The persistent rise in mortgage rates continued to exert a cooling effect on the housing market. Texas’ home sales experienced an 8.4 percent year-over-year decline in July. Despite this diminished home demand, the scarcity of existing home sales contributed to a 2.1 percent increase in the state’s median price in 2023, leaving the index for shelter the greatest driver behind the escalating living costs. While existing home sales declined, residential construction starts continued to climb. At the same time, permits have fallen for several consecutive months, signaling a possible decline in starts in the near future.

Housing Market for New Construction in High Demand

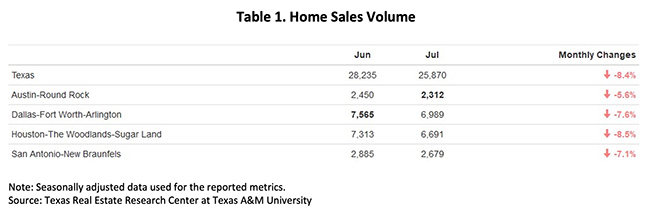

More prospective buyers are dissuaded from making a home purchase in today’s high-interest environment, leading to a drop in sales. Compared with last month’s reading at 28,000 and July 2020’s record high at 38,400 transactions, Texas’ total home sales fell below 26,000 transactions this month. Monthly sales volume contracted 8.4 percent month over month (MOM) and 32 percent in three years (Table 1).

Despite the reduced housing demand, the market share of new construction sales ballooned. Within a year, the share of new construction sales rose from 15.2 percent to more than 20 percent, indicating every five closed listings is now a new home. Both demand and supply factors contributed to the increasing trend for new homes. The shortage of existing homes is due to current owners’ reluctance to give up their current homes. For more information on Austin’s new construction, read “Austin Home Price Illusion” at https://www.recenter.tamu.edu/articles/tierra-grande/Austin-Home-Price-Illusion-2378.

Texas’ average days on market (DOM) stayed at 56 days for the second straight month, deviating from the steep rebounding trend that lasted for over a year. The current reading is merely three days short of the five-year average before 2020, which stood at 59 days. The consistent reading suggests that the housing market may have reached a state of equilibrium. Among the major metros, Austin and San Antonio reported a longer-than-average DOM of 69 days, while Dallas and Houston had DOM figures of 46 days and 49 days, respectively.

The number of active listings rose to 2.3 percent, reaching just above 85,000 listings. All four of the major metros posted positive monthly gains with Dallas accounting for the largest gain at 5.7 percent MOM while Houston remained at last month’s level with a 0.4 percent MOM game. Conversely, the state’s new listings dipped by 12.7 percent to 36,880 units, with Dallas contributing significantly to this double-digit decline by registering a decrease of 1,800 units in July. Amid the rise in active listings, months of inventory (MOI) had a marginal gain to 3.3 months.

Since the Fed hiked interest rates by another quarter point, both treasury rates and mortgage rates increased in July. The ten-year U.S. Treasury Bond yield grew 15 basis points, reaching 3.9 percent. Likewise, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate increased to 6.8 percent, up 13 basis points. The inflated mortgage rate is expected to further raise the cost of home ownership and decrease mortgage applications.

Single-Family Permit Levels Continue to Drop

Texas’ single-family construction permits shrank to 12,240 applications in July after seasonal adjustment, marking a 3 percent MOM decrease. Houston’s (4,070 permits) contribution to the monthly shrinkage was prominent, as permits plummeted 17.8 percent MOM. Although Austin (1,380 permits) reported the largest rebound of 34.3 percent MOM, the gain was not enough to cover half of Houston’s loss. Dallas (3,540 permits) and San Antonio (760 permits) maintained their activity levels like June.

Construction starts had not yet reflected the decline in construction permits. After three consecutive growths, single-family construction starts in Texas balanced at 11,450 units. Both Dallas and Houston led with over 3,200 houses breaking ground, surpassing the combined total of other metros outside the “Big Four.” The ratio between home projects in Austin (1,580 starts) and San Antonio (810 starts) remained at approximately 2:1.

The state’s total single-family starts value reached $18.8 billion, up from $15.9 billion in June. While the current starts value fell short of the peak during the pandemic frenzy in 2020-22, it aligned with construction activity levels observed in 2019. Notably, Houston and Dallas remain pivotal players, contributing to more than half of the state’s construction activity values. Dallas’ market share rose to 27.6 percent, closely trailing Houston’s 27.7 percent share.

Steady and Modest Price Gains Amid Sales Decline

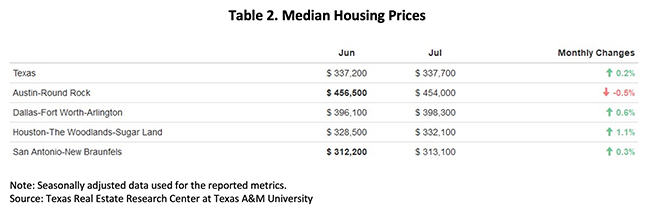

The low supply of homes had supported price gains, and the steady uptick in Texas’ median home prices, including both new and existing homes, moderated from 0.4 percent in the first five months to 0.2 percent in June and July. Three of the Big Four metros reported monthly changes of less than 1 percent, indicating price stability for the state’s housing market. Austin’s median price remained more elevated than all other metros at $454,000 (Table 2). Dallas followed with $398,300.

Amid Austin’s recent price volatility, this metro was still approximately 10 percent below last year’s $507,400 median price. Meanwhile, the state along with the other major metros narrowed the gap to 1 percent, down from 5 percent in June. These changes indicate the real estate industry has nearly reached a full recovery from the price correction observed in the second half of 2022.

Since the dip from July to December 2022, the Texas Repeat Sales Home Price Index (Dec 2004=100) had reverted to the trend. Though the acceleration slowed to 0.7 percent YOY, the index balanced at 229.4, beating June 2022’s record-high reading when the annual increase was at an astonishing rate of 16.5 percent YOY. The elevated index corroborates a rebound in home price appreciation in 2023.

Despite the challenge of high mortgage rates and reduced housing demand, the market share of new construction sales surged. Within a year, the share of new construction sales rose from 16.3 percent to more than 20 percent, indicating every five closed listings is a new home. Both demand and supply factors contributed to the increasing trend for new homes. The shortage of existing homes is due to current owners’ reluctance to give up their current homes, while the state’s consistent home demand, fueled by a growing population, is spurring new construction orders.

Texas’ average days on market (DOM) stayed at 56 for the second straight month, deviating from the steep rebounding trend observed for over a year. The current reading is merely three days short of the five-year average before 2020, which stood at 59 days. The consistent reading suggests that the housing market may have reached a state of equilibrium. Among the major metros, Austin and San Antonio both reported a DOM of 71 days, while Dallas and Houston had DOM figures of 52 days and 49 days, respectively.

Steady and Modest Price Gains Amid Sales Volatility

Texas’ median home prices continued to show its strength by increasing 0.3 percent to $337,900 (Table 2). Austin recorded the largest monthly gain of 4.2 percent, reaching a price peak in the past nine months. The remaining three metros recorded changes of less than 1 percent.

Despite Austin’s price hike in June, this metro was still close to 10 percent below last year’s record high, facing the largest price gap. Meanwhile, Dallas, Houston, and San Antonio had less than 5 percent to bridge. These price drops indicate the real estate industry still has room to recover from the price correction observed in the second half of 2022.

The Texas Repeat Sales Home Price Index, which accounts for compositional price effects and provides a better measure of change in single-family home values, showed a slight advance of 0.3 percent MOM and 0.1 percent YOY. Houston had the highest annual appreciation with 1.6 percent YOY increase, while Austin remained balanced with no YOY changes.

Mortgage rates typically follow Treasury rates, and both increased in June. The ten-year U.S. Treasury Bond yield grew 18 basis points, reaching 3.8 percent. Likewise, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate increased moderately to 6.7 percent, up 28 basis points. With the Fed resuming their increasing of interest rates in July, both the bond and the mortgage rates also grew.

Source – Joshua Roberson, Weiling Yan, and Koby McMeans (September 7, 2023)

https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight