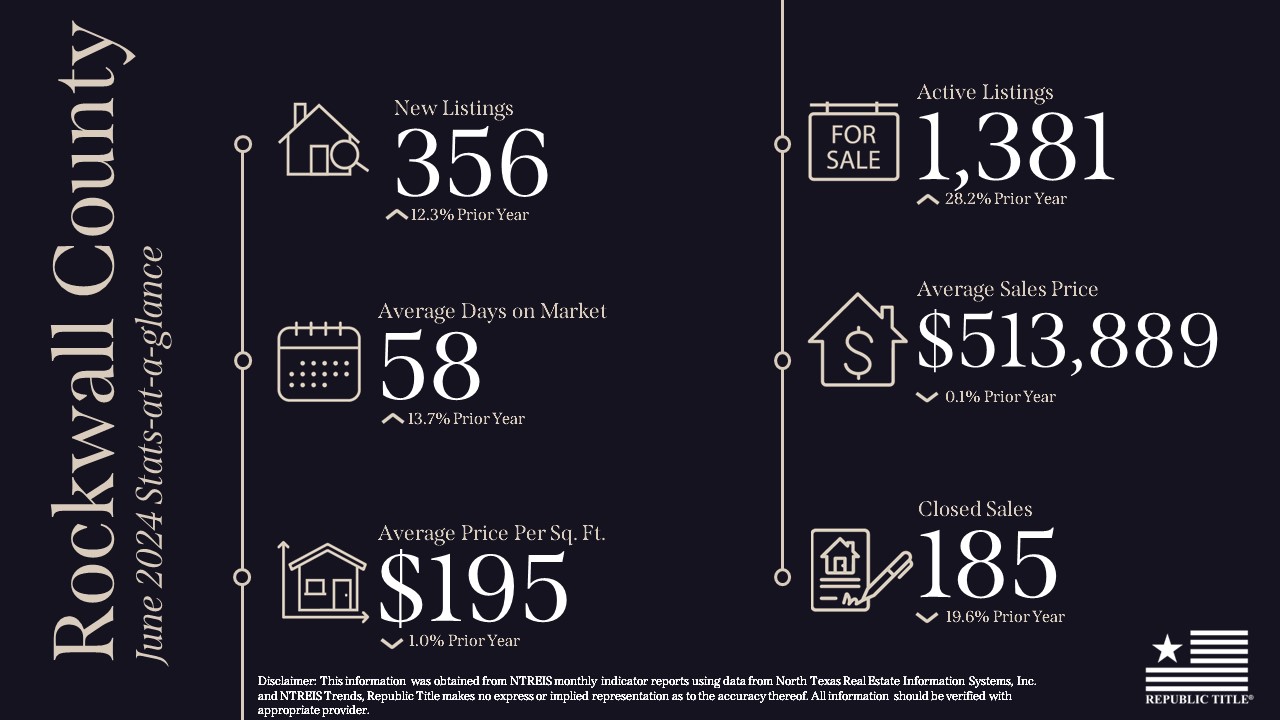

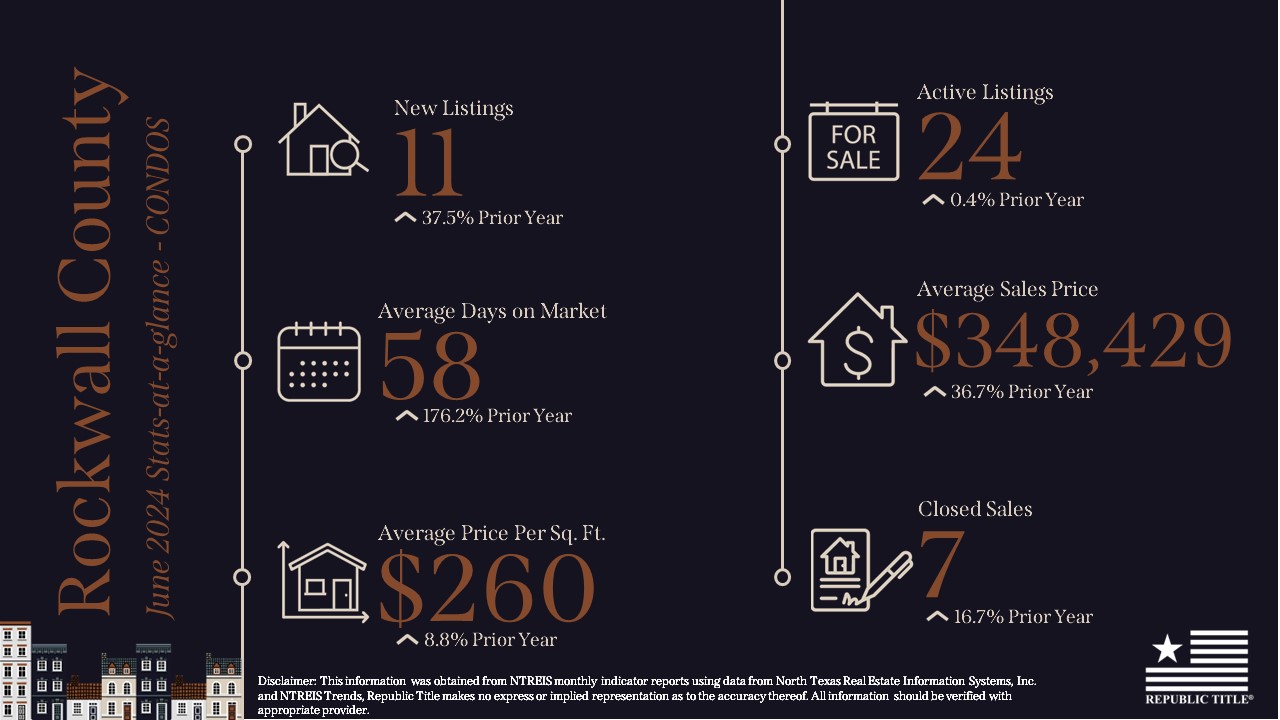

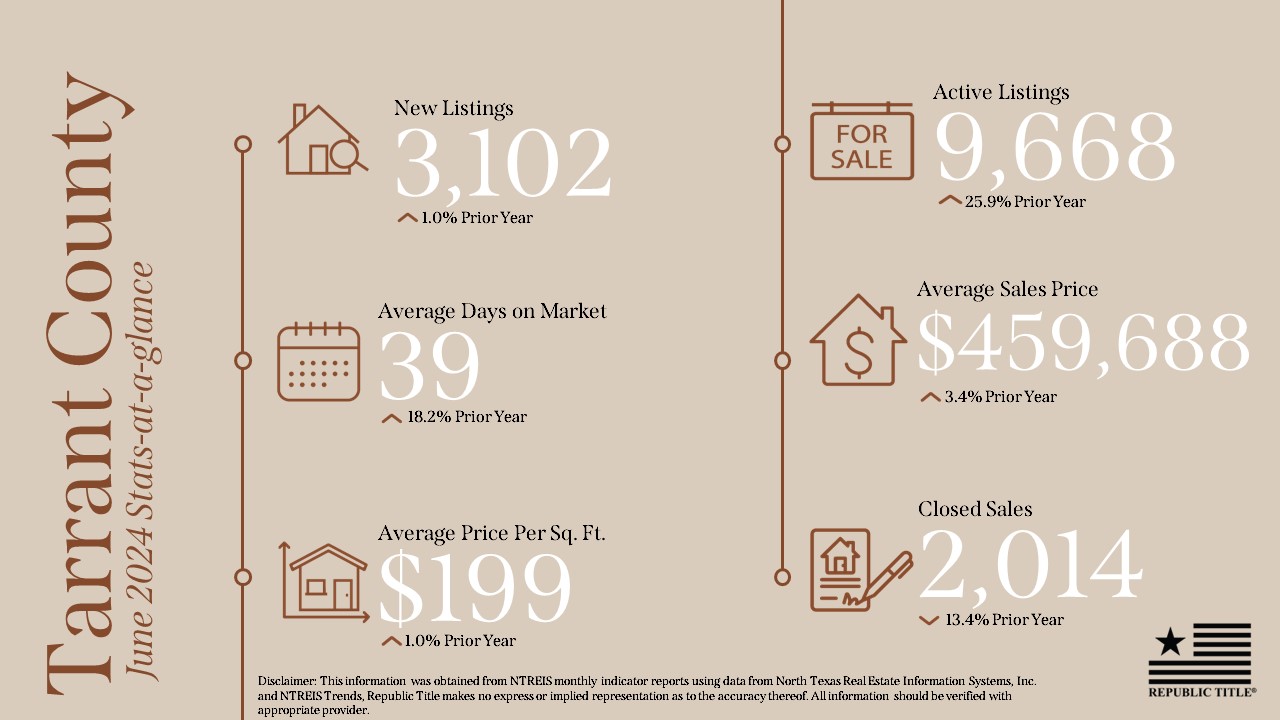

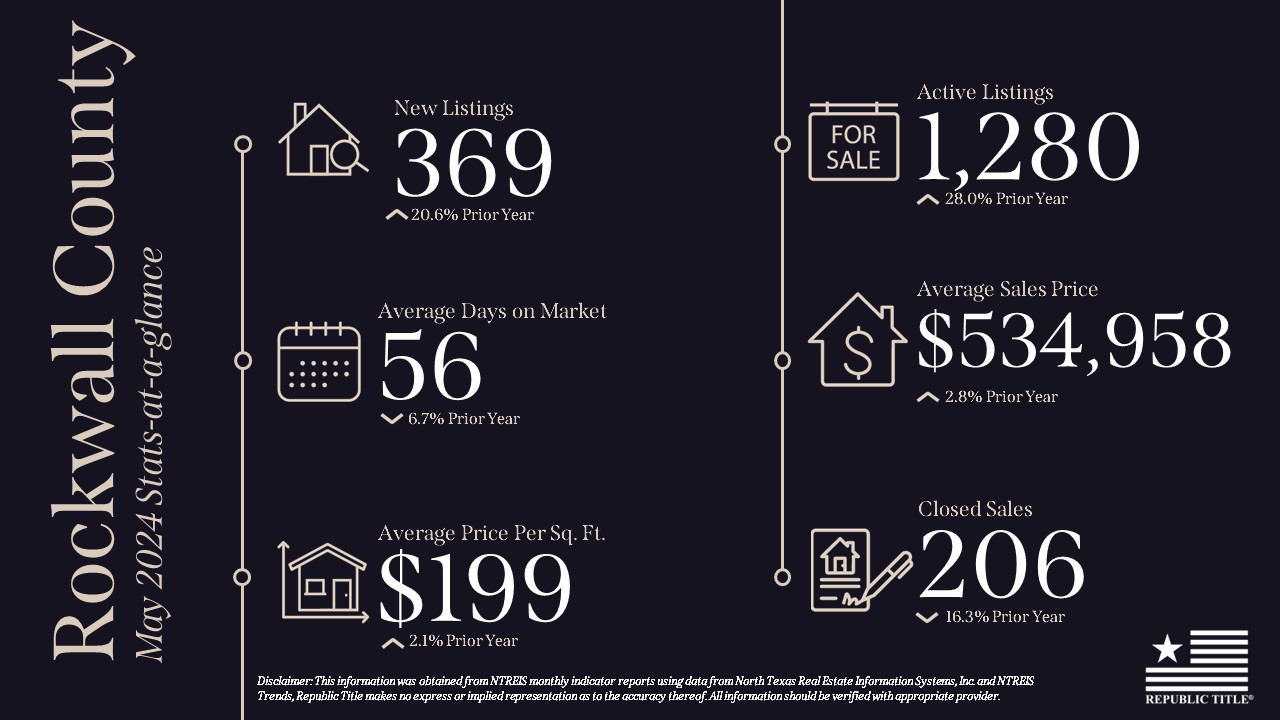

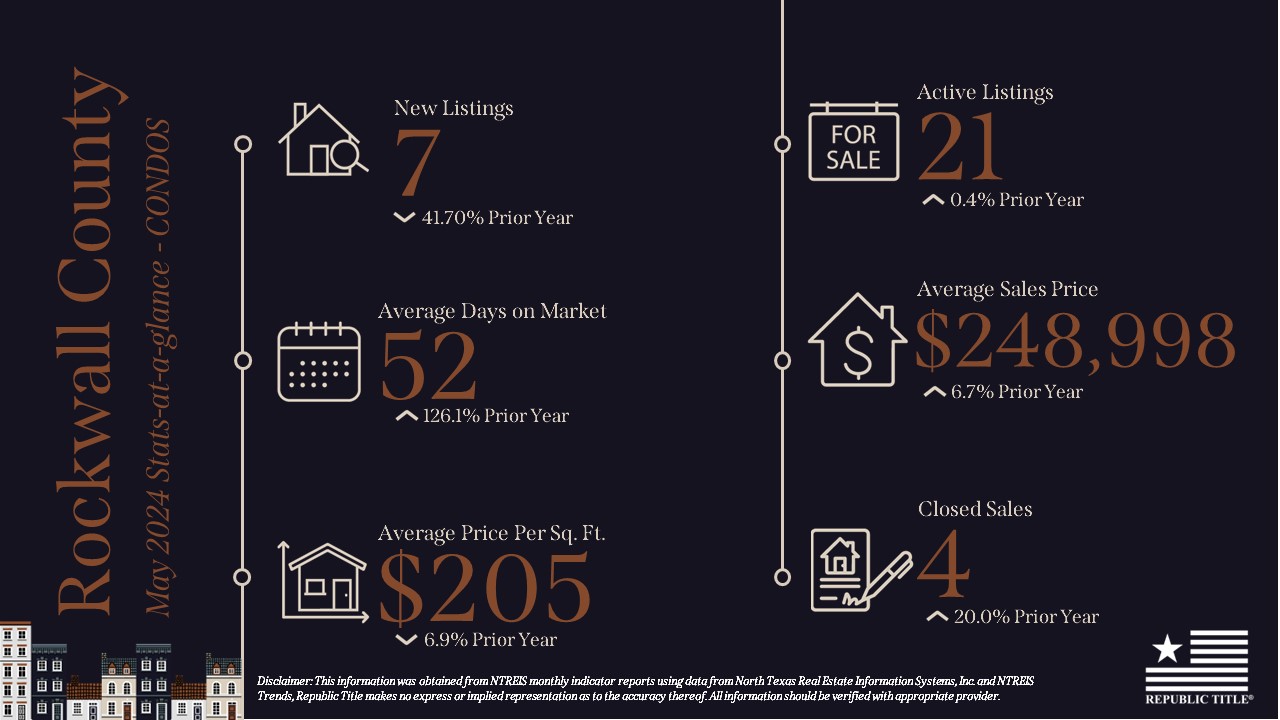

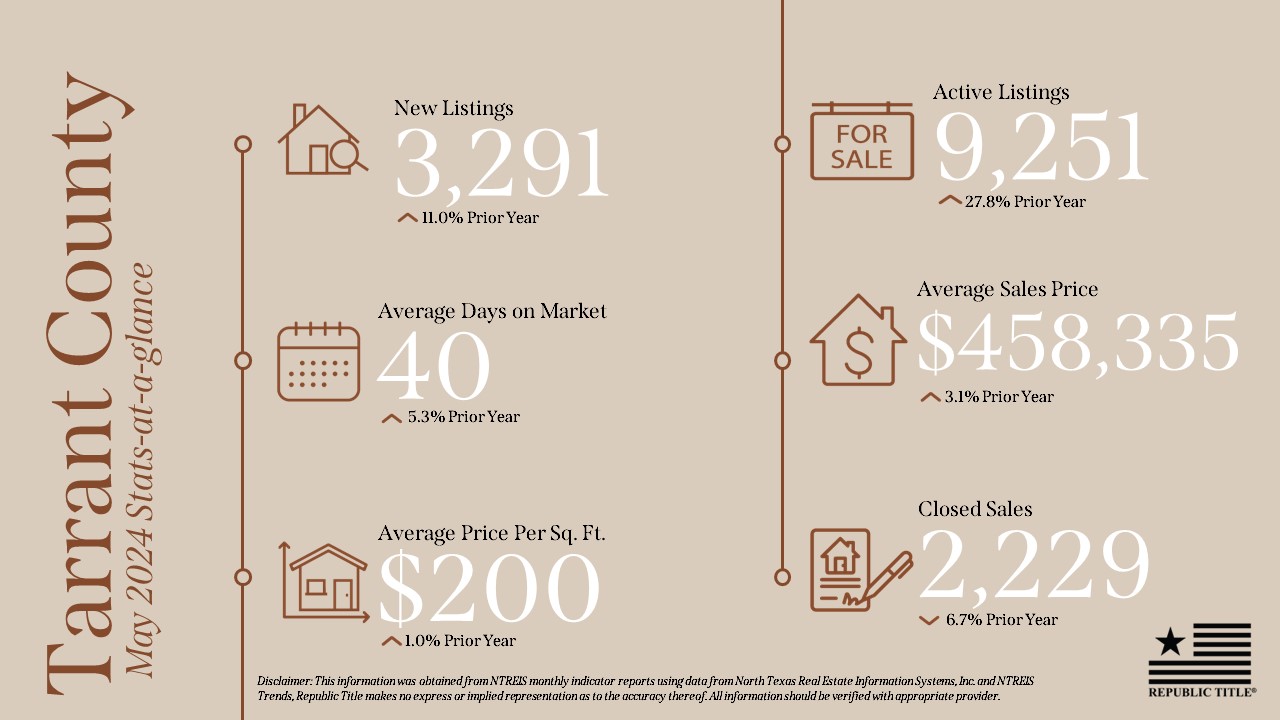

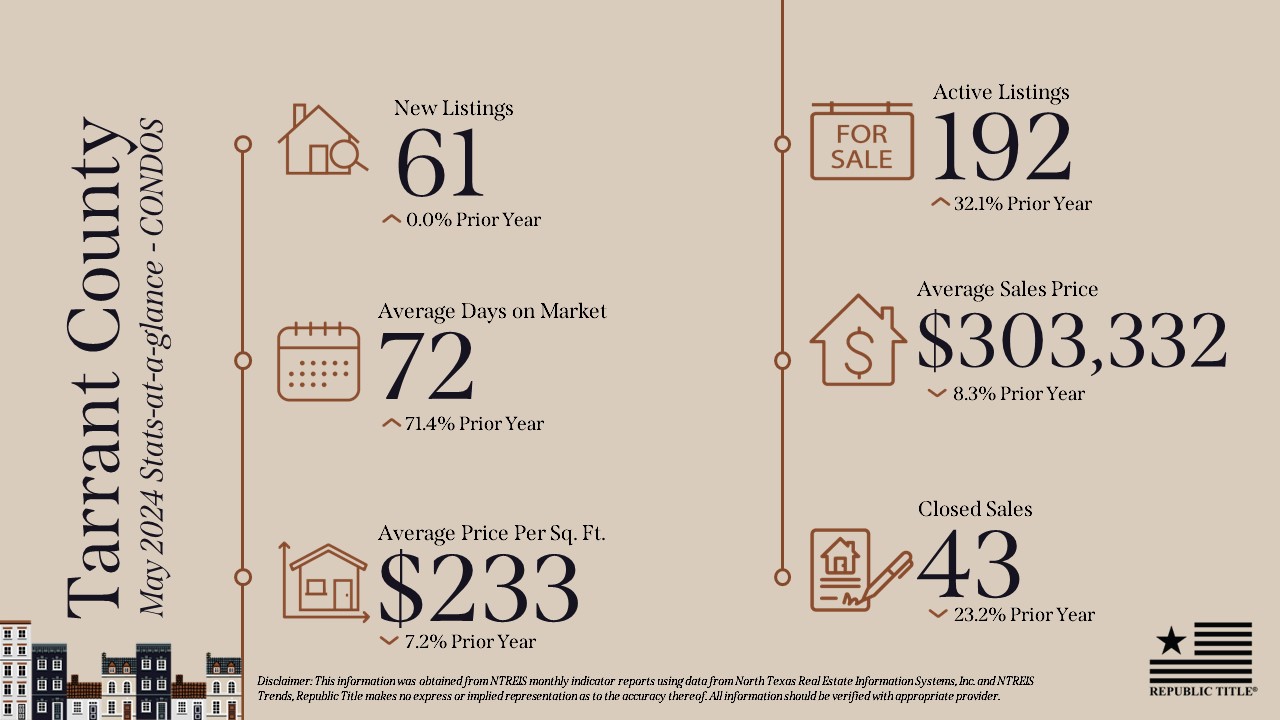

Our stats infographics include a year over year comparison and area highlights for single family homes broken down by county. We encourage you to share these infographics and video with your sphere.

For more stats information, pdfs and graphics of our stats including detailed information by county, visit the Resources section on our website at DFW Area Real Estate Statistics | Republic Title of Texas.

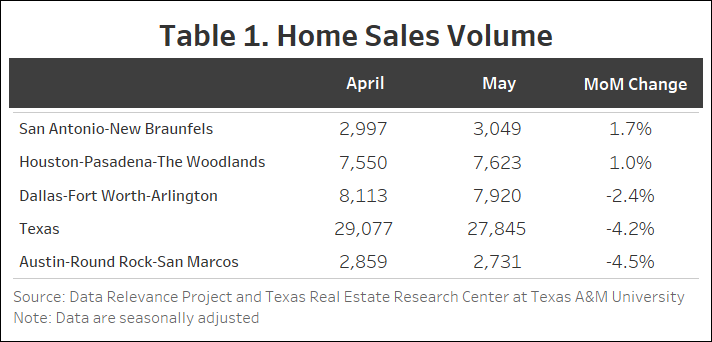

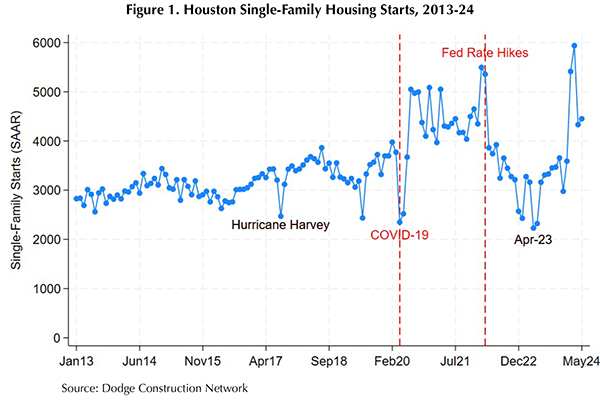

For the full report from the Texas A&M Real Estate Research Center, click here. For NTREIS County reports click here.