October 2022 Stats are IN!

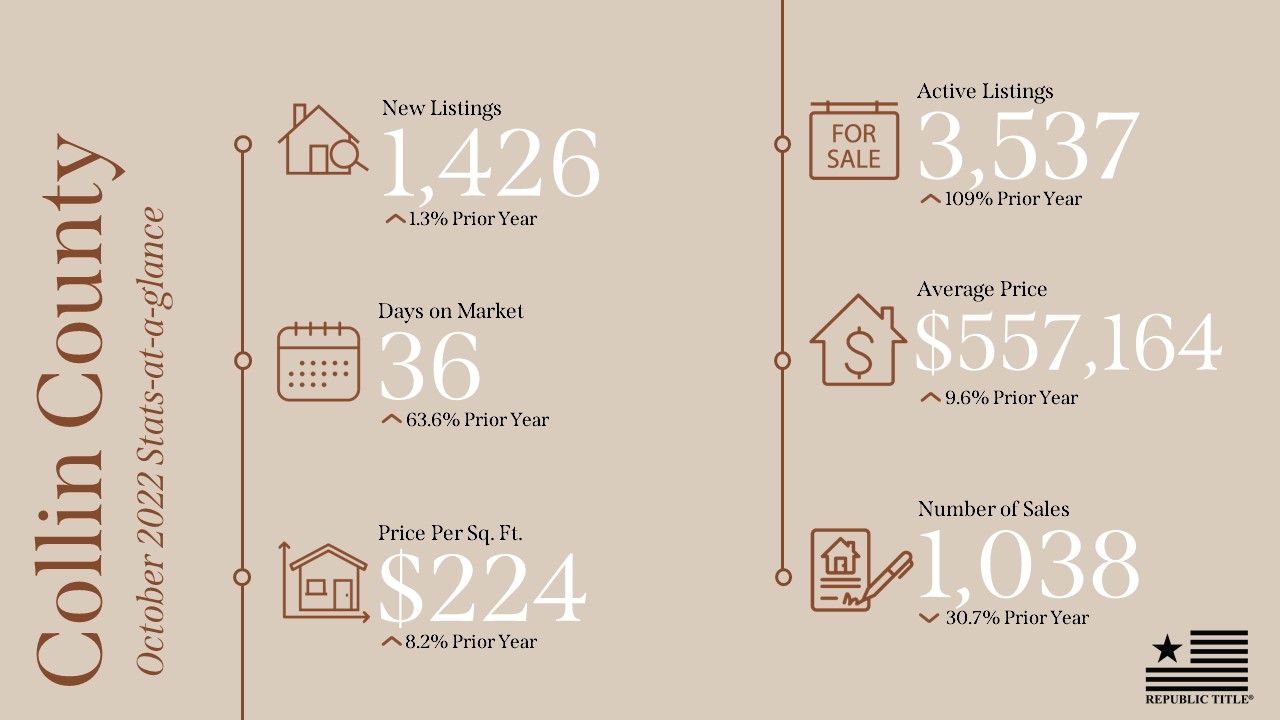

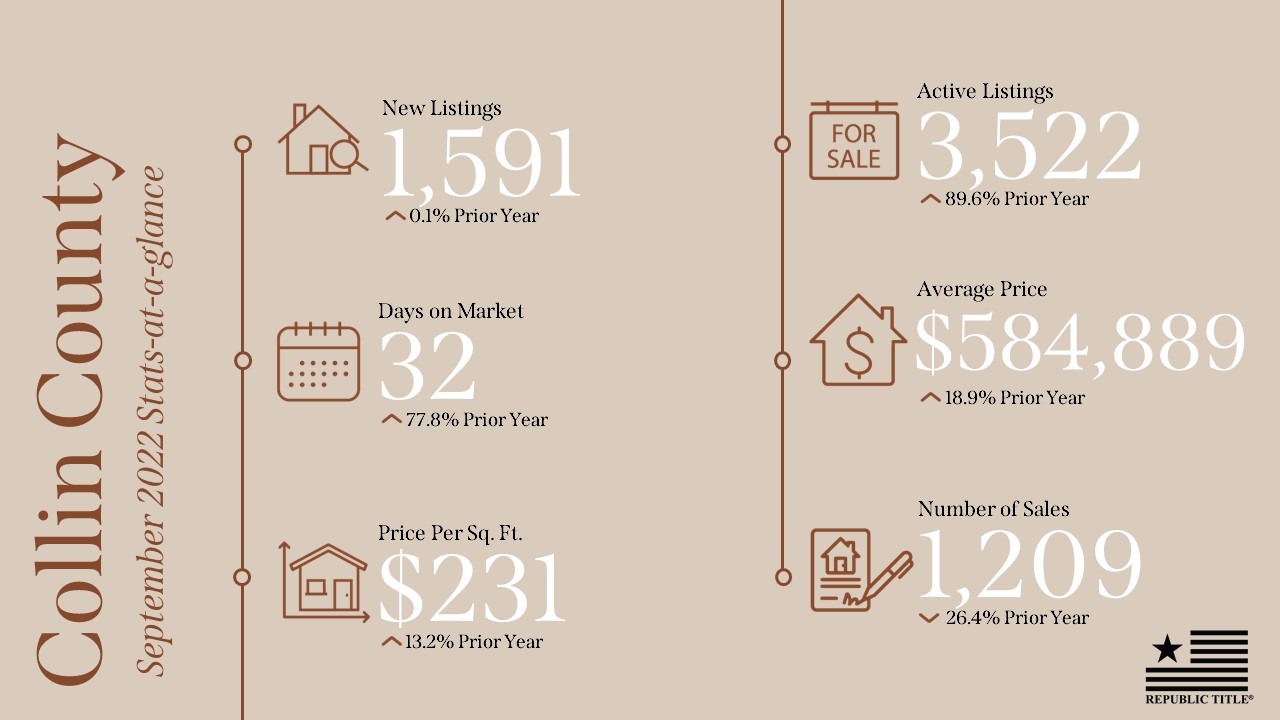

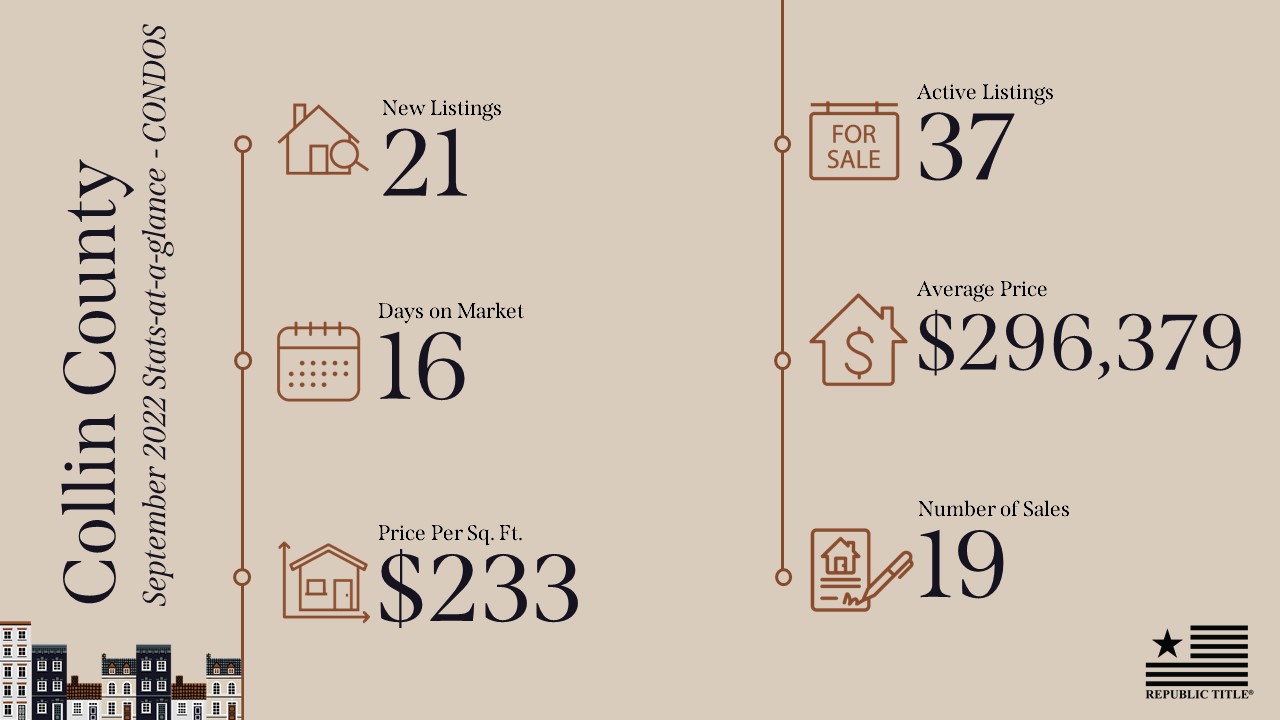

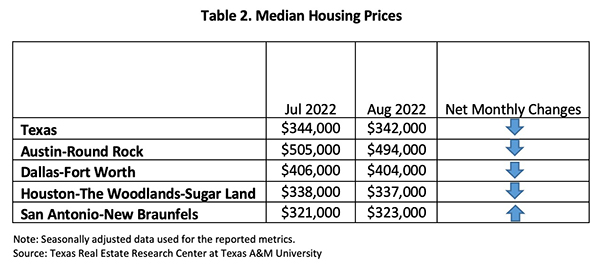

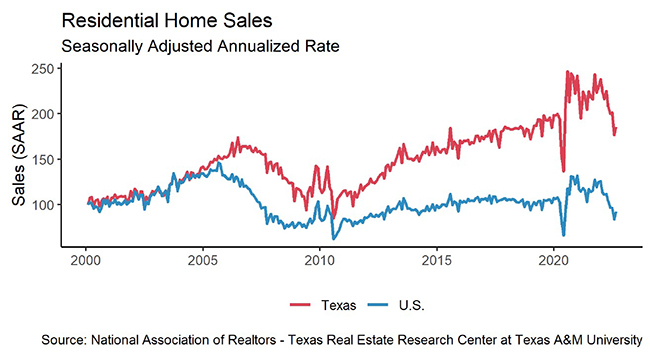

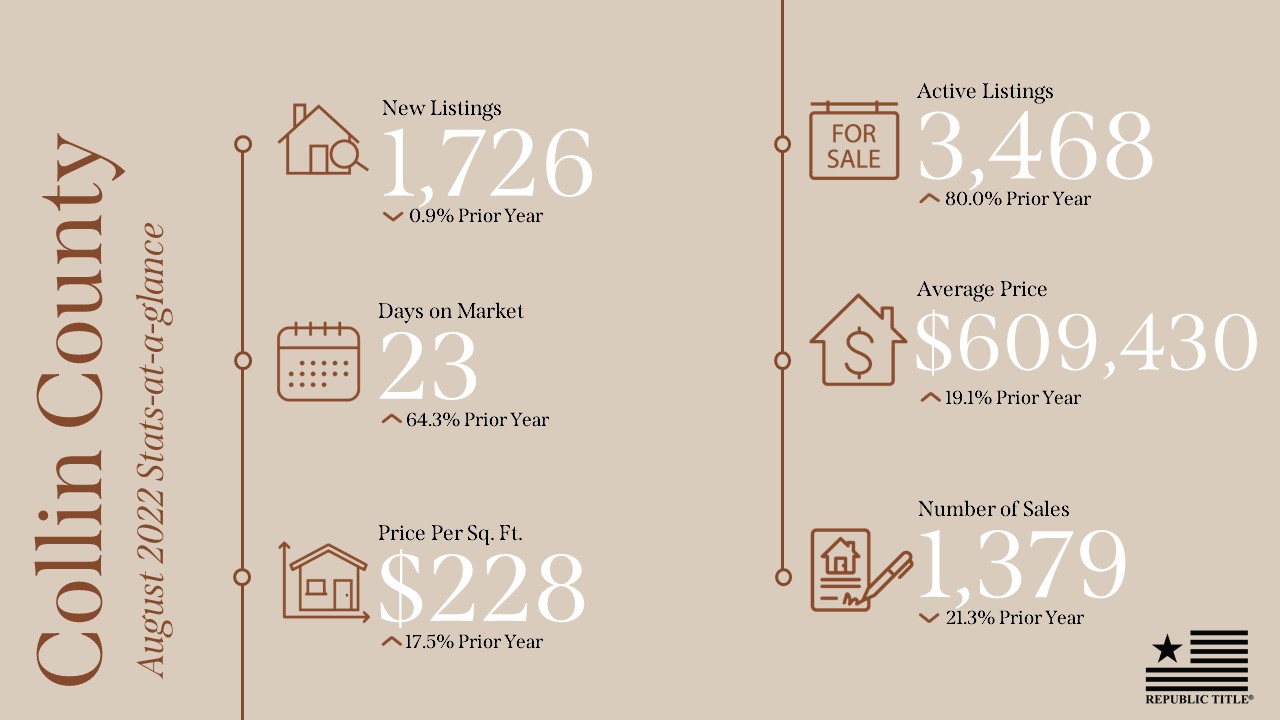

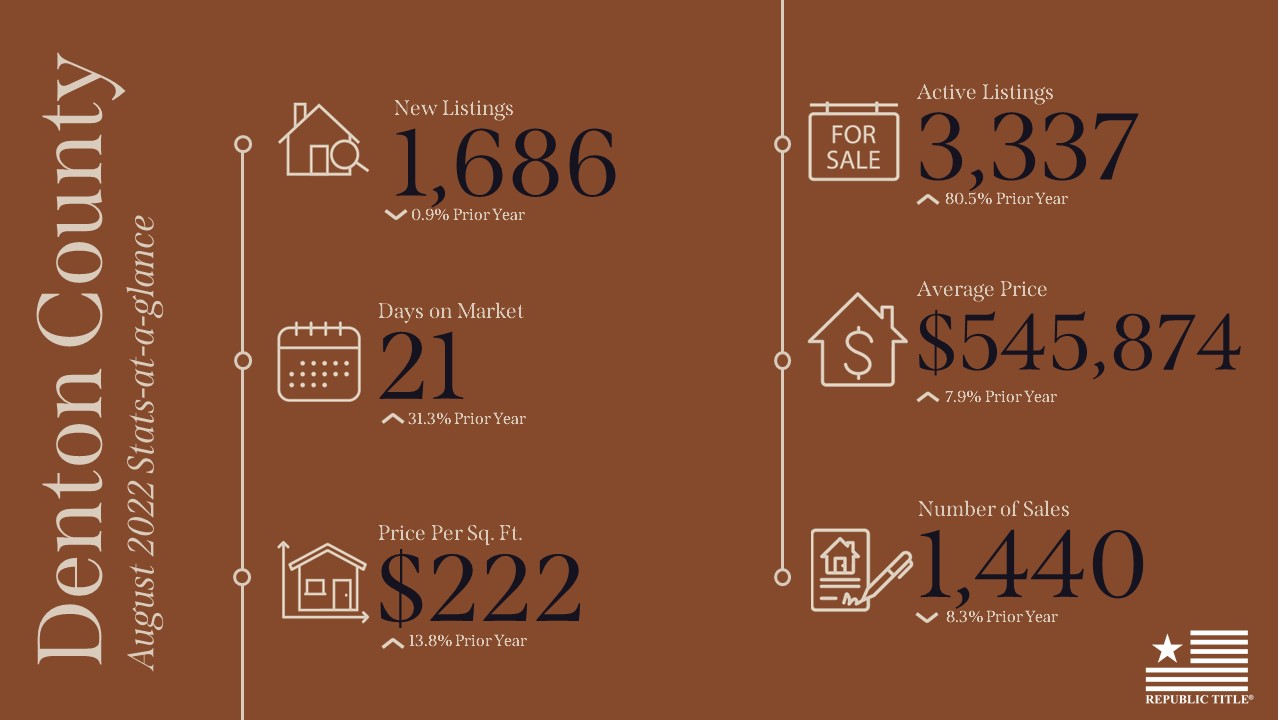

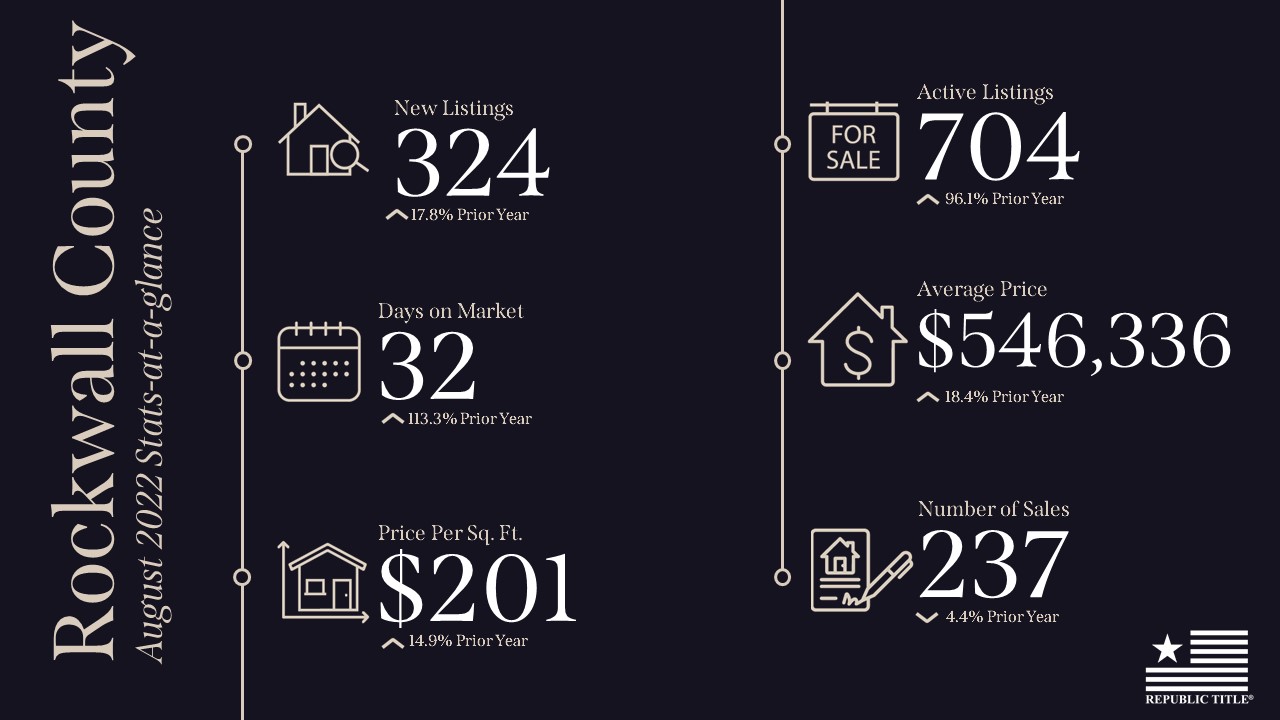

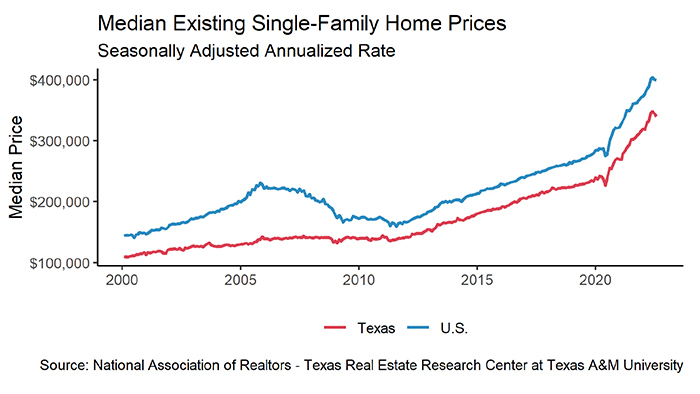

In Collin and Denton counties, all arrows are pointing up in the areas of new listings and active listings with active listing seeing an increase of over 100% in both counties compared to last year. It will come as no surprise that the average days on market has also increased in these counties over last year’s market. What we are all seeing in the news is reflected in the number of sales in October which has declined between 25 and 30%.

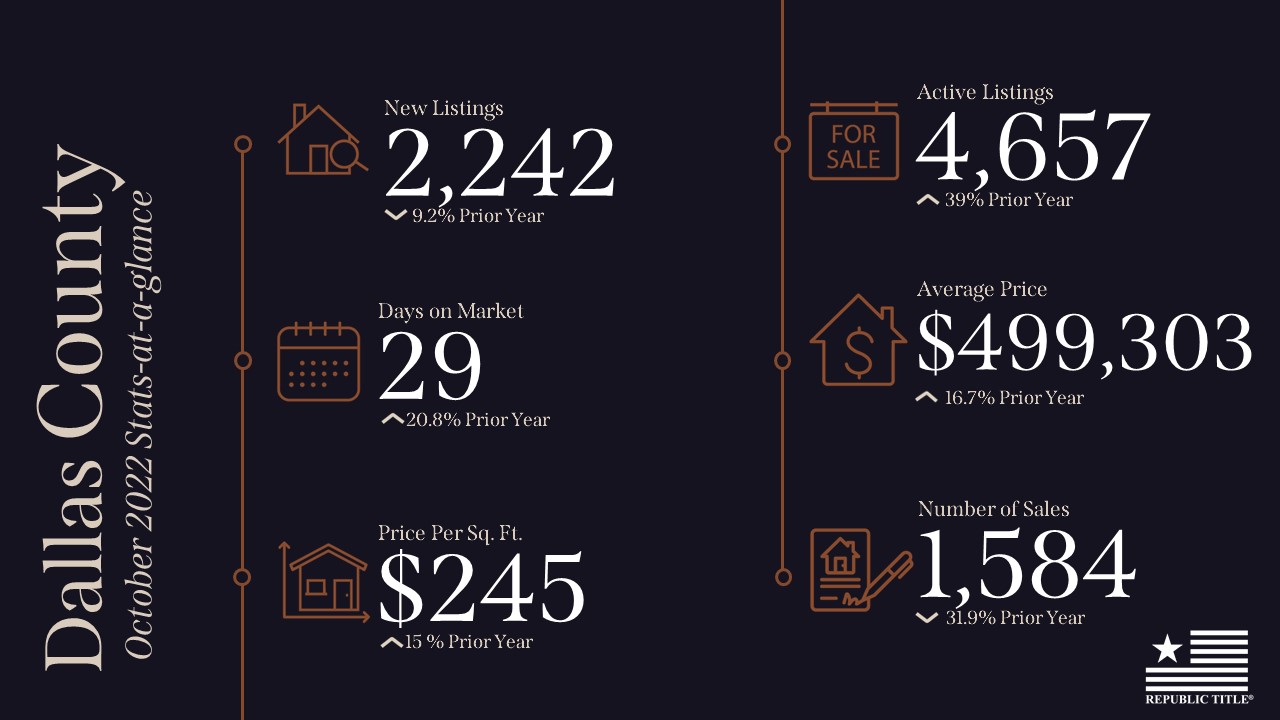

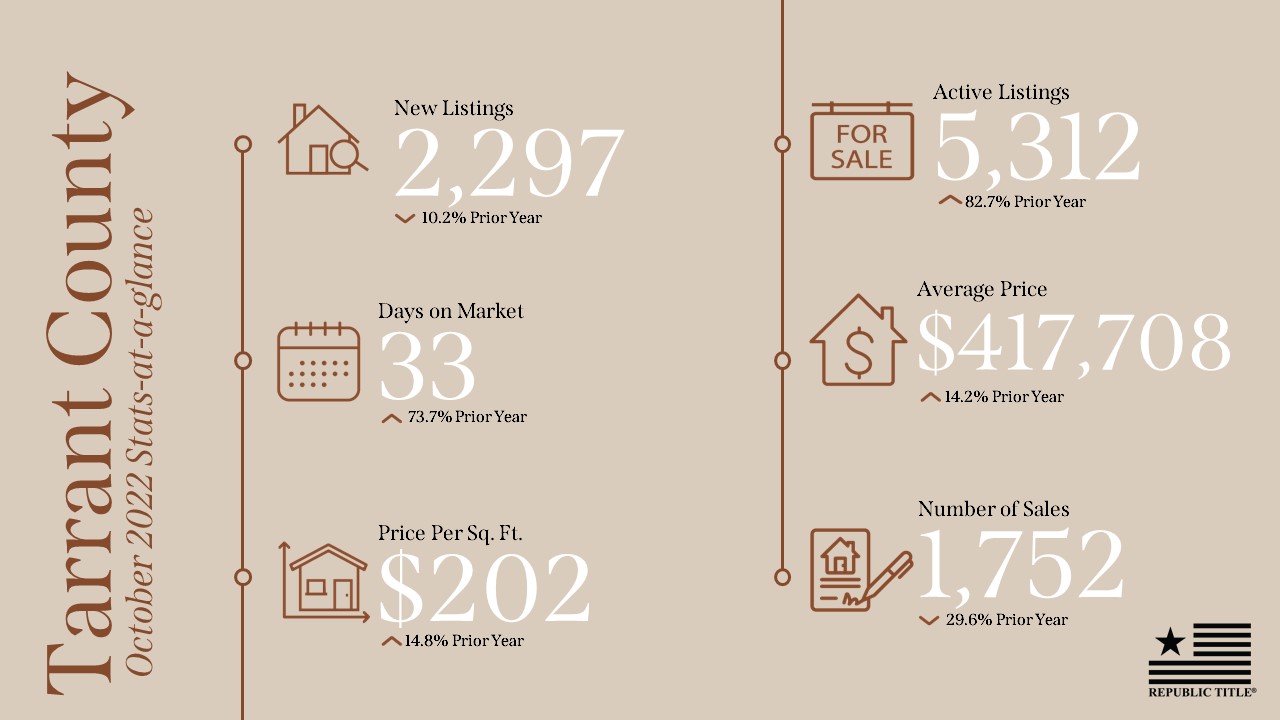

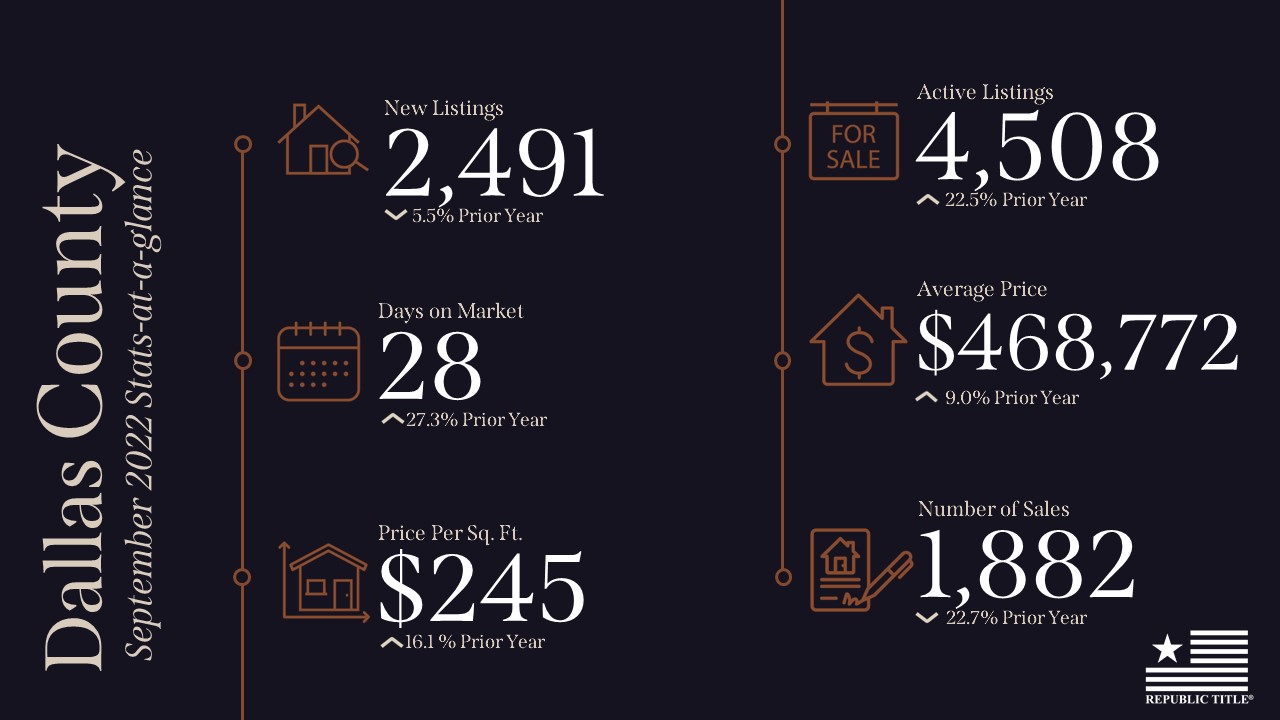

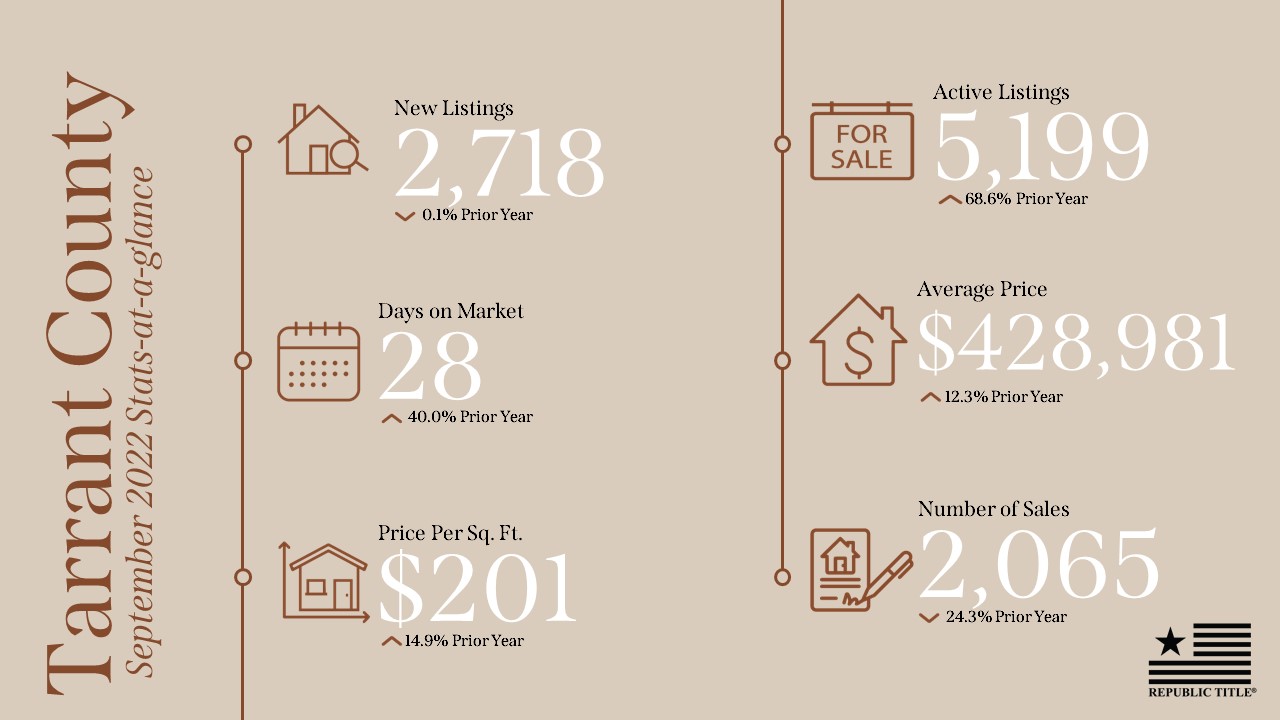

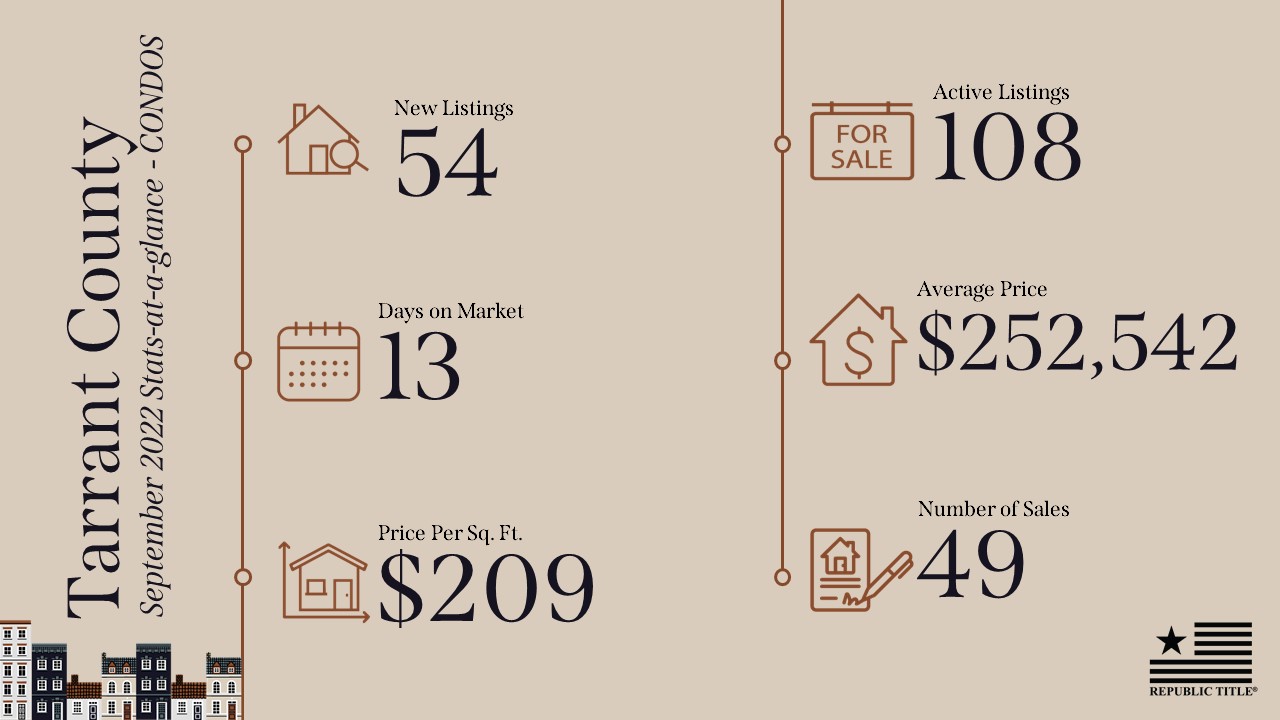

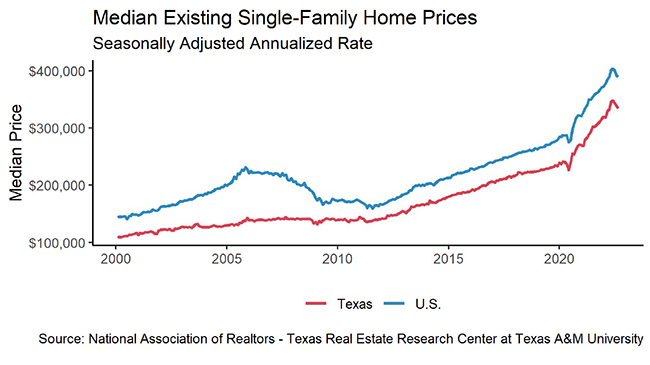

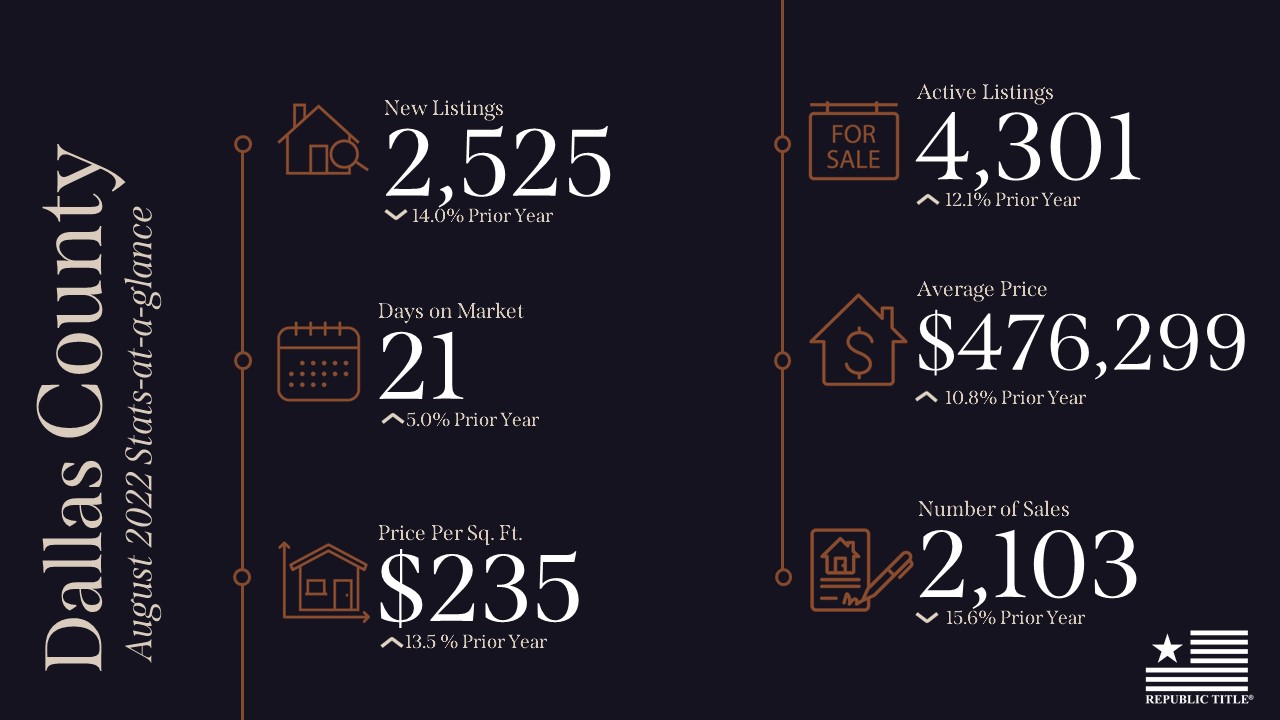

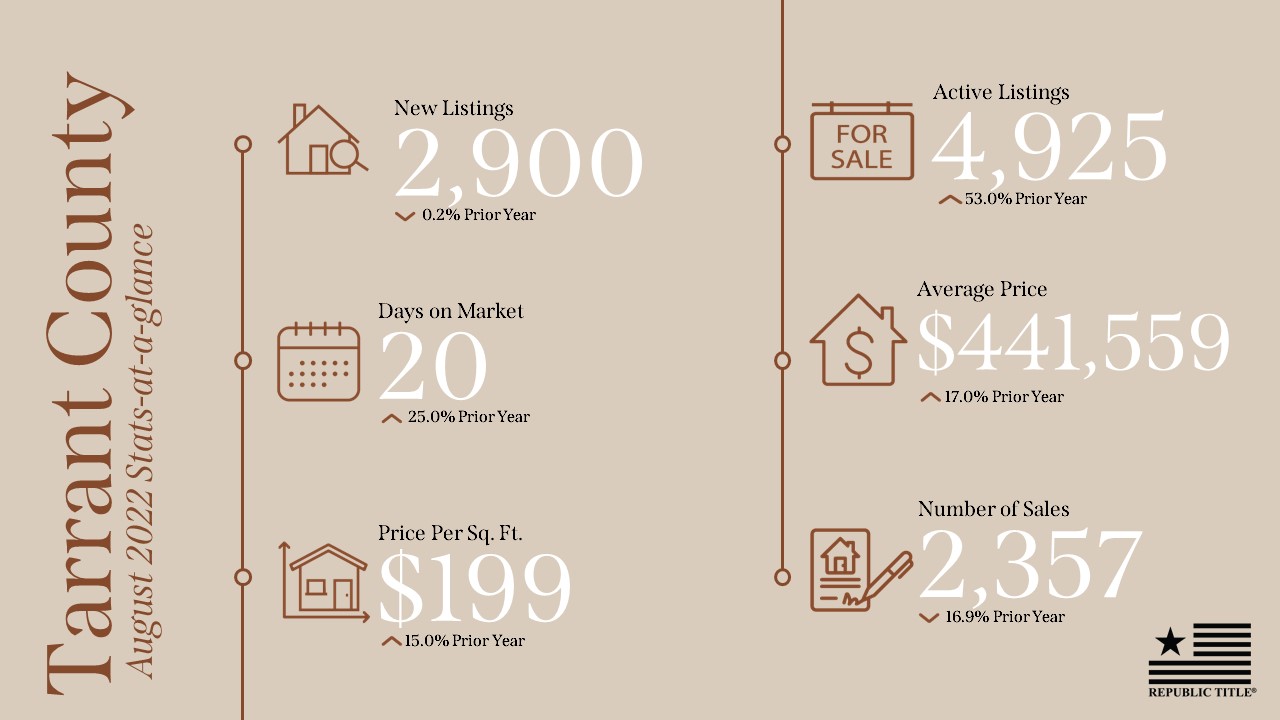

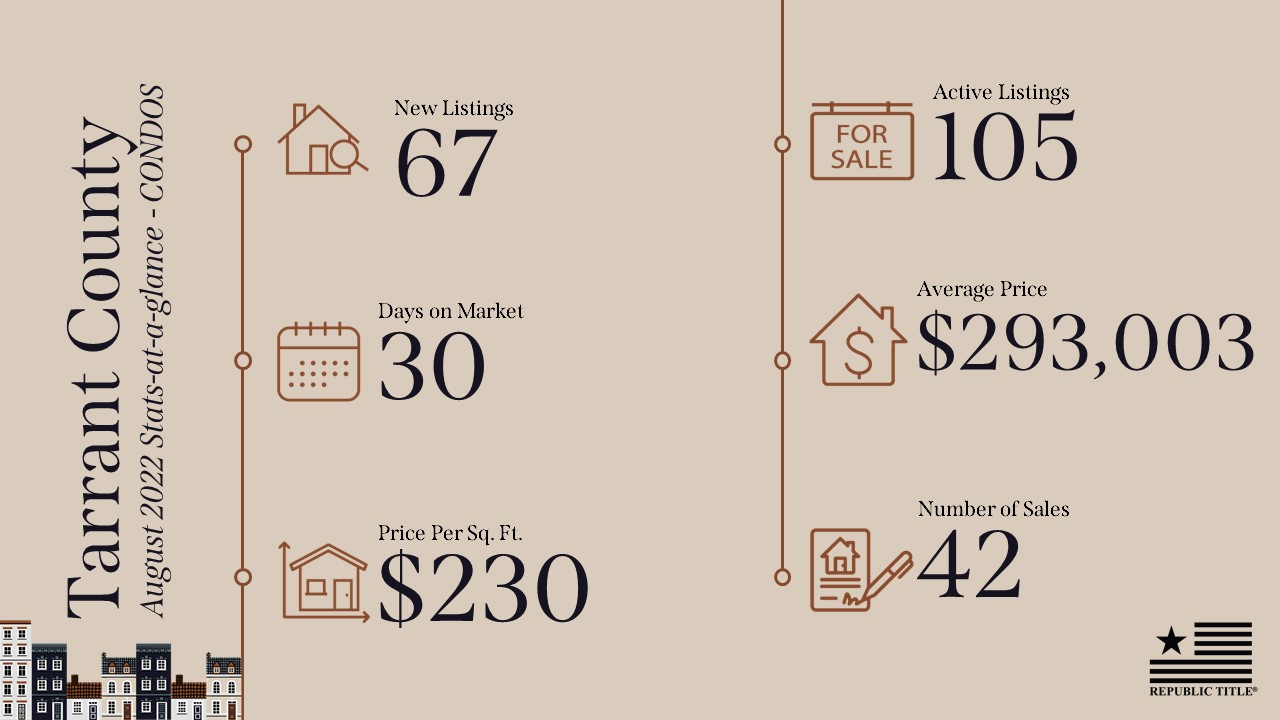

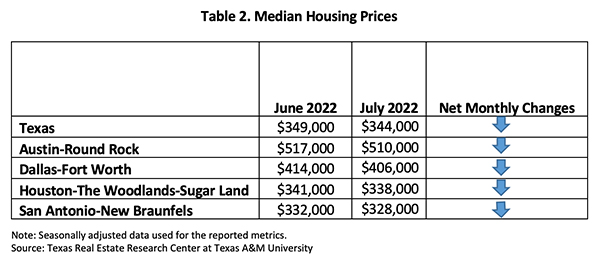

In Dallas and Tarrant counties, we are seeing similar trends, however, new listings are down by about 10% in both counties. Active listings are down 39% in Dallas County and up 82% in Tarrant County. Average sales prices are up 16.7% in Dallas and 14.2% in Tarrant. Again, the number of sales is down by approximately 30% in both of these counties.

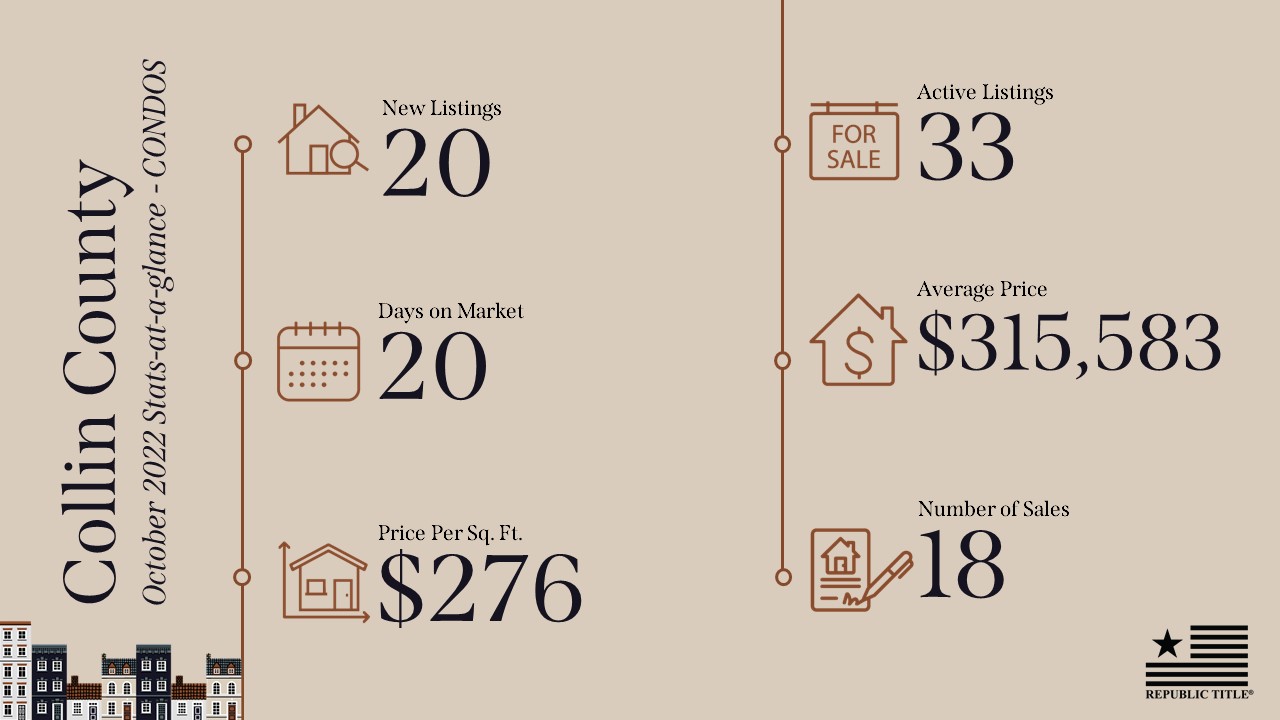

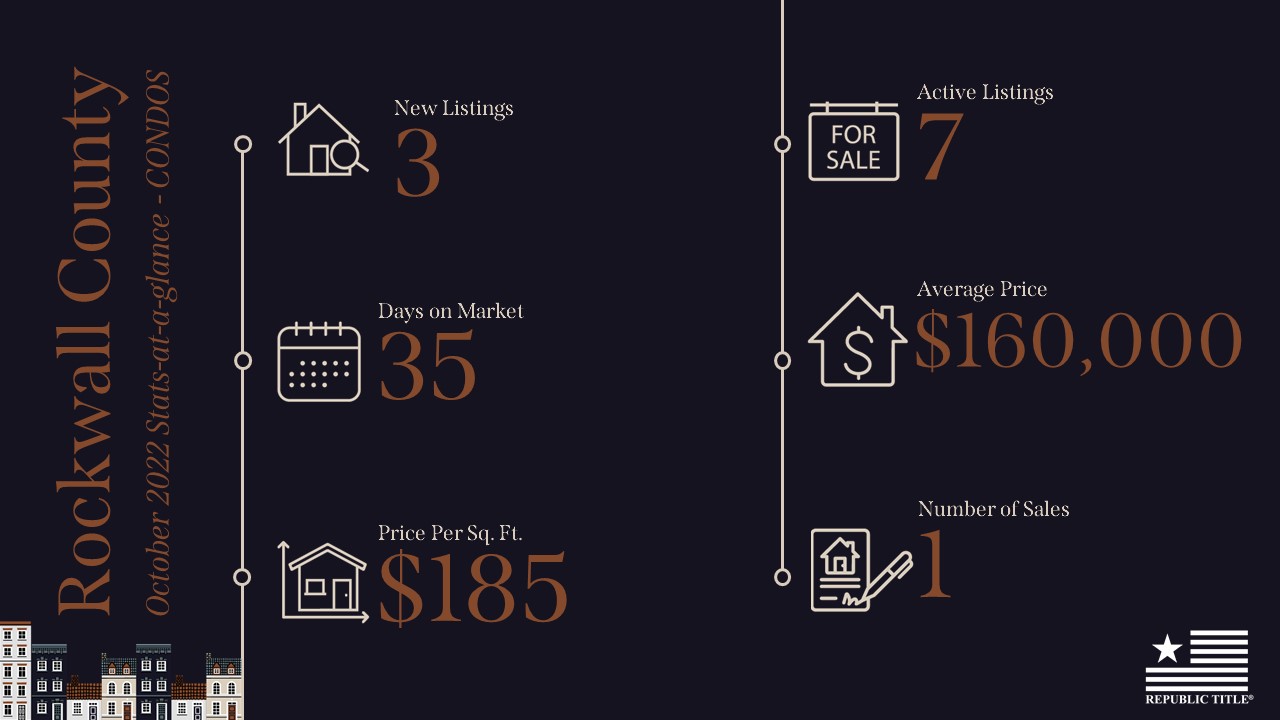

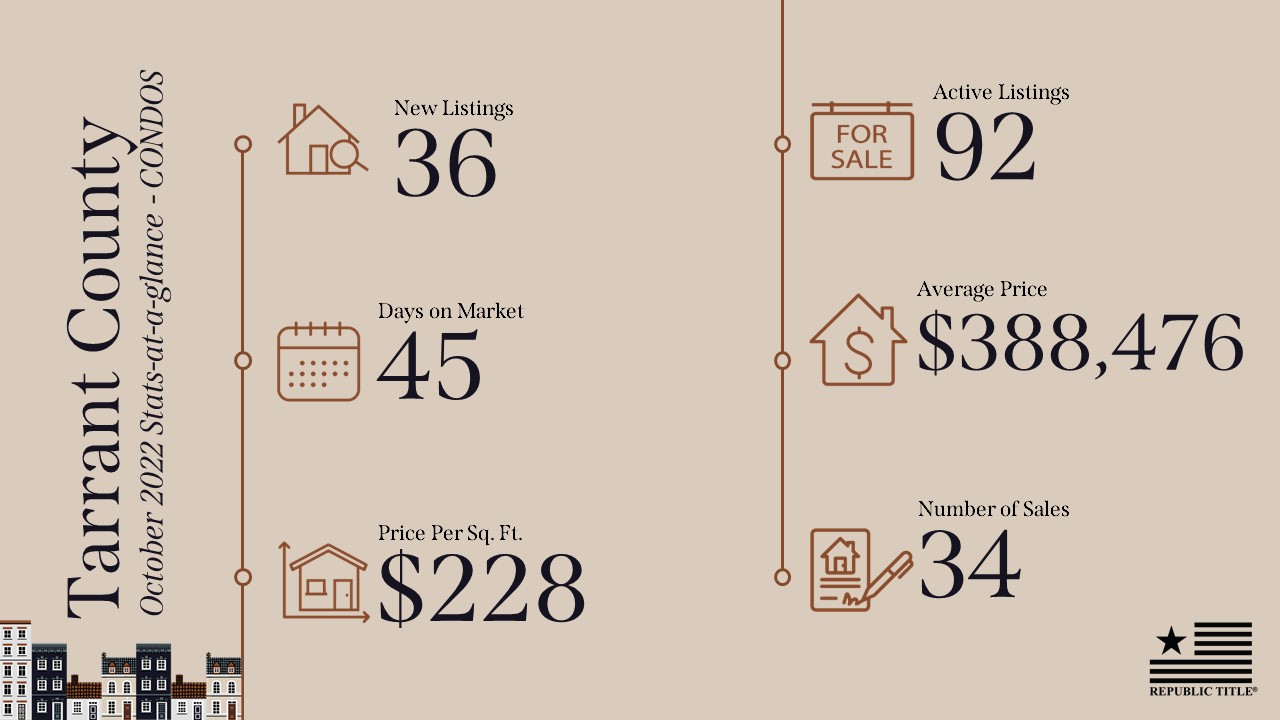

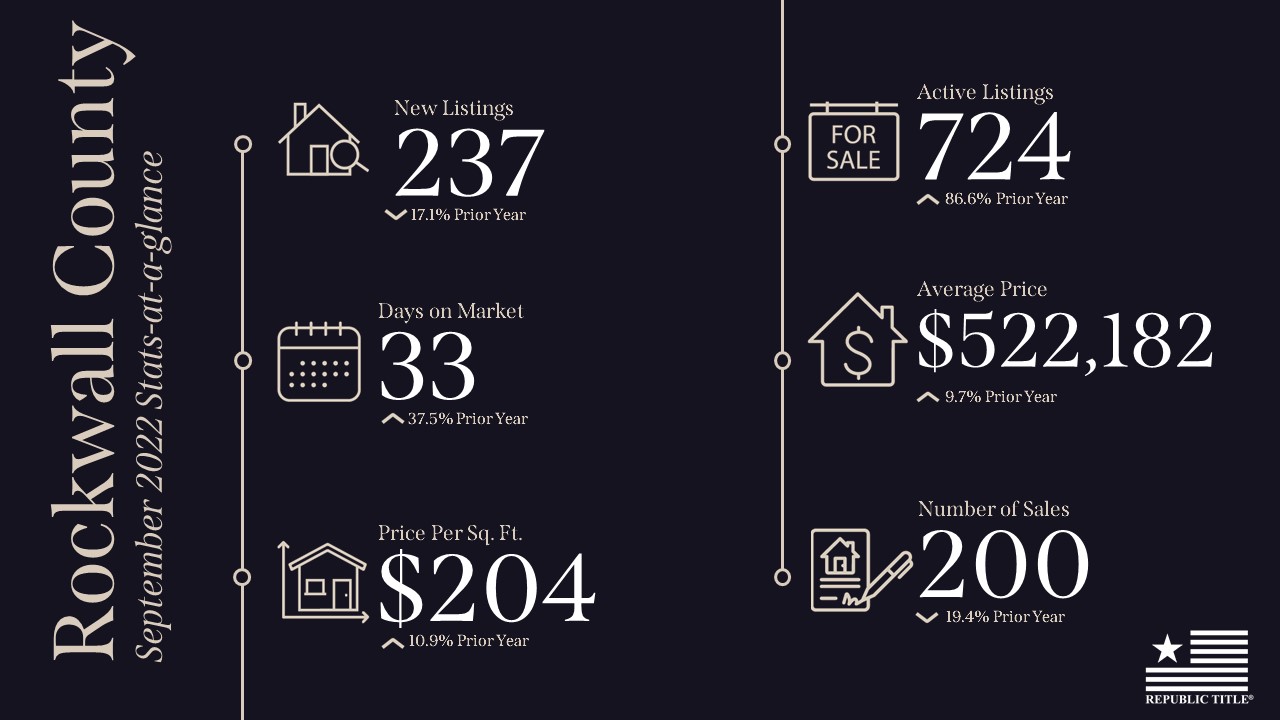

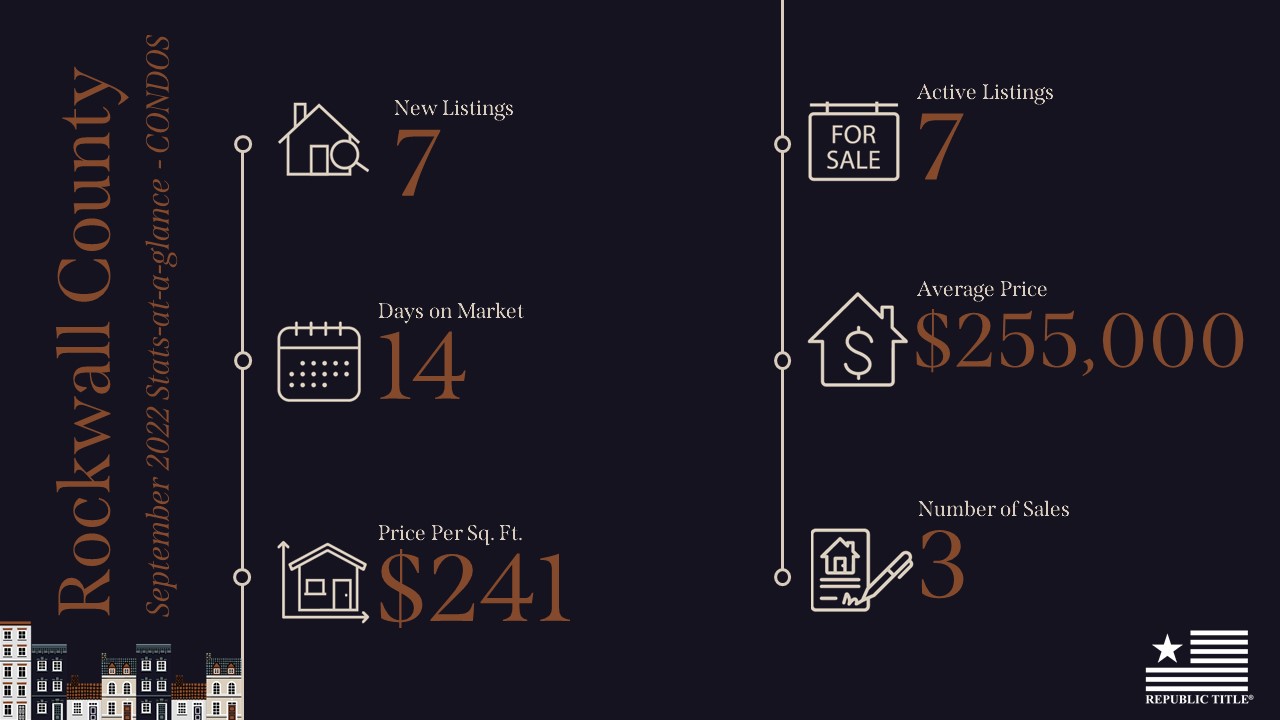

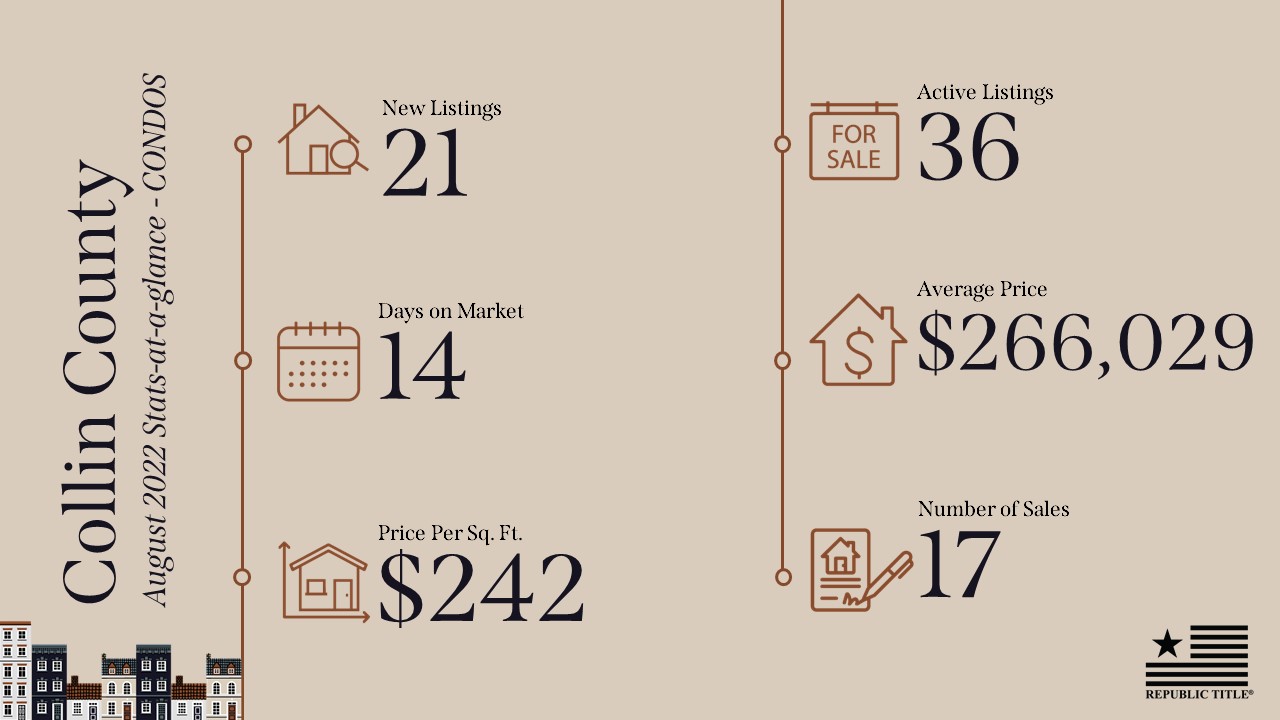

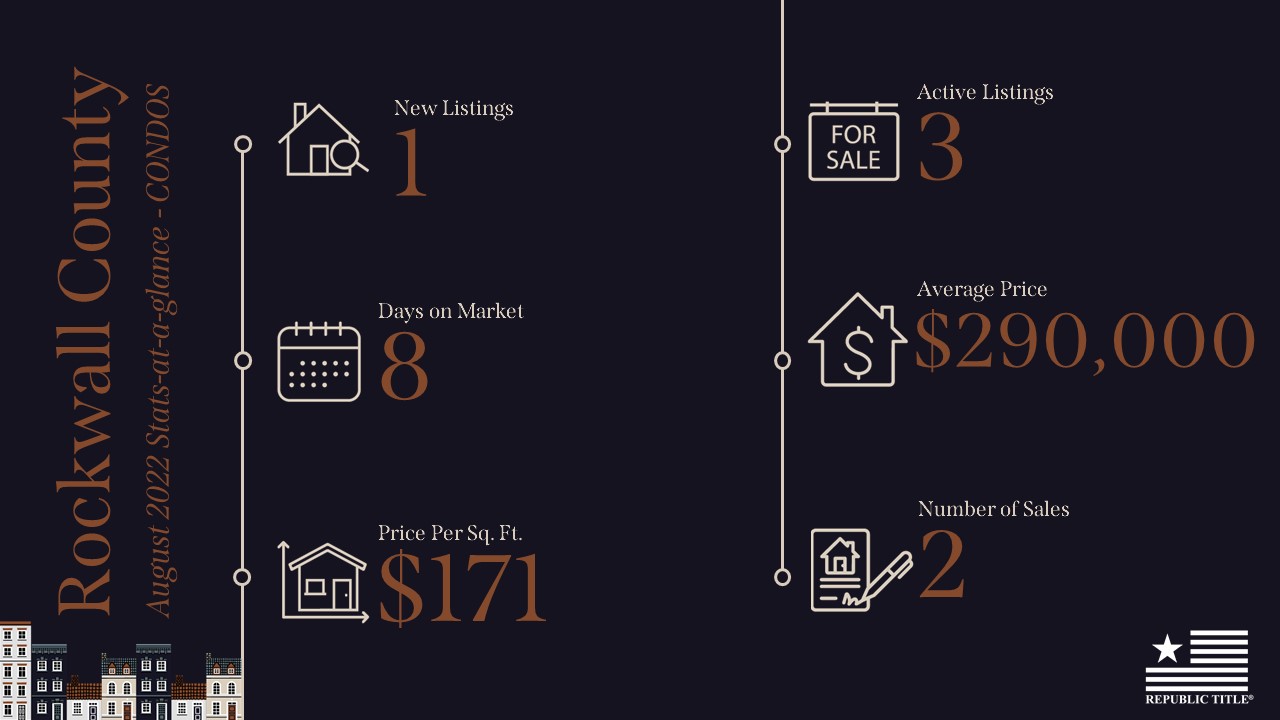

Our stats infographics include a year over year comparison and area highlights for single family homes broken down by county. We encourage you to share these infographics and video with your sphere.

For more stats information, pdfs and graphics of our stats including detailed information by county, visit the Resources section on our website at DFW Area Real Estate Statistics | Republic Title of Texas.

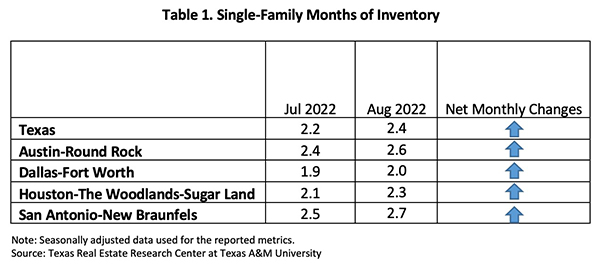

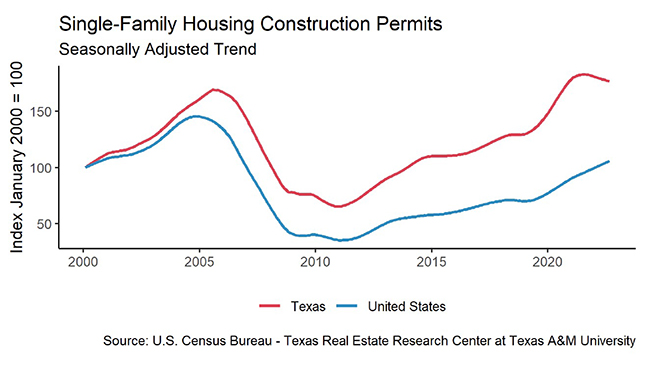

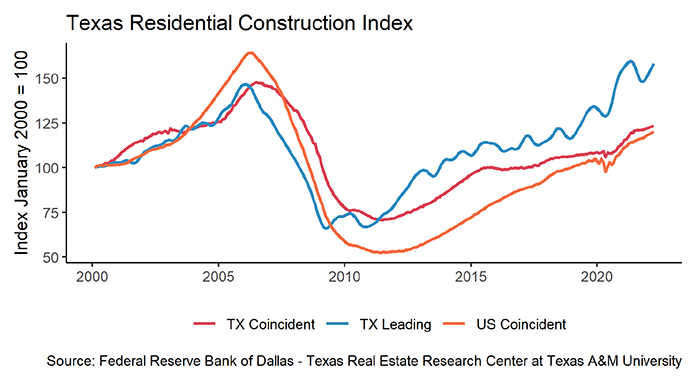

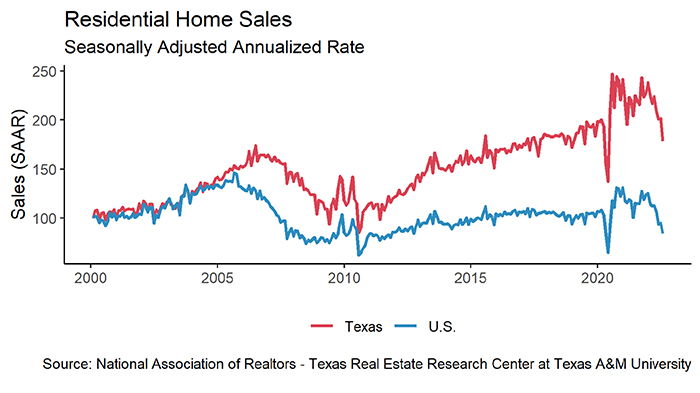

For the full report from the Texas A&M Real Estate Research Center, click here. For NTREIS County reports click here.