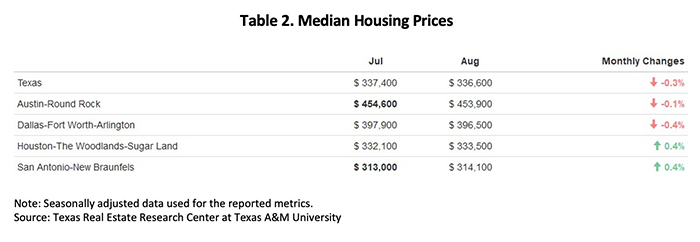

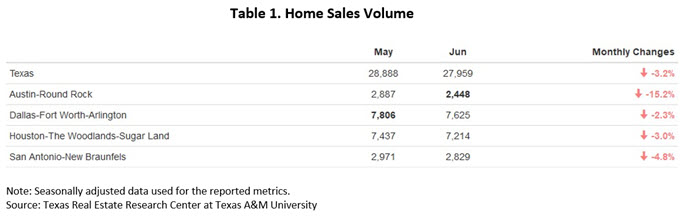

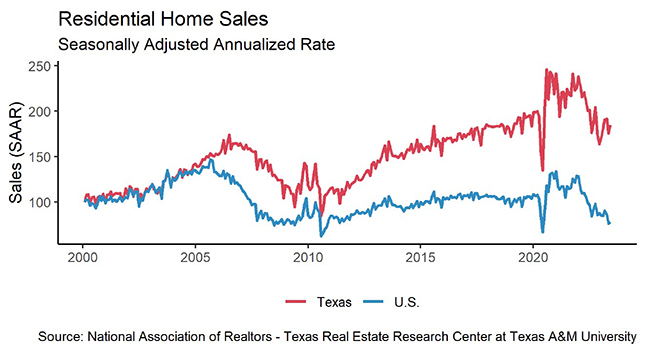

Reduced home sales were mostly reflected by constrained sales of existing homes, while the new construction market hiked in demand. Sales for new construction grew by 20 percent in a year. Correspondingly, the market share of new construction sales climbed five percentage points to 21.7 percent. This indicates that for every five closed listings, one will be a new home. Both demand and supply factors contributed to the increasing trend for new homes. The shortage of existing homes is due to current owners’ reluctance to give up their homes in exchange for a higher-cost home.

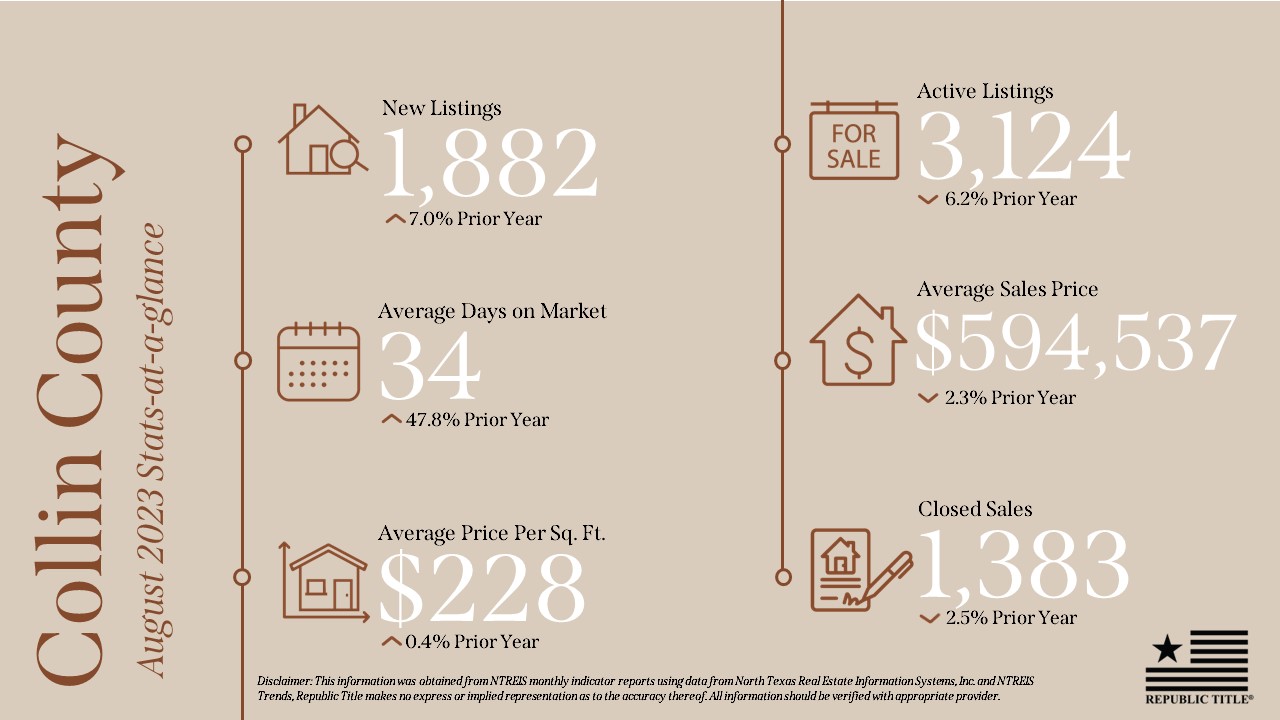

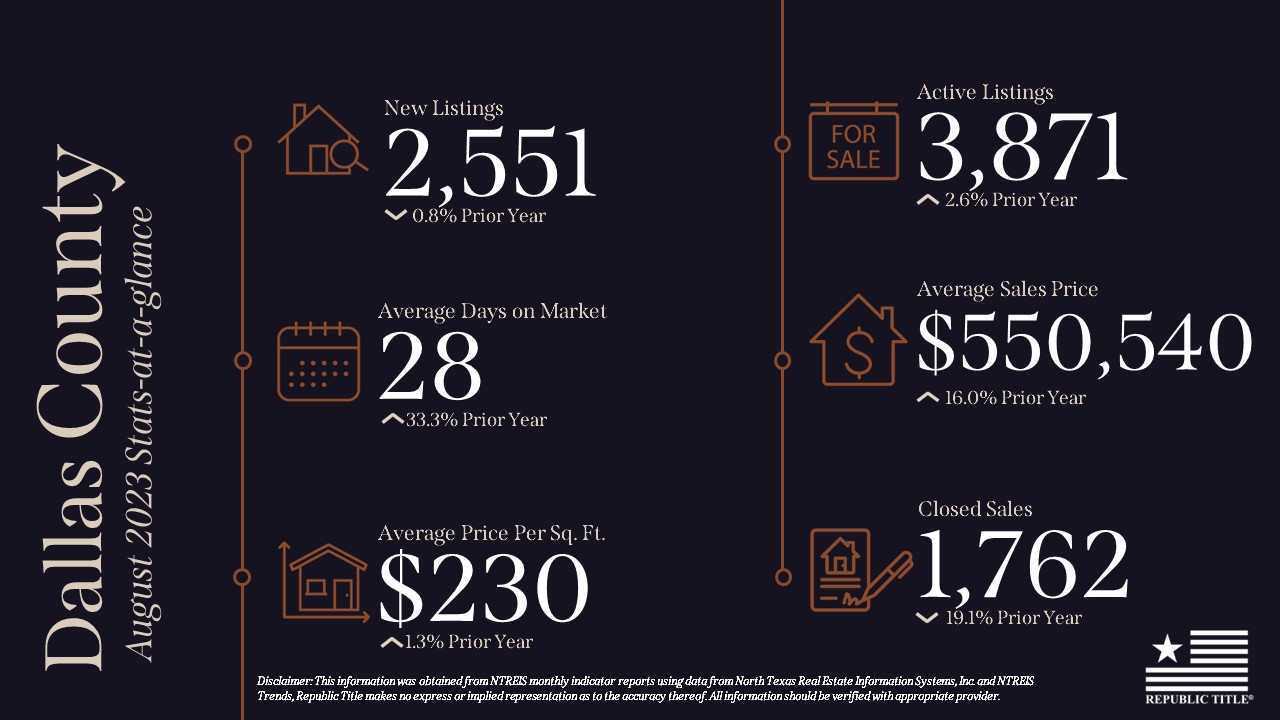

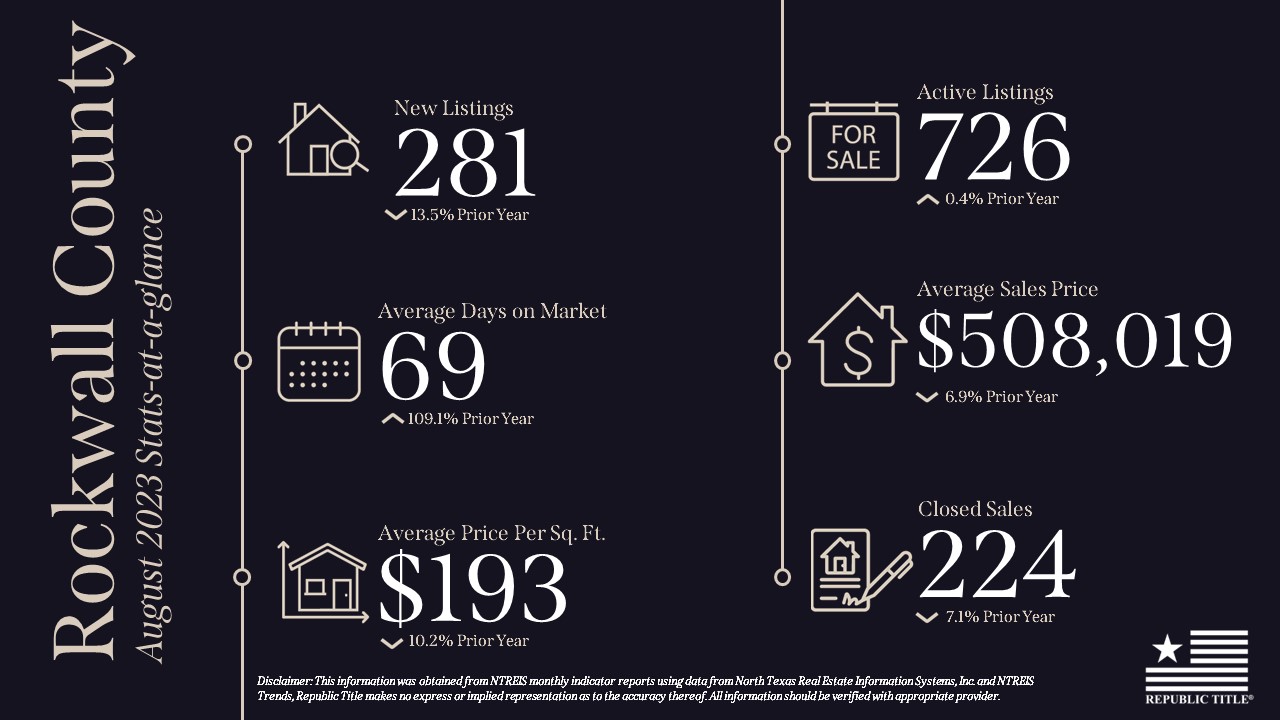

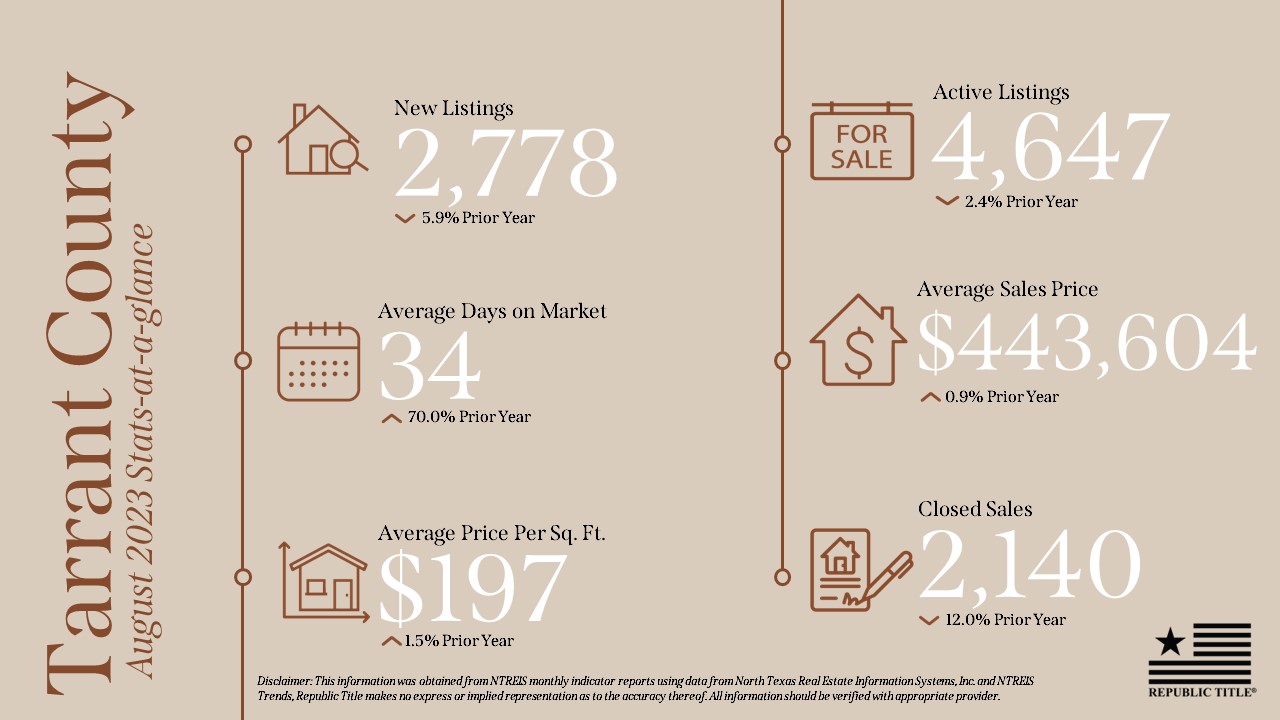

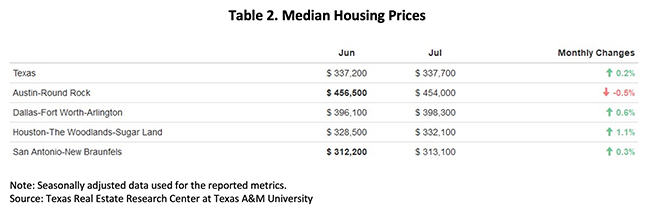

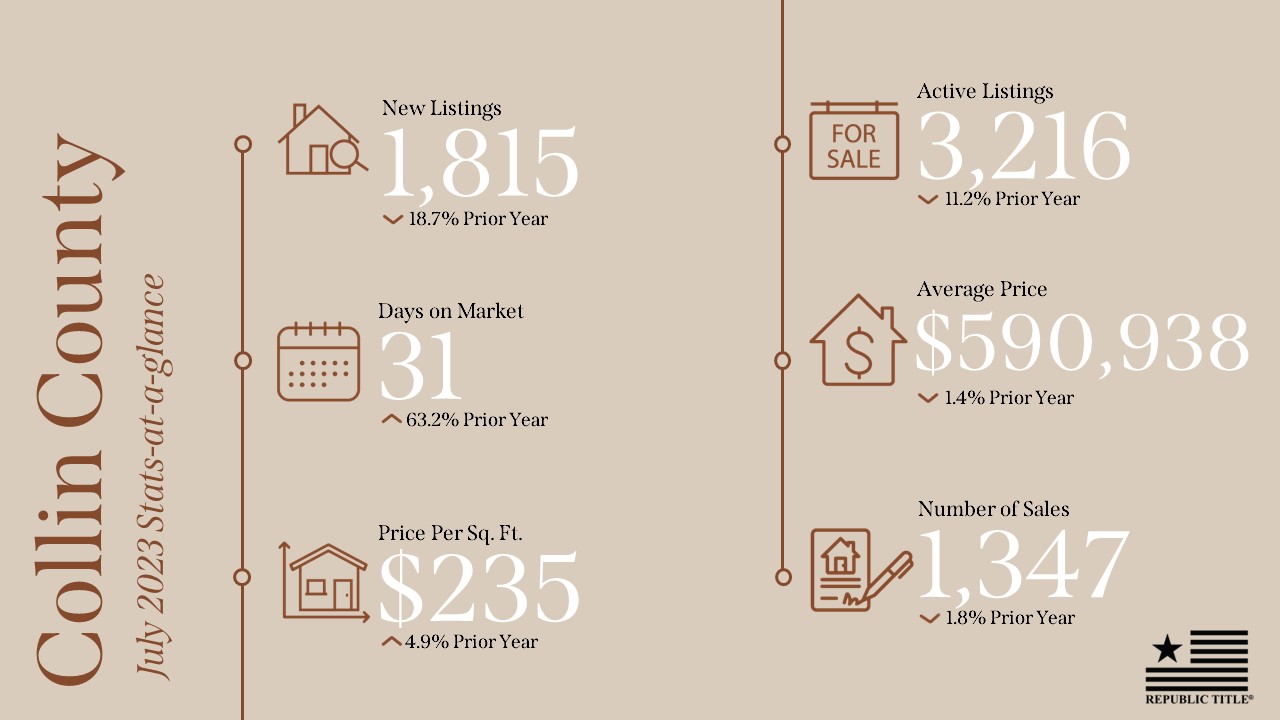

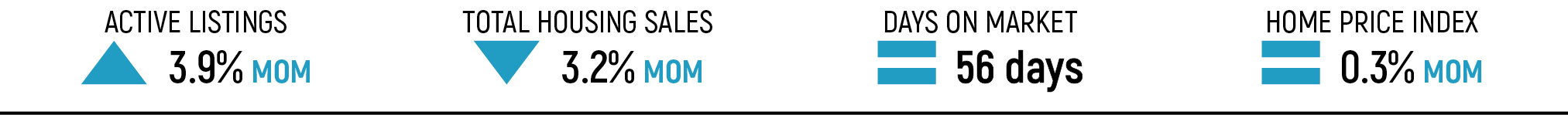

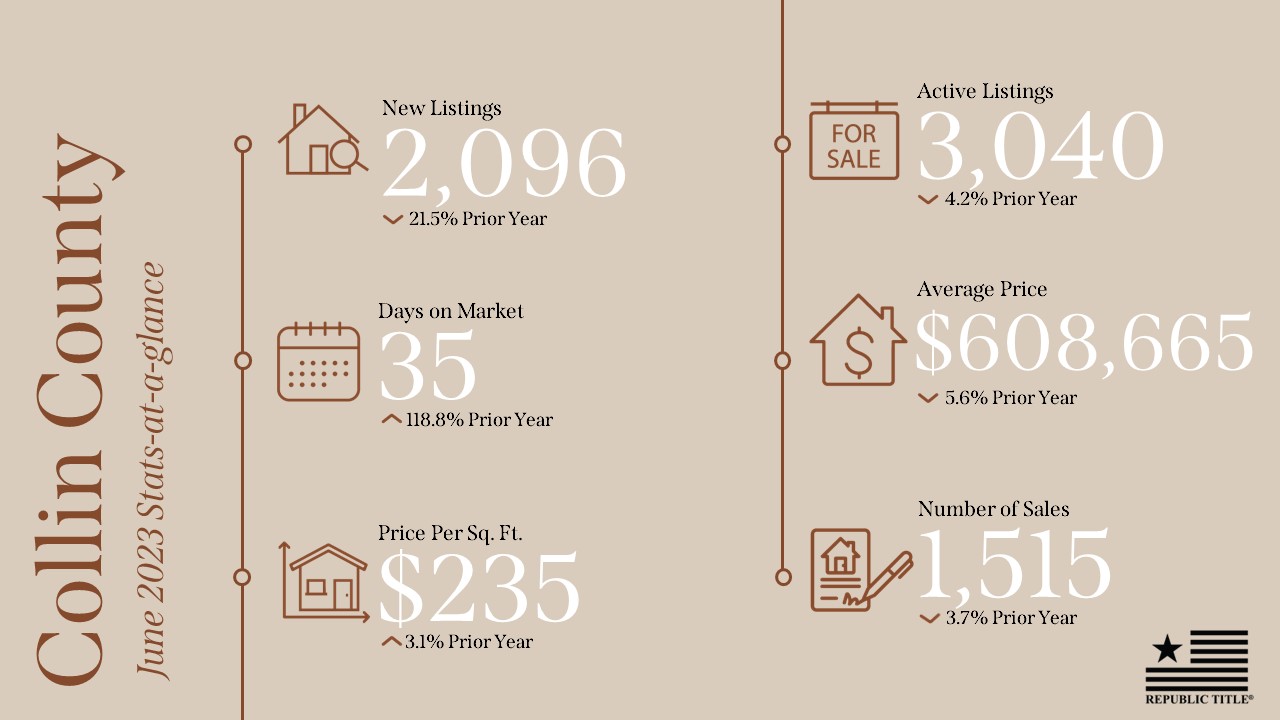

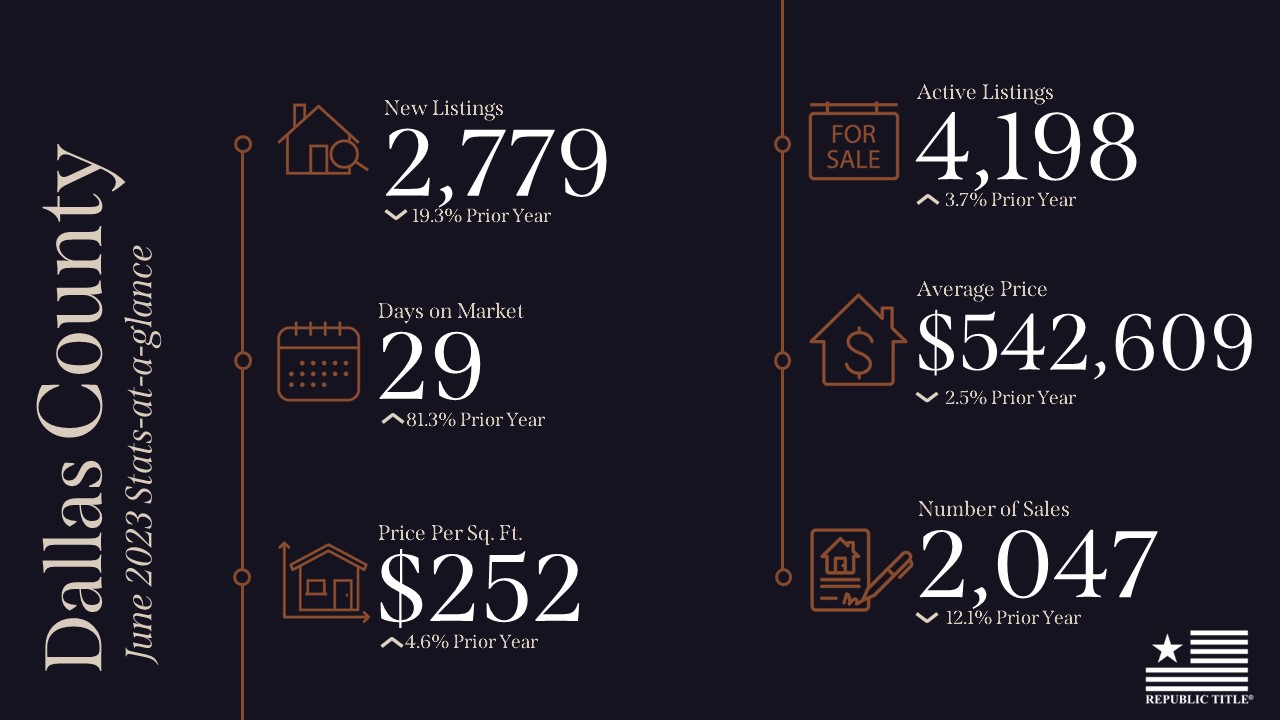

After balancing at 57 days for two months, the state’s average days on market (DOM) dropped to 55 days, deviating from the steep rebounding trend that lasted for over a year. For the past six months, readings fluctuated between 55 days and 59 days. That small range suggests the housing market may be stabilizing. Among the major metros, Austin (69 days) and San Antonio (66 days) reported a longer-than-average DOM, while Dallas and Houston had DOM figures of 47 days and 48 days, respectively.

Housing supplies are stocking up, as active listings have trended upward since February, and the accumulation speed is accelerating. In August, the number of homes available for sales rose 5.9 percent, reaching 90,750 listings. The four major metros posted monthly gains between 4.4 percent and 5.2 percent, with Dallas leading the pack. The state’s new listings rose 5.7 percent to 40,620 units, with Austin contributing a double-digit jump and an increase of 642 units. Despite the rise in active listings, months of inventory (MOI) had a marginal loss to 3.2 months due to recouped home sales.

High Mortgage Rates Push Down Loan Applications by One Fifth

Since the Fed initiated the series of interest rates hikes, both treasury rates and mortgage rates have increased accordingly. The ten-year U.S. Treasury Bond yield has had an average yield of 3.8 percent in 2023, up from 3 percent in 2022 and 1.5 percent in 2021. The expectation of further rate hikes pushed the bond yield to a new high since the Great Recession in 2008 at 4.2 percent.

Elevated by the bond yield, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate inched up to 7.1 percent, up 23 basis points. The inflated mortgage rate is expected to further raise the cost of homeownership and decrease mortgage applications. Under the pressure of high mortgage rates, mortgage loan applications have fallen in 2023 with the annual high in January. In the past eight months, the Mortgage Bankers Association reported a volume index drop of over 20 percent.

Momentum for Housing Inventories Might Be Forthcoming

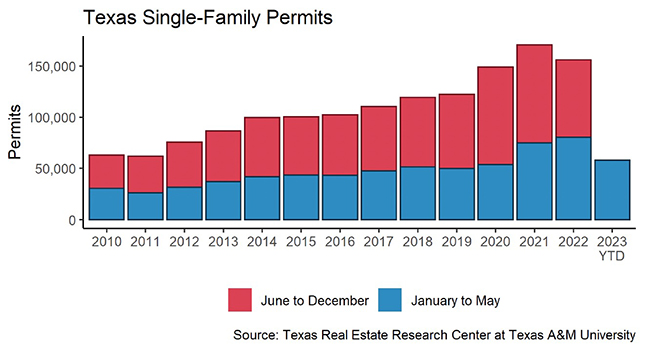

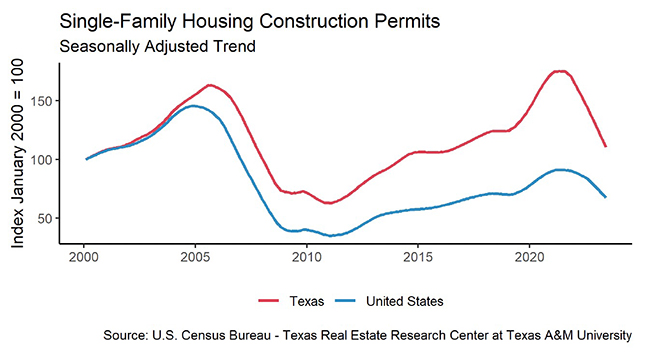

Texas’ single-family construction permits rose 5.3 percent MOM to 13,160 issuances. This rise highlights August as the second month this year with more than 13,000 houses approved for construction. All four major metros reported growing demand except for San Antonio (630 permits), falling 16.4 percent MOM. Of the other three metros, Houston led with close to 4,500 permits, accounting for a third of the state’s total permits for future homebuilding. Dallas followed with 3,980 permits. Austin (1,717 permits), which had drastic construction slowdown with last year’s price correction, finally jumped out of the lows, reporting impressive rebounds with a double-digit growth rate.

Construction starts grew alongside construction permits. After five consecutive months of growth, single-family construction starts in Texas inched up to 11,950 units. Both Dallas and Houston led with over 3,300 houses breaking ground, surpassing the combined total of other metros outside the “Big Four.” Home project starts in Austin (1,810 starts) and San Antonio (810 starts) surpassed the typical 2:1 ratio.

The state’s total single-family starts value reached $21.2 billion, up from $18.8 billion in July. While the current starts value fell short of the peak during the 2020-22 pandemic frenzy, it mirrored the construction activity levels observed in 2019. Notably, Houston and Dallas remain pivotal players, contributing to more than half of the state’s construction activity values. Dallas’ market share rose to 27.6 percent, closely trailing Houston’s 27.7 percent share.

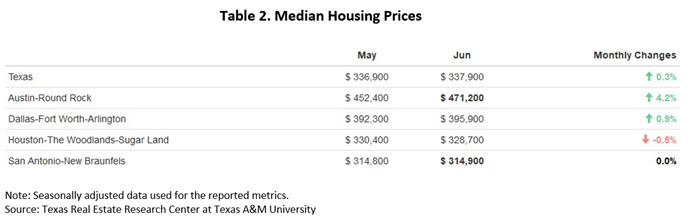

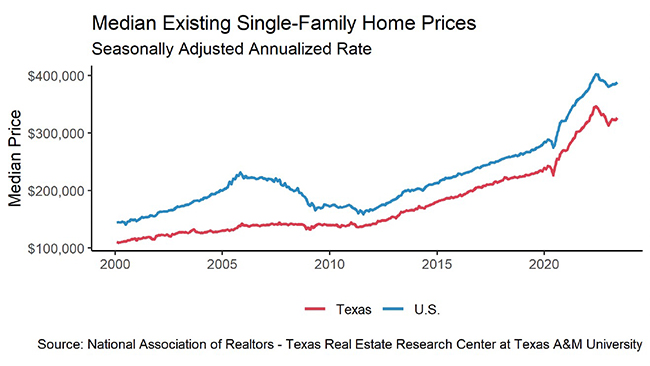

Price Gains Pause for the First Time This Year

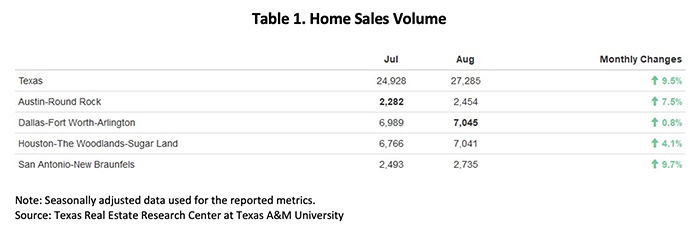

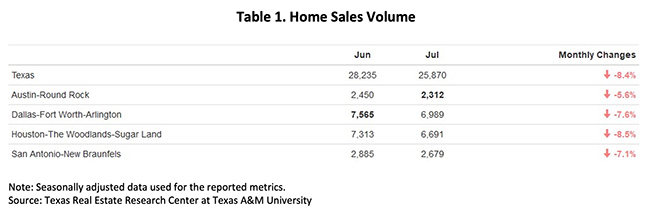

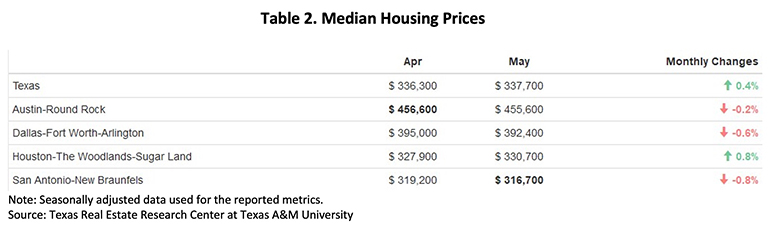

This year’s steady price gains took a pause in August as Texas‘ median home price dipped. Despite the 0.3 percent MOM decrease, the seasonally adjusted price at $336,600 was still at a higher standing than the June reading. The state’s housing market signaled no large volatility, as the Big Four metros reported monthly changes of less than 0.5 percent. At the metro level, Austin’s median price remained elevated at $454,000, while Dallas followed with $396,500 (Table 2).