Construction had a great March as it made monumental leaps over February. Meanwhile, active listings dropped as sales continued to rise. Days on market (DOM) increased for yet another month, conflating with the fact that demand is slowing though still trending upward. However, too few existing homes are being put on the market to fill the void. Interest rates’ continued climb and an uncertain economic future were likely contributing factors to possible buyers holding onto their current homes. These factors continue to point to a cooling housing market.

Supply* Recedes as Construction Skyrockets

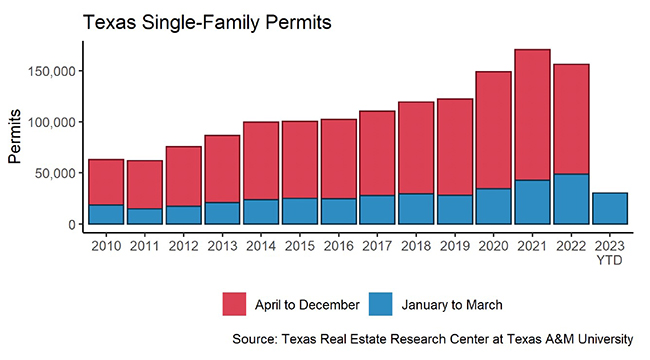

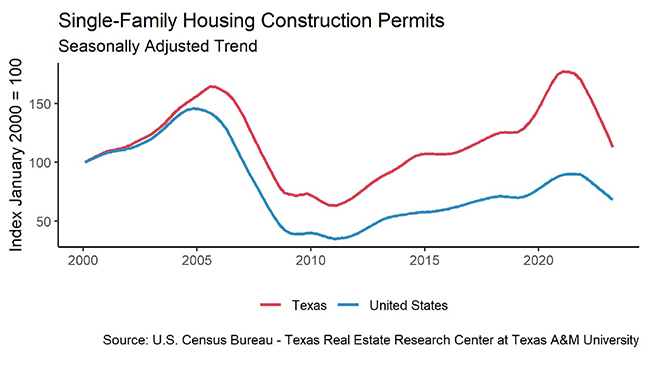

Single-family construction permits have continued increasing since February with 12,431 issued in March, a 23 percent month-over-month (MOM) improvement. All four major metros contributed to the statewide rise, as they all had positive gains for the month. Houston continued to lead the other metros with a 21.5 percent increase (4,616 permits) over last month’s already impressive growth. San Antonio replaced Austin as the metro with the lowest growth at 2.3 percent (605 permits).

Single-family construction starts recorded a strong count in March at 11,478. While nowhere near 2021 and 2022 levels, they are comparable to 2019, which was a strong year and a positive sign for the rest of 2023. Construction generally hits a seasonal low in December and peaks in March or June.

The state’s total single-family starts value reached $7.1 billion in March, down from $12 billion in March 2022. Houston and Dallas-Fort Worth continue to account for over half of the state’s values, holding a combined 55 percent of the Texas market. Austin and San Antonio remained on par with previous years’ market percentage shares.

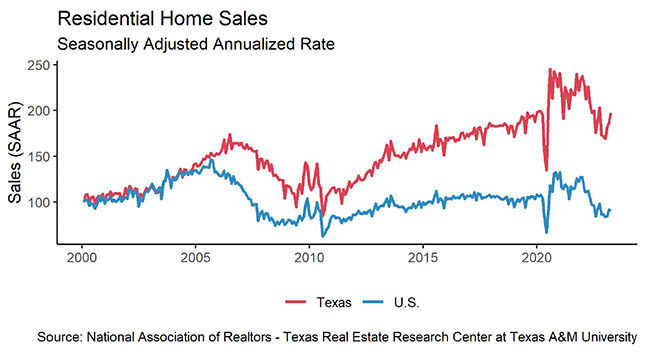

Demand Trends Upward as Sales Remain Strong

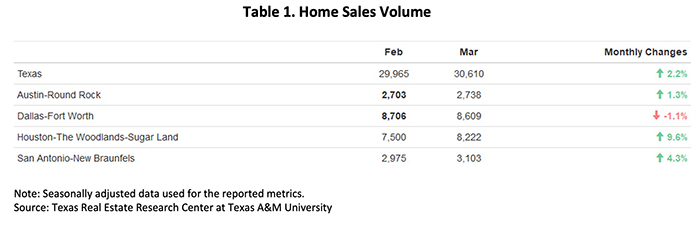

Housing demand started the year off strong with three consecutive months of seasonally adjusted sales growth. Total home sales gained 2.2 percent MOM reaching 30,610 (Table 1). Three of the four major metros have risen in monthly home sales, with Dallas being the only to have a drop, moving 97 fewer homes than the previous month. Houston was the metro with the largest monthly increase in March, reaching a 9.6 percent improvement. Austin and San Antonio lagged Houston and Dallas with sales of 2,738 and 3,103, respectively.

As the metro with the most sales in Texas, Dallas had sales volumes that were consistent with 2022 across price cohorts. However, transactions for homes on the two tails—below $200K and above $750K—both shrank significantly. Transactions in the upper tail dropped to 805 units in March, falling more than 15 percent year-over-year.

Texas’ average DOM steadily advanced to 57 days. Compared with the five-year average of 59 days before 2020, the housing market is fast approaching historic norms. Houston’s homes seemed to be in the hottest market, reporting the lowest DOM level of 51.4 days. Austin’s DOM record kept inching up, marking 72.7 days this month, the longest market time since 2013. This is a major swing from the intense market conditions from just a year ago.

Amid the overall trend of continuously growing house inventories, active listings had their first major dip since March 2022. The 8 percent drop brought the count of available homes in Texas down to 83,497 units. While Austin ticked up 4.5 percent, Dallas dropped marginally. Due to March’s robust sales volumes in Houston and San Antonio, these two metros had a hard time quickly restocking. As a result, they had significant reductions of 8.5 percent and 11.3 percent, respectively. Despite the drop in housing inventories, months of inventory (MOI) resumed an upward trend at three months. The trend was largely sustained by Austin’s increasing MOI.

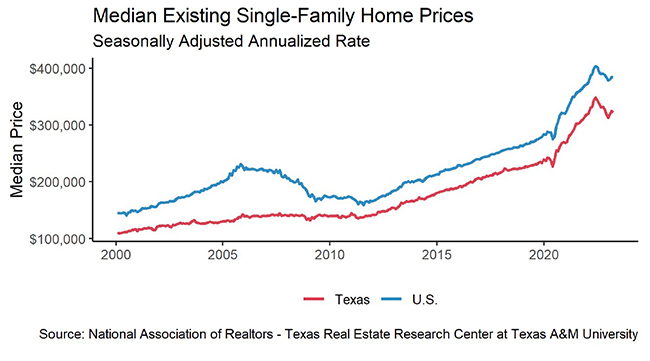

Prices Make Minimal Gains as Long-Term Rates Rise

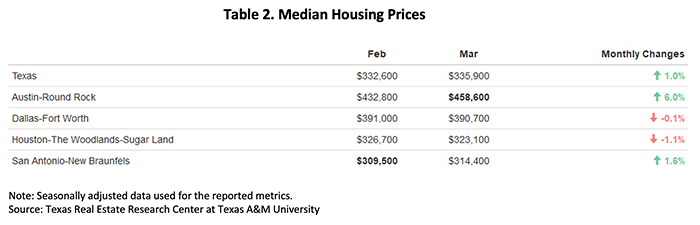

Texas’ median home price inched up 1 percent MOM, and the price was mainly unchanged from a year ago (Table 2). Austin had the greatest rebound of 6 percent since the price correction started in May 2022. Despite the recent improvement, Austin’s median price still fell $70K short of 2022’s market price, diminishing 15 percent. Other than Austin, the remaining three metros did not post drastic changes. Relatively, Houston’s and San Antonio’s housing prices were the most stable among the four major metros, with March prices staying in a reasonable range from the local markets’ peaks.

The ten-year U.S. Treasury bond yield dipped nine basis points MOM to reach 3.6 percent. The Federal Home Loan Mortgage Corporation’s 30-year fixed-rate reversed course as it climbed to 6.5 percent, the first increase since October 2022.

Though mortgage rates remain high, sales have trended upward and continued through March. The Texas Repeat Sales Home Price Index accounts for compositional price effects and provides a better measure of changes in single-family home values. Texas’ index gained 1.9 percent MOM. Houston was the only metro whose index remained constant, while the four other major metros all had modest increases over February. These modest rises indicate price normalization.

_________________

* All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

Source – Joshua Roberson, Weiling Yan, and John Shaunfield (May 26, 2023)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight