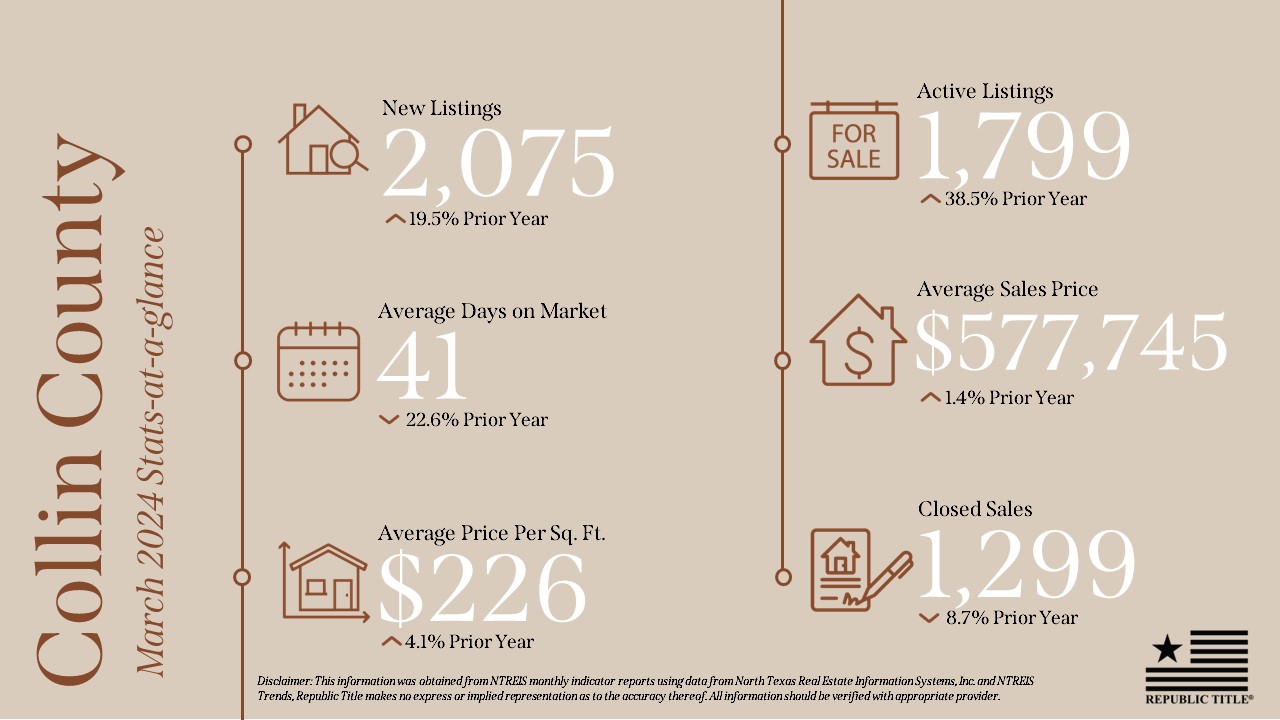

Moving is a big deal, right? But in this age, it’s not just about throwing stuff in boxes and hitting the road. There are all sorts of reasons people are moving in 2024. According to data from the U.S. Census Bureau, the net migration for the 13-county Dallas-Fort Worth metropolitan area from July 2022 to July 2023 (the latest data available at this time) was 101,419 people, which equates to 278 more people in D-FW per day via migration, and that doesn’t even include those people who already live in the area and are looking to relocate.

If you, or someone you know, is planning a move this year, ask your real estate agent about partnering with Republic Title, the North Texas title insurance market leader, and how we can help get your deal done smoothly so you can begin enjoying your new home!

Alright, let’s dive into the reasons people are moving in 2024:

1. Family Ties

You can’t beat family, can you? Sometimes, being close to the people you love most means moving to be nearer to them. Whether it’s for Sunday dinners or helping out with the grandkids, family is a big reason why people pack up and head to new places.

According to the National Association of Realtors, which surveys homebuyers and sellers as part of their annual Generational Trends Report, the desire to be closer to family/friends/relatives was at the top of the list of primary reasons for purchasing a home, especially for those in the Baby Boomer generation and Silent Generation.

2. Need For a Bigger Space

Ever feel like your walls are closing in? Growing families, work-from-home setups, or just wanting more elbow room can all make you crave a bigger space. Sometimes, you’ve just got to spread out a bit!

3. Desire For a Vacation Home

Picture this: your own little slice of paradise where you can kick back, relax, and soak up the sun whenever you please. Sounds dreamy, right? That’s why some folks are scooping up vacation homes – for getaways and maybe a little rental income on the side.

4. Lots of Equity; Lots of Choice

If your home’s value has shot up, you might find yourself sitting on a pile of equity. That means you’ve got options – whether it’s upgrading to your dream home or exploring new neighborhoods, the world (or at least the housing market) is your oyster!

5. Upgrade The Neighborhood

Sometimes, you just want a change of scenery. Maybe you’re eyeing a neighborhood with better schools, a better dining scene, or just a friendlier vibe. Whatever your reasons, upgrading your neighborhood can be a game-changer.

6. Time to Downsize

Who needs all that extra space, anyway? Downsizing can be liberating – less stuff to take care of, lower bills, and maybe even a little extra cash in your pocket. Sometimes, less really is more.

7. Out-of-Area Relocation

New job? New school? New adventure? Sometimes, life takes you places you never expected. According to U-Haul’s Top Growth States Report, Texas ranked the No. 1 state for newcomers in 2023. Whether it’s across the country or just a few towns over, moving to a whole new area can open up a world of possibilities.

8. Change of Work/Change of Life

Thanks to remote work, you’re not tied down to one place anymore. According to a Pew Research Center survey, about a third (35 percent) of workers with jobs that can be done remotely are working from home all of the time, which opens up options and is a big one of the reasons people are moving in 2024.

So there you have it – the top reasons people are making moves in 2024. Whether you’re relocating for family, space, or a fresh start, Republic Title is the smart choice to partner with in the closing of your home.

Make sure to check out Republic Title’s website where we have curated a list of over 40 local community Fast Facts to help familiarize you with all that North Texas has to offer!

Source: Republic Title Explores The Top Reasons People Are Moving in 2024 – CandysDirt.com